HSBC 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

72

average outstanding credit card advances were 18 per

cent higher. Funds sold to customers rose by 51 per

cent to US$272 million compared with 2000. A

wider range of trade, cash management and

institutional products also contributed to the increase

in other operating income.

The expansion of the personal banking sales

teams and the related strengthening of the credit

function across the region drove staff costs higher

and was the principal contributor to operating

expenses being US$19 million, or 11 per cent, higher

than in 2000. Investment in new products (including

the card loyalty programme), costs associated with

centralisation of regional back office processes in

Dubai and investment in internet service capabilities

also contributed to increased operating expenses. The

bank’s new internet service was soft launched in the

United Arab Emirates in November 2001and a full

regional launch to customers is planned for the

second half of 2002.

The individually significant bad debt provisions

which burdened HSBC Bank Middle East in 2000

were not repeated and as a result the charge for bad

and doubtful debt provisions was 30 per cent lower.

This also reflected an increased level of recoveries

following investment in strengthening the credit

systems and collection processes.

Elsewhere, HSBC operations in Korea and

Thailand each contributed in excess of US$50

million to pre-tax profits and HSBC’s operations in

Taiwan, the Philippines and Mauritius each

contributed in excess of US$25 million to pre-tax

profits. Following investment to take HSBC’s stake

in HSBC Bank Egypt from 40 per cent to 94.5 per

cent HSBC’s return on a pre-tax basis grew to US$19

million. HSBC’s associates, The Saudi British Bank

and British Arab Commercial Bank, contributed

US$96 million to cash basis pre-tax profits.

In Lebanon, losses of US$31 million were

suffered on an operation which has subsequently

been closed. In addition, increased levels of credit

provisions raised against a small number of

customers reduced the contribution from operations

in Australia and resulted in losses being reported in

Indonesia.

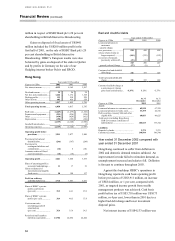

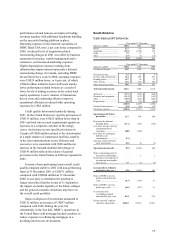

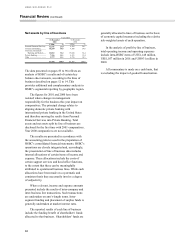

North America

Cash basis profit before tax

Year ended 31 December

Figures in US$m 2002 2001 2000

HSBC Bank USA (excl

Princeton) ....................... 1,406 1,273 871

HSBC Markets USA............ (100 )(6) 35

Other USA operations.......... 413 5

USA operations ................... 1,310 1,280 911

Canadian operations ............ 267 230 236

Mexico ................................ 35 14 9

Panama ................................ (15)11 2

1,597 1,535 1,158

Princeton Note settlement ... –(575) –

Group internet

development – hsbc.com.(83 ) (161) –

Intermediate holding

companies....................... (130 ) (151 ) (154)

1,384 648 1,004

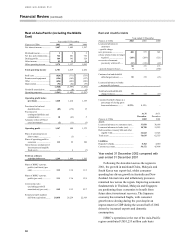

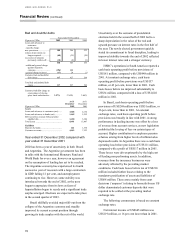

Year ended 31 December

Figures in US$m 2002 2001 2000

Net interest income............... 2,732 2,450 2,185

Dividend income .................. 24 29 68

Net fees and commissions..... 984 913 862

Dealing profits...................... 161 346 229

Other income ........................ 333 207 179

Other operating income ........ 1,502 1,495 1,338

Total operating income 4,234 3,945 3,523

Staff costs............................. (1,537 ) (1,440) (1,406)

Premises and equipment ....... (356) (323 ) (312 )

Other .................................... (651) (653 ) (561)

Depreciation ......................... (131) (124) (117 )

(2,675) (2,540 ) (2,396)

Goodwill amortisation .......... (146 ) (145 ) (144)

Operating expenses............... (2,821 ) (2,685) (2,540)

Operating profit before

provisions........................ 1,413 1,260 983

Provisions for bad and

doubtful debts .................. (300 ) (300) (157)

Provisions for contingent

liabilities and

commitments ...................

- other ................................... 3(7 ) 1

- Princeton Note settlement .. – (575 ) –

Amounts written off fixed

asset investments ............. (9) (5 ) –

Operating profit.................. 1,107 373 827

Share of operating losses in

joint venture..................... (2 ) (7) –

Share of operating

profit/(losses) in

associates ......................... 85(2)

Gains on disposal of

investments and tangible

fixed assets ...................... 125 132 35

Profit on ordinary

activities before tax ........ 1,238 503 860