HSBC 2002 Annual Report Download - page 309

Download and view the complete annual report

Please find page 309 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

307

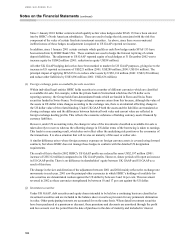

the extent of residual external US dollar liabilities which were no longer matched with US dollar assets. HSBC

recognised these losses through its income statement in 2001; these amounted to US$520 million.

Following pesification, HSBC Argentina’s balance sheet primarily reflected Argentine peso assets more than

fully funded by Argentine peso liabilities and this represents HSBC’ s ongoing business in Argentina. On top of

this HSBC Argentina had residual external US dollar liabilities which essentially represented a portion of the

loss recognised in 2001.

Under UK GAAP these US dollar liabilities, as they are no longer funding the ongoing business, are treated as a

separate operation with the US dollar as the unit of account. To date, these liabilities have been settled as they

fall due by the Group outside Argentina. As HSBC prepares its accounts in US dollars no further translation

effect arises.

Under US GAAP this accounting treatment is not possible and the US dollar liabilities are treated as part of the

Argentine operation which accounts in Argentine pesos. As a result, as the Argentine peso weakens, the US

dollar denominated liabilities generate a substantial loss in Argentine pesos which is reflected in US GAAP

income. However, as HSBC accounts in US dollars and economically there is no change in the amount of US

dollars owing an exactly offsetting gain is reflected in the US GAAP accounts in shareholders’ equity.

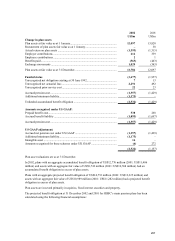

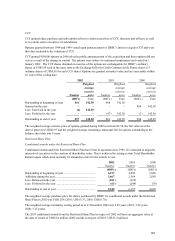

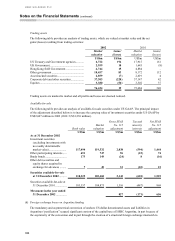

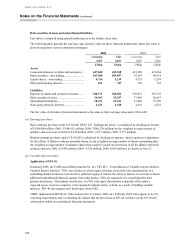

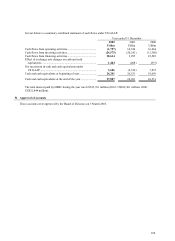

(l) Taxation

The components of the net deferred tax liability calculated under SFAS No. 109 ‘Accounting for Income

Taxes’ , are as follows:

2002 2001

US$m US$m

Deferred tax liabilities:

Leasing transactions............................................................................................. 1,247 1,041

Capital allowances ............................................................................................... 73 79

Provision for additional UK tax on overseas dividends....................................... 44 24

Reconciling items ................................................................................................ 1,060 938

Other .................................................................................................................... 460 354

Total deferred tax liabilities ................................................................................. 2,884 2,436

Deferred tax assets:

Provisions for bad and doubtful debts.................................................................. 1,259 743

Tax losses............................................................................................................. 908 1,014

Reconciling items ................................................................................................ 1,316 901

Other .................................................................................................................... 661 892

Total deferred tax assets before valuation allowance........................................... 4,144 3,550

Less: valuation allowance.................................................................................... (868) (920)

Deferred tax assets less valuation allowance ....................................................... 3,276 2,630

Net deferred tax (asset) under SFAS No. 109...................................................... (392) (194)

Included within ‘other assets’ under US GAAP .................................................. (2,585) (1,509)

Included within ‘deferred tax liabilities’ under US GAAP.................................. 2,193 1,315

The valuation allowance against deferred tax assets principally relates to trading and capital losses carried

forward, which have not been recognised due to uncertainty as to when and if they will be utilised. A valuation

allowance is established to reduce deferred tax assets if, based on available evidence, it is considered more

likely than not that some portion or all of the deferred tax assets will not be realised.

(m) Loans and advances

SFAS 114 ‘Accounting by Creditors for Impairment of a Loan’ as amended by SFAS No. 118 ‘Accounting by

Creditors for Impairment of a Loan – Income Recognition and Disclosures’ is effective for accounting periods