HSBC 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

49

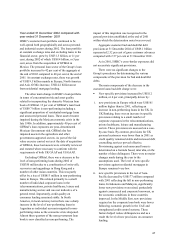

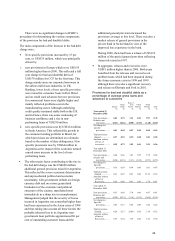

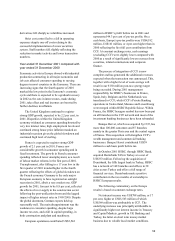

There were no significant changes to HSBC’s

procedures for determining the various components

of the provision for bad and doubtful debts.

The main components of the increase in the bad debt

charge were:

• New specific provisions increased by 15 per

cent, or US$335 million, which was principally

driven by:

i. new provisions in Europe which were US$195

million higher than in 2000. This reflected a full

year charge for bad and doubtful debts of

US$178 million for CCF for the first time. This

charge mainly arose on corporate borrowers in

the airline and leisure industries. In UK

Banking, lower levels of new specific provision

were raised for consumer loans in First Direct

and on credit card advances but new provisions

for commercial loans were slightly higher and

mainly reflected problems seen in the

manufacturing sector. Although underlying

credit quality remained stable both in the UK

and in France, there was some weakening of

business confidence and a rise in non-

performing loans of US$290 million.

ii. new specific provisions rose by US$114 million

in South America. This reflected the growth in

the consumer lending portfolio in Brazil, for

which provisions are determined on a formula

based on the number of days delinquency. New

specific provisions rose by US$64 million in

Argentina as the impact of the economic turmoil

caused some increase in the level of non-

performing loans.

• The other major factor contributing to the rise in

the bad debt charge was the US$600 million

additional general provision raised for Argentina.

This reflected the severe economic deterioration

and unprecedented political and economic

uncertainty, with government default on foreign

currency debt and on a more generalised

breakdown of the economic and political

structures of the country, manifested most

immediately in a sharp rise in unemployment.

Management judged that the severity of losses

incurred in Argentina was somewhat higher than

had been experienced in the Asian crisis of 1998

and that, taking into account all these factors the

probable inherent loss in its Argentine non-

government loan portfolio approximated 60 per

cent of outstanding customer loans and the

additional general provision increased the

provision coverage to this level. There was also a

modest release of general provisions in the

private bank in Switzerland in view of the

improved loss experience in the book.

During 2000, there had been a release of US$174

million of the special general provision reflecting

Asian risk raised in 1997.

• In aggregate, releases and recoveries were

US$81 million higher than in 2000. Both years

benefited from the releases and recoveries on

problem loans which had been impaired during

the Asian economic crisis in 1998 and 1999

although there was also a significant recovery

and release on Olympia and York in 2001.

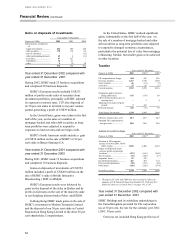

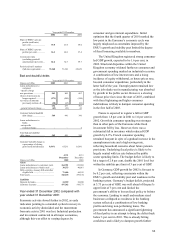

Provisions for bad and doubtful debts as a

percentage of average gross loans and

advances to customers

Euro

p

e

Hon

g

Kon

g

Rest o

f

Asi

a

Pacific

Nort

h

Americ

a

Sout

h

Americ

a

Tota

l

%% % % %%

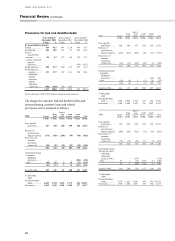

Year ended 31

December 2002

New provisions ..... 0.62 0.75 1.13 0.51 9.97 0.78

Releases and

recoveries ......... (0.21 ) (0.26 ) (0.90 ) (0.15 ) (1.48 ) (0.29 )

Net charge for

specific

p

rovisions......... 0.41 0.49 0.23 0.36 8.49 0.49

Total provisions

charge

d

................. 0.37 0.35 0.25 0.38 3.01 0.38

Amounts written

off net of

recoveries........... 0.25 0.72 1.55 0.41 3.91 0.56

Year ended 31

December 2001

New provisions ..... 0.60 0.66 1.85 0.55 5.72 0.82

releases and

recoveries ......... (0.24 ) (0.36 ) (1.31 ) (0.12 ) (0.71 ) (0.35 )

Net charge for

Specific

p

rovisions......... 0.36 0.30 0.54 0.43 5.01 0.47

Total provisions

charge

d

................ 0.33 0.29 0.55 0.42 15.36 0.65

Amounts written

off net of

Recoveries.......... 0.28 0.88 0.93 0.39 5.78 0.61

Year ended 31

December 2000

New provisions ..... 0.53 0.68 1.70 0.66 4.07 0.81

Releases and

recoveries ......... (0.28 ) (0.31 ) (1.16 ) (0.17 ) (0.65 ) (0.39 )

Net charge for

Specific

p

rovisions......... 0.25 0.37 0.54 0.49 3.42 0.42

Total provisions

charge

d

................ 0.28 0.37 (0.05) 0.26 3.39 0.32

Amounts written

off net of

Recoveries.......... 0.35 0.64 1.39 0.45 1.43 0.58