HSBC 2002 Annual Report Download - page 306

Download and view the complete annual report

Please find page 306 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

304

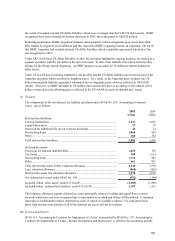

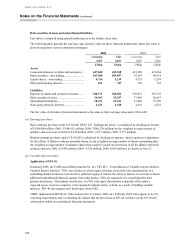

Since 1 January 2001 further contracts which qualify as fair value hedges under SFAS 133 have been entered

into by HSBC’ s North American subsidiaries. These are used to hedge the risk associated with the risk free

component of the value of certain fixed rate investment securities. As above, since there was no material

ineffectiveness of these hedges no adjustment is required to US GAAP reported net income.

In addition, since 1 January 2001 certain contracts which qualify as cash flow hedges under SFAS 133 have

been entered into by HSBC Bank USA. These contracts are used to hedge the forecast repricing of certain

deposit liabilities. The adjustment to US GAAP reported equity of such hedges at 31 December 2002 was to

increase equity by US$42 million (2001: reduction in equity US$38 million).

All other UK GAAP hedging derivatives have been marked to market for US GAAP purposes, giving rise to the

increase in US reported net income of US$221 million (2001: US$280 million; 2000: US$116 million). The

principal impact of applying SFAS133 is to reduce other assets by US$3,114 million (2001: US$2,150 million)

and reduce other liabilities by US$3,896 million (2001: US$2,636 million).

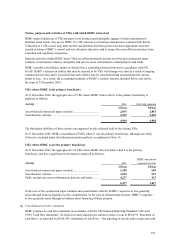

(i) Foreign exchange gains on available-for-sale securities

Within individual legal entities HSBC holds securities in a number of different currencies which are classified

as available-for-sale. For example, within the private bank in Switzerland which has the US dollar as its

reporting currency, the Group holds Euro-denominated bonds which are funded in Euros and Swiss Franc

securities funded in Swiss Francs. No foreign exchange exposure arises from this because, although the value of

the assets in US dollar terms changes according to the exchange rate, there is an identical offsetting change in

the US dollar value of the related funding. Under UK GAAP both the assets and the liabilities are translated at

closing exchange rates and the differences between historical book value and current value are reflected in

foreign exchange dealing profits. This reflects the economic substance of holding currency assets financed by

currency liabilities.

However, under US accounting rules, the change in value of the investments classified as available-for-sale is

taken directly to reserves whereas the offsetting change in US dollar terms of the borrowing is taken to earnings.

This leads to an accounting result, which does not reflect either the underlying risk position or the economics of

the transactions. It is also a situation that will reverse on maturity of the asset or earlier sale.

A similar difference arises where foreign currency exposure on foreign currency assets is covered using forward

contracts, but where HSBC does not manage these hedges to conform with the detailed US designation

requirements.

The result of this is that for 2002 HSBC's US GAAP profits are reduced by some US$2,197 million (2001:

increase of US$ 312 million) compared to its UK GAAP profits. However, future periods will report an increase

in US GAAP profits. There is no difference in shareholders’ equity between UK GAAP and US GAAP as a

result of this item.

The change in the size and direction of the adjustment between 2001 and 2002 mainly reflects the exchange rate

movements in each year. 2001 saw the principal other currencies in which HSBC’ s holdings of available-for-

sale securities are denominated weaken against the US dollar by between 2 and 14 per cent. This movement

reversed in 2002 as these currencies strengthened by between 10 and 17 per cent against the US dollar.

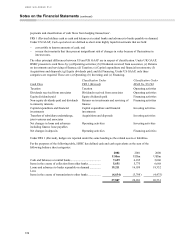

(j) Investment securities

Under UK GAAP, debt securities and equity shares intended to be held on a continuing basis are classified as

investment securities and are included in the balance sheet at cost less provision for any permanent diminution

in value. Other participating interests are accounted for on the same basis. Where dated investment securities

have been purchased at a premium or discount, these premiums and discounts are amortised through the profit

and loss account over the period from the date of purchase to the date of maturity and included in ‘interest