HSBC 2002 Annual Report Download - page 271

Download and view the complete annual report

Please find page 271 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

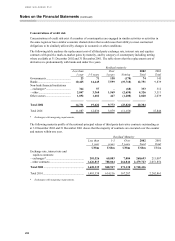

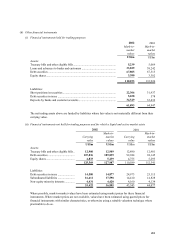

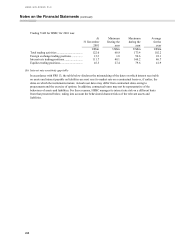

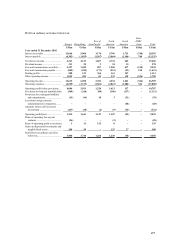

269

31 December 2002

Not more

than three

months

More than

three

months

but not

more than

six months

More than

six months

but no

t

more than

one yea

r

More than

one yea

r

but no

t

more than

five years More than

five years

Non-

interes

t

bearin

g

Bankin

g

book total Tradin

g

book total Total

US$m US$m US$m US$m US$m US$m US$m US$m US$m

Assets

Treasury bills and

other eligible bills 8,857 2,054 1,479 512 – – 12,902 5,239 18,141

Loans and advances

to banks ............... 67,568 3,772 4,243 438 262 2,409 78,692 16,804 95,496

Loans and advances

to customers ........ 241,504 19,510 12,335 39,781 18,249 3,940 335,319 17,025 352,344

Debt securities and

equity shares........ 42,693 7,661 11,493 30,959 15,046 4,906 112,758 71,185 183,943

Other assets ............. 1,902 – – – – 81,261 83,163 26,159 109,322

Total assets............. 362,524 32,997 29,550 71,690 33,557 92,516 622,834 136,412 759,246

Liabilities

Deposits by banks ... (32,172 ) (1,602 ) (2,065 ) (798 ) (408) (4,247) (41,292 ) (11,641 ) (52,933 )

Customer accounts .. (391,328 ) (11,945 ) (10,533 ) (4,947 ) (641) (53,136) (472,530 ) (22,908) (495,438 )

Debt securities in

issue ..................... (12,913 ) (1,859 ) (1,112 ) (11,013 ) (1,440) (1,590) (29,927 ) (5,038 ) (34,965 )

Other liabilities........ (29) (4) (9) (259) (45) (53,187) (53,533 ) (45,047) (98,580 )

Loan capital and

other

subordinated

liabilities.............. (3,753) (1,647 ) (1,094 ) (2,616 ) (9,261 ) – (18,371 ) – (18,371 )

Minority interests

and shareholders’

funds..................... – – – – – (56,952) (56,952) (2,007) (58,959)

Internal funding of

the trading book... 43,481 3,127 891 2,681 50 (459) 49,771 (49,771) –

Total liabilities ....... (396,714) (13,930) (13,922) (16,952) (11,745) (169,571) (622,834) (136,412) (759,246)

Off-balance-sheet

items ................... (31,517 ) 1,443 7,630 24,982 (2,538) – – – –

Interest rate

sensitivity gap .... (65,707) 20,510 23,258 79,720 19,274 (77,055) – – –

Cumulative

interest rate

sensitivity gap .... (65,707) (45,197) (21,939) 57,781 77,055 – – – –

A positive interest rate sensitivity gap exists where more assets than liabilities re-price during a given period.

Although a positive gap position tends to benefit net interest income in a rising interest rate environment, the

actual effect will depend on a number of factors, including the extent to which repayments are made earlier or

later than the contracted date and variations in interest rates within re-pricing periods and among currencies.

Similarly, a negative interest rate sensitivity gap exists where more liabilities than assets re-price during a given

period. In this case, a negative gap position tends to benefit net interest income in a declining interest rate

environment, but again the actual effect will depend on the same factors as for positive interest rate gaps, as

described above.