HSBC 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

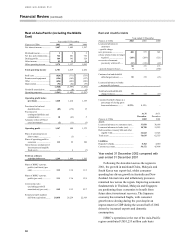

fell by 7 per cent compared with 2001 as lower

interest rates reduced the benefit from its investment

portfolio and from free funds. Part of the portfolio

was repositioned at the beginning of the year into

lower yielding but higher grade securities in

anticipation of difficult credit markets.

Other operating income at US$6,272 million in

2002 was US$25 million lower than in 2001,

reflecting lower income from equity-market-related

activity and sales of investment products largely

offset by strong growth in credit facility, life and

income protection fees. Lower dealing profits

reflected difficult conditions in the equity markets,

and costs associated with the hedging of the

corporate bond portfolio.

In UK Banking, other operating income at

US$3,040 million was 2 per cent lower than in 2001

but within this performance there was encouraging

evidence of success in reaching customers with

products to match their current preferences. The

number of customers who benefited from HSBC

Bank’s individual service reviews more than doubled

to 485,000 and over 750,000 personal banking

products were sold through call centres in 2002.

HSBC’s Premier service for its higher value

customers was further enhanced and the number of

customers using this service increased by 44 per cent

to 182,000. Overall sales of HSBC branded life,

critical illness and income protection products

through its tied sales-force were 7 per cent higher

than in 2001. Life protection sales grew by 42 per

cent on the back of strong mortgage growth and there

was a 26 per cent increase in sales of creditor

protection insurance, driven by the growth in

personal lending. Fees and commissions in

commercial banking increased on the back of a rise

in current accounts and overdrafts. Cards income

grew by 6 per cent and Invoice Finance saw a 13 per

cent rise in the number of clients opting for credit

protection. Corporate banking fees were 7 per cent

lower than in 2001 reflecting the impact of subdued

stock market activity on the custody services

business and lower fee income from reduced

corporate activity. In addition, sales of investment

products fell by 14 per cent reflecting continued

uncertainty in the investment markets and the impact

of a sustained fall in equity markets reduced the

value of long-term assurance business.

In CCF, a similar pattern was evidenced. Good

growth was achieved in fee income on credit

facilities, payments and cash management and cards.

Stockbroking, market making and asset management

fees were all lower in the face of subdued equity

markets although sales of investment protection

products in CCF’s regional banking subsidiaries rose.

In the European bond markets, CCF benefited from

synergies as a core member of HSBC Group,

growing origination and distribution fees on euro-

denominated products. Dealing profits, however, fell

in difficult market conditions. Equity fees were

boosted by CCF’s role as lead manager in the

privatisation of Autoroutes du Sud de la France, the

largest IPO in the European market in 2002. In

aggregate other operating income was US$84

million, or 7 per cent, lower than 2001.

Treasury and Capital Markets’ other operating

income at US$400 million was US$70 million, or 21

per cent, higher than in 2001. Although dealing

profits were down in aggregate, foreign exchange

revenues grew by 6 per cent following expansion in

emerging markets business and currency options. Fee

income from fixed income products also benefited

strongly from the continued alignment with HSBC

corporate clients and HSBC achieved number one

ranking in bond issuance with UK and French

corporates in all currencies.

This was offset by the costs of interest rate

swaps used as part of the management of the

corporate bond portfolio. In addition, equity swap

activity generated dealing losses, although these

were offset by a rise in dividend income.

In HSBC Republic (Suisse), transaction and safe

custody fees increased in line with the growth in

funds under management of US$4.1 billion to

US$45.6 billion reflecting net inflows as world stock

markets fell. US$2 billion of net new funds were

attracted. Investment fees benefited strongly from the

success of the Hermitage Fund, which offered clients

access to Russian investment opportunities.

Operating expenses, excluding amortisation of

goodwill, at US$7,878 million were US$265 million,

or 3 per cent, higher than in 2001, reflecting

acquisition related growth, one-off property related

expenses and continued investment in customer

contact and relationship management systems.

Staff costs at US$4,425 million were broadly in

line with 2001. In UK Banking, staff costs reduced

by US$24 million, or 1 per cent, compared with

2001. This was due in part to a switch into ‘other

operating expenses’ of the cost of outsourcing HSBC

Bank’s cash and cheque processing services and to