HSBC 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

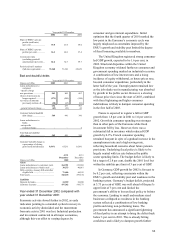

US$32 million, or 1 per cent, lower than in 2001.

Further growth in personal lending, particularly

mortgages and credit cards, and an improved spread

arising from lower funding deposit costs were offset

by intense competition reducing spreads on mortgage

and commercial lending. In addition net interest

income benefitted from a strong treasury

performance. The reduced spreads on mortgages

reduced net interest income by US$142 million.

There was also a considerable reduction in the

benefit of net free funds as average interest rates

remained low.

Average customer advances increased by

US$2.0 billion compared with 2001, with growth in

mortgages and credit cards. Average credit card

advances increased by a further 15 per cent

compared to 2001. Term lending to corporate and

commercial customers also increased, despite

subdued demand for lending.

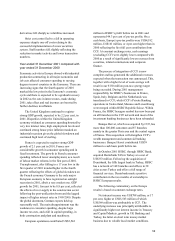

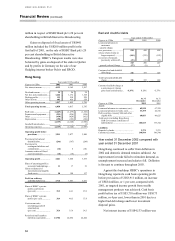

For the Hongkong and Shanghai Banking

Corporation in Hong Kong actions taken to improve

lending mix and target lower cost deposits held net

interest margin essentially flat, the actual margin

falling by 1 basis point to 2.47 per cent. Spread

widened by 13 basis points, driven by a strong

treasury performance, suspended interest recoveries,

increased levels of high-yielding credit card

balances, and a greater level of low cost deposits.

These factors more than offset lower spreads on

mortgages and deposits. Continued price competition

in the residential mortgage portfolio, excluding the

Government Home Ownership Scheme loans,

resulted in a further reduction in the average yield on

the residential mortgage portfolio to 151 basis points

below the bank’s best lending rate (‘BLR’ ) in 2002.

The overall improvement in spread was offset by a

reduction in 14 basis points from the benefit of net

free funds, as average interest rates remained low.

Hang Seng Bank’s net interest margin fell by 10

basis points to 2.46 per cent. Net interest spread

improved, driven by improved spreads on debt

securities and higher levels of low-cost deposits.

These were offset by lower spreads on mortgages –

Hang Seng Bank’s average yield on residential

mortgages was 149 basis points below BLR in 2002

– and a lower benefit from net free funds as average

interest rates remained low.

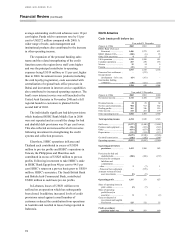

Other operating income increased by US$65

million, or 4 per cent, to US$1,917 million. Fee

income grew by US$92 million, or 8 per cent, to

US$1,264 million, driven by growth in revenues

from wealth management initiatives. Sales of unit

trusts were strong, including the sale of over US$4

billion of funds launched by HSBC in 2002, up 33

per cent compared with 2001. Revenues from

insurance and underwriting also increased strongly.

Revenue from cards also increased by US$9 million,

or 4 per cent. There was also growth in the

Hongkong and Shanghai Banking Corporation in

Hong Kong in Corporate Banking revenues, due to

higher income from structured and corporate finance

transactions. Other income increased by US$59

million, driven by improved underwriting results.

Dealing profits fell by US$85 million, or 39 per cent,

due to lower profits on debt securities as credit

spreads widened following the series of corporate

scandals in the USA. Part of the decline was also

attributable to treasury positions which generated

improved net interest income at the expense of lower

dealing profits as hedge costs were reflected on that

line. Foreign exchange trading remained strong with

profits increasing 11 per cent over 2001.

Operating expenses were in line with 2001.

Staff costs fell by US$30 million, driven by a

reduction in full time equivalent headcount of 868 as

back office processing functions transferred to

HSBC’s Group Service Centres in India and

mainland China, and the non-recurrence of a pension

top-up in Hang Seng Bank in 2001. These reductions

were partially offset by higher revenue-related

remuneration. Other administrative expenses

increased by US$31 million, or 7 per cent, due to

continuing marketing initiatives, higher IT costs to

support business growth, and higher professional

fees in relation to higher levels of structured finance

transactions.

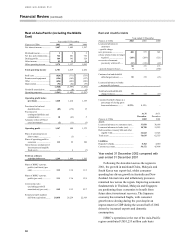

The charge for bad and doubtful debts increased

by US$49 million, or 25 per cent, to US$246 million.

The increase was driven by new provisions against

credit card lending, rising to US$250 million in

2002, compared with US$122 million in 2001;

provisions against other retail lending also increased,

as bankruptcy filings grew. Provisions against the

mortgage portfolio fell as delinquency rates fell.

Recoveries and releases against commercial and

corporate customers were lower than in 2001,

although economic conditions remained difficult.

The above increases were partially offset by a release

in general provisions reflecting a reduction in latent

losses.

Gains on the disposal of fixed asset investments