HSBC 2002 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

130

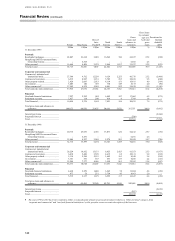

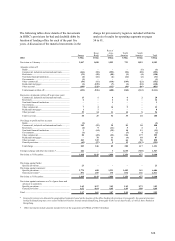

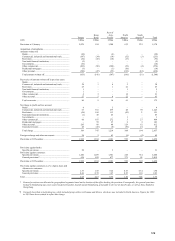

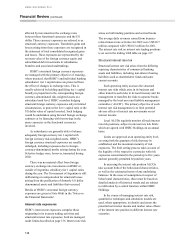

Provisions against loans and advances to

customers

31 December 31 Decembe

r

2002 2001

%%

Total provisions to gross lending*

Specific provisions............................. 1.94 1.90

General provisions

- held against Argentine risk .............. 0.04 0.21

- other ................................................ 0.70 0.71

Total provisions ................................. 2.68 2.82

* Net of suspended interest, reverse repo transactions and settlement

accounts.

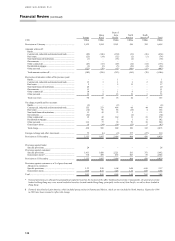

Risk elements in the loan portfolio

The SEC requires disclosure of credit risk elements

under the following headings that reflect US

accounting practice and classifications:

• loans accounted for on a non-accrual basis;

• accruing loans contractually past due 90 days or

more as to interest or principal; and

• troubled debt restructurings not included in the

above.

HSBC, however, classifies loans in accordance

with UK accounting practice which differs from US

practice as follows:

Suspended interest

Under the UK Statement of Recommended Practice

on Advances, UK banks continue to charge interest

on doubtful debts where there is a realistic prospect

of recovery. This interest is credited to a suspense

account and is not included in the profit and loss

account. In the United States, loans on which interest

has been accrued but suspended would be included

in risk elements as loans accounted for on a non-

accrual basis.

Assets acquired in exchange for advances

Under US GAAP, assets acquired in exchange for

advances in order to achieve an orderly realisation

are usually reported in a separate balance sheet

category, ‘Owned Real Estate’ . Under UK GAAP,

these assets are reported within loans and advances.

Troubled debt restructurings

US GAAP requires separate disclosure of any loans

whose terms have been modified due to problems

with the borrower. Such disclosures may be

discontinued after the first year if the new terms were

in line with market conditions at the time of the

restructuring and the borrower has remained current

with the new terms.

In addition, US banks typically charge off

problem lending more quickly than is the practice in

the United Kingdom. This practice means that

HSBC’s reported level of credit risk elements is

likely to be higher than for a comparable US bank.

Potential problem loans

Credit risk elements also cover potential problem

loans. These are loans where known information

about possible credit problems of borrowers causes

management serious doubts as to the borrowers’

ability to comply with the loan repayment terms. At

31 December 2002, all loans and advances in

Argentina, and all cross-border loans to Argentina,

which were not included as part of total risk elements

have been designated as potential problem loans.

There were no other significant potential problem

loans at 31 December 2001.

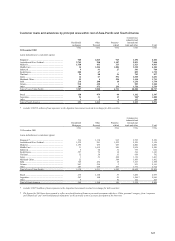

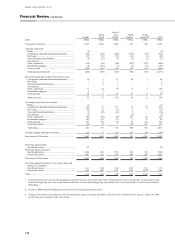

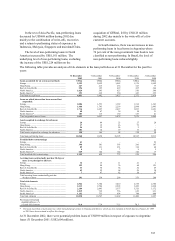

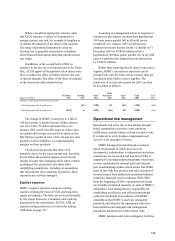

31 December 31 Decembe

r

2002 2001

US$m US$

m

Non-performing loans and

advances*

Banks.................................... 17 9

Customers............................. 10,523 9,649

Total non-performing loans and

advances .......................... 10,540 9,658

Total provisions cover as a

percentage of non-performing

loans and advances .......... 86.7% 84.7%

*Net of suspended interest.

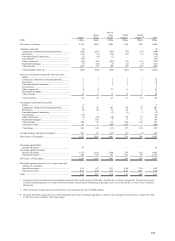

Total non-performing loans to customers

increased by US$874 million, however excluding the

increase of US$1,224 million arising on the

acquisition of GFBital, non-performing loans

reduced by US$350 million during 2002. At 31

December 2002, non-performing loans represented

2.9 per cent of total lending compared with 3.0 per

cent at 31 December 2001.

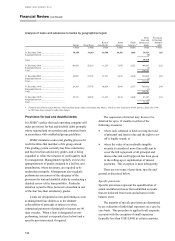

In Europe, total non-performing loans to

customers increased by US$813 million during 2002.

In the UK, and to a lesser extent France, there was

some weakening in business confidence due to the

continued uncertainty and weaknesses in global

economies. In addition, intense competition and

over-capacity in the energy and telecommunications

sectors resulted in the downgrading to non-

performing loan status of a small number of

corporate accounts in these sectors.

In Hong Kong, non-performing loans decreased

by US$304 million during 2002 due mainly to write-

offs, recoveries and a return to performing status of

some customer accounts.