HSBC 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC Holdings plc Annual Report

and Accounts

Table of contents

-

Page 1

HSBC Holdings plc Annual Report and Accounts -

Page 2

... Notes on the Financial Statements ...195 Exchange Controls and Other Limitations Affecting Security Holders ...7 Taxation of Shares and Dividends ...314 Description of Business ...8 Shareholder Information ...317 Description of Property ...34 Organisational Structure ...321 Legal Proceedings ...35... -

Page 3

...Dividends...Net asset value at year-end...Share information US$0.50 ordinary shares in issue (million)...Market capitalisation at year-end ...Closing market price per share at year-end ... 0.67 0.76 0.66 0.53 5.53 9,481 US$105bn £6.87 HSBC 9,355 US$109bn £8.06 Benchmark 76 95 Total shareholder... -

Page 4

... HOLDINGS PLC Financial Highlights (continued) 2002 Performance ratios On a cash basis Return on invested capital ...Return on net tangible equity...Post-tax return on average tangible assets...Post-tax return on average risk-weighted assets ...On a reported basis Return on average shareholders... -

Page 5

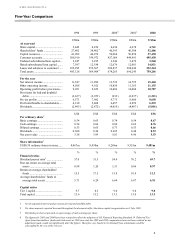

HSBC HOLDINGS PLC Five-Year Comparison 1998 US$m At year-end Share capital...Shareholders' funds ...Capital resources...Customer accounts...Undated subordinated loan capital ...Dated subordinated loan capital...Loans and advances to customers1 ...Total assets...For the year Net interest income ...... -

Page 6

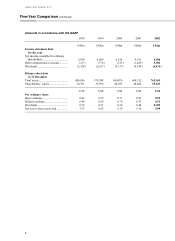

HSBC HOLDINGS PLC Five-Year Comparison (continued) Amounts in accordance with US GAAP 1998 US$m Income statement data for the year Net income available for ordinary shareholders...Other comprehensive income...Dividends...Balance sheet data at 31 December Total assets...Shareholders' equity ...1999... -

Page 7

...sterling) and government-established exchange rates (for example, between the Hong Kong dollar and the US dollar); volatility in interest rates, including in Asia and South America; volatility in equity markets, including in the smaller and less liquid trading markets in Asia and South America; lack... -

Page 8

... currencies of HSBC' s operations, has been translated at current period exchange rates. Information About the Enforceability of Judgements made in the United States HSBC Holdings is a public limited company incorporated in England and Wales. Most of HSBC Holdings' Directors and executive officers... -

Page 9

HSBC HOLDINGS PLC Exchange Controls and Other Limitations Affecting Equity Security Holders There are currently no UK laws, decrees or regulations which would prevent the transfer of capital or remittance of dividends and other payments to holders of HSBC Holdings' equity securities who are not ... -

Page 10

... key locations - London, Hong Kong, New York, Geneva, Paris and Düsseldorf - HSBC has significant investment and/or private banking operations which, together with its commercial banks, enable HSBC to service the requirements of its high net worth personal, corporate and institutional customers... -

Page 11

...added value. When considering acquisition opportunities, HSBC takes full account of the fact that the price paid determines the rate of return to shareholders. Over the years, HSBC has successfully acquired a number of businesses that have provided access to new markets, an increased presence in key... -

Page 12

...-term careers within HSBC, are key to this integration process. The most significant developments are described below. The Hongkong and Shanghai Banking Corporation purchased The Mercantile Bank of India Limited and The British Bank of the Middle East (now HSBC Bank Middle East) in 1959, increasing... -

Page 13

...venture between HSBC and Merrill Lynch in April 2000 to provide direct investment and banking services, primarily over the internet, to mass affluent investors outside the US. It currently operates in Australia, Canada and the UK. Working with HSBC' s private banking business, HSBC USA Inc. employed... -

Page 14

... Banking Private Banking fulfil customer needs when they arise. Principal products and services for personal customers include current, cheque and savings accounts, loans and home finance, cards, payments, insurance and investment services, including securities trading. Services are increasingly... -

Page 15

... of current and savings accounts, corporate and purchasing cards, treasury services and lending products, HSBC also provides a wide range of insurance and investment products to commercial banking customers and their employees through an extensive, worldwide network of branches and business banking... -

Page 16

... with HSBC's retail, commercial and corporate and investment banking networks to generate and maintain 'two-way' client referrals. Client services include deposits and funds transfer, tax and trustee structures, asset and trust management, mutual funds, currency and securities transactions, lending... -

Page 17

... number of business areas, including cards, mortgage processing, investment products and retail banking. The HSBC Premier customer account base in the UK has grown by 44 per cent during 2002. The Premier telephone service has been enhanced to include the opening of personal loans, credit cards... -

Page 18

... services. By increasingly employing product specialists, investing in new sales channels and through effective marketing, HSBC Bank demonstrated its customer focus and thereby increased its share of the business start-up market in 2002. During the year, over 87,000 new start-up business accounts... -

Page 19

... foreign exchange risk and develop new services for institutional and corporate customers. HSBC Bank' s major dealing room in London serves as the hub for HSBC's European network of treasury and capital markets operations, delivering a high quality, tailored service to HSBC's corporate, commercial... -

Page 20

...its Corporate Banking Division, CCF offers account management, credit, cash management and stock custody services to the 100 largest French institutional and corporate groups, and to international clients. The Corporate Banking Division is also very active in providing trade financing, export credit... -

Page 21

... the services available. Investment in training and communications has developed excellent teamwork with HSBC' s retail banking operations and led to a significant increase in client referrals from Hong Kong, Singapore and London, and on a reciprocal basis to the introduction of significant business... -

Page 22

... retirement business continued to develop, both through new sales and the transfer to HSBC of Pacific Century Insurance Company Limited' s Mandatory Provident Fund ('MPF' ) business. In another year of fierce competition for quality assets and increasing consumer loan write-offs in Hong Kong, HSBC... -

Page 23

... business customers regardless of their size. HSBC's Corporate, Investment Banking and Markets business in Hong Kong reported strong results in 2002. A diversified portfolio of businesses has helped it ride the economic downturn well, with strong profits in its treasury and capital markets business... -

Page 24

... emphasised service to corporate and commercial banking customers with a strong trade services element augmented by an increasingly important treasury and capital markets business. In recent years, HSBC' s strategy has evolved to promote an increased focus on providing products and services that... -

Page 25

... locations, a new processing site in Malaysia will be opened in the first half of the year. In the Asia-Pacific region outside Hong Kong, HSBC' s Corporate Investment Banking and Markets business posted robust results. As a result of investment in human resources, marketing and systems development... -

Page 26

.... In 2002, hsbc.com, HSBC's internet development facility based in New York, launched business applications in Asia, North America and Europe; implemented an improved internet service for Global Treasury and Capital Markets customers; launched new web sites for Group businesses in North America and... -

Page 27

... of any banking institution in Mexico. HSBC plans to use this network and customer base to expand personal banking services and cross-sell other products and services, particularly leveraging the important position now held in all of the North American Free Trade Agreement countries (Canada, the US... -

Page 28

... directly with HSBC in an increasing number of markets worldwide in which previously only HSBC and a few other global banks offered the full range of banking services. Limited market growth In HSBC' s largest current markets, the UK, France, the US and Hong Kong, there is limited market growth... -

Page 29

... global customer base will help position GFBital to compete more effectively in trade finance, Corporate, Investment Banking and Markets and Personal Financial Services. Mexico's economy is very closely linked to that of the US and Canada; over 90% of Mexico's exports stay within the North American... -

Page 30

... to offer in those markets and how HSBC structures specific operations. The UK Financial Services Authority ('FSA' ) supervises HSBC on a consolidated basis. Additionally, each operating bank within HSBC is regulated by local supervisors. Thus, The Hongkong and Shanghai Banking Corporation Limited... -

Page 31

... investment business in the UK from retail life and pensions business to custody, branch share dealing and treasury and capital markets activity. FSA rules establish the minimum criteria for authorisation for banks and investment businesses in the UK. They also set out reporting (and, as applicable... -

Page 32

...FDIC and the State of New York Banking Department govern many aspects of HSBC' s US business. HSBC and its US operations are subject to supervision, regulation and examination by the Federal Reserve Board because HSBC is a bank holding company under the US Bank Holding Company Act of 1956 (the 'BHCA... -

Page 33

... Federal Reserve Board' s flexibility with respect to the capital adequacy requirements applicable to such US bank holding companies. HSBC Bank USA, like other FDIC-insured banks, is required to pay assessments to the FDIC for deposit insurance under the FDIC' s Bank Insurance Fund (calculated using... -

Page 34

... HSBC Bank USA under the Bank Secrecy Act and applicable Federal Reserve Board regulations. These include requirements to adopt and implement an anti-money laundering program, report suspicious transactions and implement due diligence procedures for certain correspondent and private banking accounts... -

Page 35

... number of employees, client accounts and branches. All credit institutions operating in France are required by law to operate a deposit guarantee mechanism for customers of commercial banks, except branches of European Economic Area banks which are covered by their home country' s guarantee system... -

Page 36

HSBC HOLDINGS PLC Description of Property At 31 December 2002, HSBC had some 7,600 operational properties worldwide, of which approximately 3,100 were located in Europe, 600 in Hong Kong and the Asia Pacific region, 2,000 in North America (including 1,370 in Mexico) and 1,600 in Brazil. ... -

Page 37

HSBC HOLDINGS PLC Legal Proceedings HSBC, through a number of its subsidiary undertakings, is named in and is defending legal actions in various jurisdictions arising from its normal business. None of the above proceedings is regarded as material litigation. 35 -

Page 38

... East and Africa; North America; and South America. Each of these businesses operates domestic banking operations in its region providing services to personal, commercial and corporate customers. In key locations including London, New York, Hong Kong and Paris, HSBC has treasury and capital markets... -

Page 39

...benefits obligations, entered into by companies during a more benign economic climate, are likely to place a severe strain on future corporate profits. Employment levels remain a key factor in economic recovery. During the current uncertainties, HSBC believes completion of the Household acquisition... -

Page 40

...historic US dollar deposits at current exchange rates), government decrees and renegotiation of banking contracts Amounts written off fixed asset investments were dominated by a US$143 million charge writing down the carrying value of a major European life assurer in which CCF has for some time held... -

Page 41

... realised from sales of investment debt securities to adjust to changes in interest rate conditions. Net interest income Year ended 31 December 2002 US$m % Europe...6,343 41.0 Hong Kong...4,133 26.7 Rest of Asia1,607 10.4 Pacific ...North America ...2,732 17.7 South America ...645 4.2 Net interest... -

Page 42

... China and the Middle East, together with personal lending growth in the United Kingdom, France, United States, Canada, Singapore, Malaysia, Korea, Taiwan and India. The increase in average interest-earning assets from acquisitions was US$4 billion. HSBC was able to maintain its net interest margin... -

Page 43

... of acquisitions, there was organic growth in Hong Kong driven principally by the placement of customer deposits, together with personal lending growth in the United Kingdom, the United States, Canada, Singapore, Taiwan, India and the Philippines. At 2.54 per cent, HSBC's net interest margin was... -

Page 44

...US$m Account services ...Credit facilities...Remittances ...Cards ...Imports/exports ...Underwriting...Insurance...Mortgage servicing rights...Trust income ...Broking income...Global custody ...Maintenance income on operating leases ...Funds under management Corporate finance Other ...Total fees and... -

Page 45

... and consistent with the pricing changes on loan and deposit products referred to above, its customers also benefited from a number of fee reductions during 2001, particularly in HSBC Bank plc's UK Banking business. In the United Kingdom, eliminating mortgage loan to valuation fees reduced... -

Page 46

... UK based investment banking operations were lower as headcount was adjusted to reflect market conditions. In Hong Kong, costs in 2002, excluding goodwill amortisation, were in line with 2001. A fall in staff costs, following the transfer of back office processing functions to Group Service Centres... -

Page 47

...business in several countries in the region, in particular mainland China, Taiwan, the Middle East and in Australia through the acquisition of NRMA. During the year The Hongkong and Shanghai Banking Corporation opened eight new branches in the Asia Pacific region. Operating expenses in North America... -

Page 48

... bad and doubtful debts and non-performing customer loans and related provisions can be analysed as follows: 2002 Europe Hong Kong Rest of AsiaNorth South Pacific America America Total 3,682 3,045 2,028 1,408 2,723 1,952 672 723 544 1,033 9,649 8,161 2000 New specific provisions ...Release... -

Page 49

... constant exchange rates, there was growth of US$19.5 billion mainly in Europe, North America and Asia. Of this increase, US$14.2 billion arose from residential mortgage lending. The other main change in HSBC's loan portfolio in terms of concentration risk and asset quality related to incorporating... -

Page 50

... of the rate at which such losses occur and are identified, on the structure of the credit portfolio and the economic and credit conditions prevailing at the balance sheet date. In the UK there was a release of some US$50 million of general provisions as a number of corporate borrowers which... -

Page 51

... in 2001. i. Provisions for bad and doubtful debts as a percentage of average gross loans and advances to customers Europe Hong Kong Rest of Asia North Pacific America South America Total % Year ended 31 December 2002 New provisions ...Releases and recoveries ...Net charge for specific provisions... -

Page 52

... from mortgage refinancing. Similar, but smaller gains were achieved in other locations. Taxation Figures in US$m UK corporation tax charge Overseas taxation...Joint ventures...Associates...Current taxation Origination and reversal of timing differences Effect of decreased tax rate on opening asset... -

Page 53

... 31 December 2001 compared to year ended 31 December 2000 HSBC Holdings and its subsidiary undertakings in the United Kingdom provided for UK corporation tax at 30 per cent, the rate for the calendar year 2001 (2000: 30 per cent). Overseas tax included Hong Kong profits tax of US$450 million (2000... -

Page 54

...At 31 December 2002 US$m % Loans and advances to customers ...Loans and advances to banks ...Debt securities ...Treasury bills and other eligible bills ...Equity shares...Intangible fixed assets...Other ...Hong Kong SAR Government certificates of indebtedness...Total assets ...At 31 December 2001 US... -

Page 55

... the year, both HSBC's asset management and private banking businesses attracted net funds inflows. The weakening of the US dollar on our sterling and Euro denominated funds also led to increases in the value of funds under management. Together these more than offset the impact of the fall in global... -

Page 56

...100.0 North America, from South America (formerly described as Latin America). Europe Cash basis profit before tax Figures in US$m UK banking ...France...International banking ...Treasury and capital markets HSBC Private Banking Holdings (Suisse) SA...HSBC Trinkaus & Burkhardt...Other*...Year ended... -

Page 57

... 441 348 0.34% 0.32% 0.26% Figures in US$m Assets Loans and advances to customers (net) . Loans and advances to banks (net) ...Debt securities, treasury bills and other eligible bills ...Total assets...Liabilities Deposits by banks...Customer accounts ... At 31 December 2002 164,701 39,373 71... -

Page 58

... bank increased its share of business start-ups and opened more than 87,000 new business accounts in 2002. Corporate current account balances improved by 9 per cent compared with 2001 although this was partly offset by a narrowing of spreads on deposit accounts. In Treasury and Capital Markets net... -

Page 59

... dealing profits were down in aggregate, foreign exchange revenues grew by 6 per cent following expansion in emerging markets business and currency options. Fee income from fixed income products also benefited strongly from the continued alignment with HSBC corporate clients and HSBC achieved number... -

Page 60

... the fall in value of central London property cost US$76 million. The contribution of customer contact systems to delivering strong growth in both personal savings and lending balances and fee based products during the year justified further investment in these systems. In CCF, the full year impact... -

Page 61

...which US$569 million was attributable to CCF. The underlying increase was principally attributable to significantly higher net interest income in Treasury and Capital Markets, growth in UK Banking and Turkey, the latter on short term money market business due to volatile local market conditions. 59 -

Page 62

... than in 2000 reflecting reduced dealing profits and lower broking and other securities-related fee income from investment banking activities. These were partly offset by increased wealth management and corporate banking fees particularly in UK Banking. CCF' s other operating income was US$1,074... -

Page 63

... raised for First Direct and on credit card advances but new provisions for commercial loans were slightly higher and reflected problems seen in the manufacturing sector and weakening in business confidence. In HSBC Republic Suisse, an increase in new provisions against a corporate exposure in the... -

Page 64

...Figures in US$m Assets Loans and advances to customers (net)...Loans and advances to banks (net)...Debt securities, treasury bills and other eligible bills ...Total assets (excluding Hong Kong SAR Government certificates of indebtedness) ...Liabilities Deposits by banks...Customer accounts... At 31... -

Page 65

...Hong Kong in Corporate Banking revenues, due to higher income from structured and corporate finance transactions. Other income increased by US$59 million, driven by improved underwriting results. Dealing profits fell by US$85 million, or 39 per cent, due to lower profits on debt securities as credit... -

Page 66

... credit card loans and wider spreads on foreign currency customer deposits also contributed to the increase in net interest income. This was partly offset by reduced spreads on residential mortgages and Hong Kong dollar deposits and subdued corporate loan demand. The combination of increased market... -

Page 67

...scheme. Operating expenses, other than staff costs, increased by US$41 million, or 5 per cent, mainly in advertising and marketing expenses to support various initiatives, including the promotion of credit cards, launch of capital guaranteed funds and other personal banking products and development... -

Page 68

HSBC HOLDINGS PLC Financial Review (continued) Rest of Asia-Pacific (including the Middle East) Figures in US$m Net interest income ...Dividend income...Net fees and commissions ...Dealing profits ...Other income ...Other operating income...Total operating income Staff costs ...Premises and ... -

Page 69

... in credit card and personal lending across the region, particularly in Taiwan, Singapore, India, the Philippines and Australia, the latter supported by HSBC' s acquisition of NRMA Building Society in 2001. Overall, average loans and advances to customers in the rest of Asia-Pacific increased by... -

Page 70

... Management systems, and increased marketing and advertising costs for PFS services. There was a net release of bad and doubtful debts of US$32 million, reflecting a number of recoveries of provisions held against various corporate customers. In Malaysia, HSBC Bank Malaysia reported operating profit... -

Page 71

... driven by increased sales of personal financial services, particularly credit cards. HSBC's operations in Japan, Thailand, the Philippines, Brunei and Australia each contributed in excess of US$25 million to pre-tax profits, the latter benefiting from HSBC's acquisition of NRMA Building Society in... -

Page 72

... exposure to an energy sector related company. Advances to customers grew by US$125 million, or 9 per cent, with strong growth in personal lending and to the commercial and industrial and public sectors. In mainland China, HSBC's operations returned to profitability reporting pre-tax profit of US$33... -

Page 73

... of credit upgrades following loan restructurings, recoveries and write-offs. The Middle Eastern operations of HSBC Bank Middle East benefited from the expansion of fee income from personal banking business and a lower charge for bad and doubtful debt provisions. Cash basis pre-tax profits were... -

Page 74

... in losses being reported in Indonesia. North America Cash basis profit before tax Figures in US$m HSBC Bank USA (excl Princeton) ...HSBC Markets USA...Other USA operations...USA operations ...Canadian operations ...Mexico ...Panama ...Princeton Note settlement ...Group internet development - hsbc... -

Page 75

... to customers (net)...Loans and advances to banks (net) ...Debt securities, treasury bills and other eligible bills ...Total assets...Liabilities Deposits by banks...Customer accounts ... 9,972 90,137 8,113 81,055 Year ended 31 December 2002 compared with year ended 31 December 2001 The United... -

Page 76

...the retail network. Difficult conditions in the capital markets prevented a recurrence of 2001' s strong dealing profits, and profits on domestic US dollar trading fell. Income relating to mortgage servicing rights was in line with 2001. In Canada, HSBC' s Canadian operations reported an increase in... -

Page 77

....com in its development centre in New York caused reported profit before tax to fall by US$357 million, or 42 per cent, to US$503 million. HSBC Bank USA' s operations in the United States reported an increase of US$402 million, or 46 per cent, in cash basis profit before tax (excluding the provision... -

Page 78

...increase in profits on debt securities and US treasury activities over 2000. In addition, HSBC Bank USA reported increased profits on foreign exchange trading. The dealing profits in HSBC' s Canadian operations were lower than in 2000 as operations were scaled back in the unsettled market conditions... -

Page 79

... in place. Operating expenses in the domestic operations of HSBC Bank USA were 2 per cent lower compared to 2000. A reduced level of acquisition related restructuring charges in 2001 was offset by business expansion in treasury, wealth management and ecommerce, and increased marketing expenses... -

Page 80

... exchange rates, cash basis operating profit before provisions was broadly in line with 2001. A strong performance in dealing income was offset by a loss of revenue from account services, as new legislation prohibited the levying of fees on certain types of account. Higher contributions to employee... -

Page 81

... to all pesified sovereign debt, deposit balances and certain (primarily commercial and corporate) customer loans. Other operating income of US$596 million was US$24 million, or 4 per cent higher than in 2001. Fee income fell by US$27 million, or 8 per cent, but dealing profits increased by US$133... -

Page 82

...corporate and retail lending (principally arising from the full years contribution from CCF' s Brazilian operations) and holdings of US dollar linked securities to take advantage of wider spreads from lower funding costs. This was partly offset by a decline in HSBC Bank Brasil' s net interest margin... -

Page 83

... US$6 million compared to dealing profits of US$16 million in 2000. This resulted from difficult trading conditions as a result of volatility in foreign exchange rates and losses on bond positions. HSBC' s Argentine pensions, healthcare and life insurance businesses also reported falls in income as... -

Page 84

... capital measures including the relative risk-weighted assets of each operation. % 20.1 19.6 32.4 13.4 14.5 100.0 Personal Financial Services . Commercial Banking...Corporate, Investment Banking and Markets...Private Banking...Other ... In the analysis of profit by line of business, total operating... -

Page 85

... and equity release loans. Personal current accounts and savings accounts continued to grow as customers preferred liquidity and security in the uncertain investment climate. The impact of product re-pricing initiatives in the UK in late 2001 and the benefit of lower cost of funds has increased... -

Page 86

HSBC HOLDINGS PLC Financial Review (continued) In Hong Kong, net interest income was broadly in line with 2001. The benefits of increased credit card and mortgage lending and improved spreads arising from lower funding deposit costs were largely offset by the impact of competitive pricing ... -

Page 87

...for bad debts increased by US$12 million in the rest of Asia-Pacific, following increased credit card lending in India, Indonesia and Taiwan. Improved credit control procedures in the Middle East reduced the cost of new specific provisions against personal customers. Provisions in South America fell... -

Page 88

...in Europe were down. In constant currency terms, the UK bank' s staff costs rose 4 per cent due to annual pay rises and increased headcount in wealth management and customer telephone services. Costs in Hong Kong increased by US$147 million, reflecting increased marketing and IT costs, together with... -

Page 89

... to profit on disposal of fixed asset investments. In other associates and joint ventures, an improved performance in Cyprus partly offset higher losses in Merrill Lynch HSBC and lower profits in the personal banking business of Saudi British Bank. Commercial Cash basis profit before tax Year ended... -

Page 90

...2000 cent. In Hong Kong, cross-selling initiatives with HSBC Asset Management and Treasury led to higher levels of fee income on investment funds. Insurance and trade services income also increased. Operating expenses were broadly in line with 2001. In constant currency terms the increase was US$27... -

Page 91

... significant growth in UK commercial loans and deposits was offset by falling margins due to lower base rates and increased competitive pressures. Net interest income in Hong Kong fell slightly, by US$44 million, due to lower margins on current account deposits. The rest of Asia-Pacific saw a small... -

Page 92

... to banks (net) ...Loans and advances to customers (net)...Debt securities, treasury bills & other eligible bills ...Deposits by banks...31 December 2002 31 December 2001* 31 December 2000* 80,870 83,312 100,073 Europe ...Hong Kong...Rest of Asia-Pacific...North America...South America... 101... -

Page 93

... Singapore, India, China and Japan. Operating expenses were in line with 2001. Whilst there were significant reductions in staff costs in Investment Banking as staff numbers were reduced in the light of market conditions, these were offset by increased revenue related costs in Treasury and Capital... -

Page 94

...$354 million reflected a number of disposals in Europe including Quilter by CCF and Pulsiv and ERGO by HSBC Trinkaus. In Hong Kong, disposal profits in 2001 included the Group's investment in Hong Kong Central Registration and certain investment securities. In North America, the business sought to... -

Page 95

... private tax services to wealthy clients. Trust business was expanded in the United States, Asia and the Channel Islands. Working with Group Insurance, the Private Bank launched new tax efficient insurance wrapper products. In fund management the range of funds expanded especially in the alternative... -

Page 96

...$31m relating to CCF' s operation in Lebanon, now closed, and smaller amounts relating to a number of individual items of litigation. Private Banking achieved US$5 million of gains on the disposal of fixed asset investments, compared with US$19 million in 2000. Other Cash basis profit before tax 31... -

Page 97

... and HSBC's holding company and financing operations. The results include net interest earned on free capital held centrally and operating costs incurred by the head office operations in providing stewardship and central management services to HSBC. A number of exceptional items are also reported in... -

Page 98

HSBC HOLDINGS PLC Financial Review (continued) segment including the impact of the Princeton Note provision and exceptional bad debt provisions and currency redenomination losses in Argentina. Net fees and commissions and other income of the Group' s wholesale insurance operations amounted to US$... -

Page 99

... future. HSBC requires operating companies to maintain a general provision which is determined taking into account the structure and risk characteristics of each company' s loan portfolio. The most important factors in determining general loan loss provisions are: • • historical loss rates for... -

Page 100

...lease financing, shareholders' interest in the longterm assurance fund, pension costs, stock-based compensation, goodwill, internal software costs, revaluation of property, purchase accounting adjustments, accruals accounted derivatives, permanent diminution in value of available-for-sale securities... -

Page 101

... that financial statements report at fair value the assets and liabilities arising from an employer' s retirement benefit obligations and any related funding. The operating costs of providing retirement benefits to employees are recognised in the accounting periods in which the benefits are earned... -

Page 102

HSBC HOLDINGS PLC Financial Review (continued) consolidate the VIE. Management have performed an initial review of HSBC' s VIEs in order to provide the disclosures required in respect of VIEs both where HSBC is and is not likely to be the primary beneficiary. HSBC has adopted the disclosure ... -

Page 103

...Assets Short-term funds and loans to banks Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA... -

Page 104

... America Other operations... Investment securities Europe HSBC Bank plc ...HSBC Private Banking Holdings...CCF...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East. HSBC... -

Page 105

...6.26 6.46 7.32 North America South America Other operations ...(32,082 ) 1,005 Total interest-earning assets Europe HSBC Bank plc ...170,706 HSBC Private Banking Holdings ...26,799 CCF ...56,949 Hang Seng Bank ...56,381 The Hongkong and Shanghai Banking Corporation Limited ...107,804 The Hongkong... -

Page 106

... total assets: Europe HSBC Bank plc ...HSBC Private Banking Holdings...CCF...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East. HSBC USA Inc ...HSBC Bank Canada ...HSBC... -

Page 107

... funds Deposits by banks # Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA Inc...HSBC Bank... -

Page 108

...91 North America South America Other operations... Loan capital Europe HSBC Bank plc ...HSBC Private Banking Holdings...CCF...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC USA Inc ...HSBC Bank Canada ...HSBC Bank Brasil ...HSBC... -

Page 109

... HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...Hong Kong Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA Inc...HSBC Bank Canada ...HSBC Markets... -

Page 110

...) Total interest-bearing liabilities Europe HSBC Bank plc ...154,707 HSBC Private Banking Holdings...24,097 CCF...44,819 Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited...The Hongkong and Shanghai Banking Corporation Limited...HSBC Bank Malaysia Berhad...HSBC Bank Middle East... -

Page 111

Year ended 31 December Net interest margin Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad ...HSBC Bank Middle East . HSBC USA... -

Page 112

... America Other operations... Loans and advances to customers Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad . HSBC Bank Middle... -

Page 113

... America Other operations ... Investment securities Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad . HSBC Bank Middle East... -

Page 114

... America Other operations... Customer accounts Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF...Hang Seng Bank...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Bank Malaysia Berhad . HSBC Bank Middle East...HSBC... -

Page 115

... North America South America Other operations Loan capital Europe HSBC Bank plc ...HSBC Private Banking Holdings ...CCF ...The Hongkong and Shanghai Banking Corporation Limited ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC USA Inc...HSBC Bank Canada ...HSBC Bank Brasil...HSBC... -

Page 116

...type of business. Country limits are • • Credit risk management Credit risk is the risk that a customer or counterparty will be unable or unwilling to meet a commitment that it has entered into with HSBC. It arises principally from lending, trade finance, treasury and leasing activities. HSBC... -

Page 117

... policy; credit scoring; new products; training courses; and credit-related reporting. • Primary interface for credit-related issues on behalf of HSBC Holdings with external parties including the Bank of England and the UK Financial Services Authority ('FSA' ), the rating agencies and corporate... -

Page 118

... UK with an increase of 10 per cent in credit card advances at 31 December 2002. Corporate commercial lending grew modestly, less than 2 per cent, reflecting muted corporate loan demand and cautious risk appetite. Personal: Residential mortgages 78,215 Hong Kong SAR Government Home Ownership Scheme... -

Page 119

... by type of customer The following tables analyse loans by industry sector and by the location of the principal operations of the lending subsidiary or, in the case of The Hongkong and Shanghai Banking Corporation, HSBC Bank plc, HSBC Bank Middle East and HSBC Bank USA operations, by the location of... -

Page 120

... ...Hong Kong SAR Government Home Ownership Scheme...Other personal...Total personal ...Corporate and commerical: Commercial, industrial and international trade...Commercial real estate...Other property-related...Government ...Other commercial*...Total corporate and commercial Financial: Non-bank... -

Page 121

...Hong Kong SAR Government Home Ownership Scheme ...Other personal ...Total personal...Corporate and commerical: Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government...Other commercial* ...Total corporate and commercial ...Financial: Non-bank... -

Page 122

... ...Hong Kong SAR Government Home Ownership Scheme...Other personal...Total personal ...Corporate and commercial: Commercial, industrial and international trade...Commercial real estate...Other property-related...Government ...Other commercial*...Total corporate and commercial ...Financial: Non-bank... -

Page 123

...exchange for debt securities Residential Mortgages US$m Other Personal US$m Propertyrelated US$m Commercial, industrial and international trade and other US$m Total US$m 31 December 2001 Loans and advances to customers (gross) Singapore†...Australia and New Zealand ...Malaysia...Middle East... -

Page 124

... included group entities in Panama and Mexico, which are now included in North America, figures for 1998 to 2001 have been restated to reflect this change. Provisions for bad and doubtful debts It is HSBC' s policy that each operating company will make provisions for bad and doubtful debts promptly... -

Page 125

... balances at each stage of delinquency. The principal portfolios assessed for specific provision on a portfolio basis are overdue credit cards and other unsecured consumer lending products and residential mortgages overdue, but less than 90 days overdue. The Group has used loss rate data to develop... -

Page 126

... of interest being paid at some future date, interest on nonperforming loans is charged to the customer' s account. However, the interest is not credited to the profit and loss account but to an interest suspense account in the balance sheet which is netted against the relevant loan. On receipt of... -

Page 127

... years: Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Residential mortgages ...Other personal...Total recoveries...Net charge to profit and loss account: Banks ...Commercial, industrial and international trade... -

Page 128

... years: Commercial, industrial and international trade...Real Estate Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages...Other personal ...Total recoveries ...Net charge to profit and loss account: Banks...Commercial, industrial and international trade... -

Page 129

... years: Banks ...Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Residential mortgages ...Other personal...Total recoveries...Net charge to profit and loss account: Banks ...Commercial, industrial and international... -

Page 130

... in previous years: Banks...Commercial, industrial and international trade...Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Other personal ...Total recoveries ...Net charge to profit and loss account: Banks...Commercial, industrial and international trade...Real... -

Page 131

... in previous years: Banks ...Commercial, industrial and international trade ...Real estate...Non-bank financial institutions ...Governments...Other commercial...Other personal...Total recoveries...Net charge to profit and loss account: Banks ...Commercial, industrial and international trade ...Real... -

Page 132

...Under the UK Statement of Recommended Practice on Advances, UK banks continue to charge interest on doubtful debts where there is a realistic prospect of recovery. This interest is credited to a suspense account and is not included in the profit and loss account. In the United States, loans on which... -

Page 133

......Total assets acquired in exchange for advances ...Total non-performing loans ...Troubled debt restructurings: Europe...Hong Kong...Rest of Asia-Pacific ...North America...South America*...Total troubled debt restructurings ...Accruing loans contractually past due 90 days or more as to principal... -

Page 134

... with the Bank of England Country Exposure Report (Form C1) guidelines, outstandings comprise loans and advances (excluding settlement accounts), amounts receivable under finance leases, acceptances, commercial bills, certificates of deposit and debt and equity securities (net of short positions... -

Page 135

...which report to Group Head Office on a regular basis. This process includes: • projecting cash flows by major currency and a consideration of the level of liquid assets in relation thereto; Liquidity management Liquidity relates to the ability of a company to meet its obligations as they fall due... -

Page 136

....8 427.1 2002 Debt securities and loans 2001 2000 Customer accounts Total assets Loans and advances to customer HSBC' s strong liquidity is demonstrated by the surplus of its lending to other banks over its borrowings from banks. As HSBC is a net lender to the inter-bank market, which is much... -

Page 137

... Customer accounts and deposits by banks 2001 % Deposits by banks Current Savings and other deposits Total 10.7 34.1 US$bn 53.6 171.8 Market risk management Market risk is the risk that foreign exchange rates, interest rates or equity and commodity prices will move and result in profits or losses... -

Page 138

... from customer-related business or from position taking. HSBC manages market risk through risk limits approved by the Group Executive Committee. Traded Markets Development and Risk, an independent unit within the Corporate Investment Banking and Markets operation, develops risk management policies... -

Page 139

... currency exposures originated by commercial banking businesses in HSBC. The latter are transferred to local treasury units where they are managed, together with exposures which result from dealing activities, within limits approved by the Group Executive Committee. VAR on foreign exchange trading... -

Page 140

... in the statement of total consolidated recognised gains and losses. These exposures are represented by the net asset value of the foreign currency equity and subordinated debt investments in subsidiaries, branches and associated undertakings. HSBC' s structural foreign currency exposures are... -

Page 141

... run to maturity. In practice, these exposures are actively managed. Equities exposure HSBC' s equities exposure comprises trading equities, forming the basis of VAR, and long-term equity investments. The latter are reviewed annually by the Group Executive Committee and regularly monitored by the... -

Page 142

... or guarantees. Trading book risk-weighted assets are determined by taking into account market-related risks, such as foreign exchange, interest rate and equity position risks, as well as counterparty risk. HSBC capital management It is HSBC' s policy to maintain a strong capital base to support the... -

Page 143

..., cost, market conditions, timing and the effect on the components and maturity profile of HSBC capital. Subordinated debt requirements of other HSBC companies are provided internally. HSBC recognises the impact on shareholder returns of the level of equity capital employed within HSBC and seeks... -

Page 144

... Bank plc (excluding CCF and HSBC Private Banking Holdings (Suisse) S.A.)...HSBC Private Banking Holdings (Suisse) S.A.* ...CCF HSBC Bank plc ...HSBC USA Inc ...HSBC Bank Middle East ...HSBC Bank Malaysia Berhad ...HSBC Bank Canada ...GFBital...HSBC South American operations HSBC Holdings sub-group... -

Page 145

... trade...- Real estate and other property related ...- Non-bank financial institutions ...- Governments ...- Other commercial ...Hong Kong SAR Government Home Ownership Scheme...Residential mortgages and other personal loans...Loans and advances to customers ...Total loans maturing in one year... -

Page 146

...property related ...- Non-bank financial institutions ...- Governments ...- Other commercial ...Hong Kong SAR Government Home Ownership Scheme...Residential mortgages and other personal loans...Loans and advances to customers ...Total loans maturing after 5 years...Interest rate sensitivity of loans... -

Page 147

...and excludes balances with HSBC companies. The 'Other' category includes securities sold under agreements to repurchase. 2002 Average Average Balance Rate US$m Deposits by banks Europe Demand and other - non-interest bearing...Demand - interest bearing ...Time...Other ...Total...Hong Kong Demand and... -

Page 148

... - interest bearing...Savings...Time ...Other ...Total ...CDs and other money market instruments Europe ...Hong Kong...Rest of Asia-Pacific...North America...South America...Total ... Year ended 31 December 2001 Average Average Average Rate Balance rate % US$m % 2000 Average Average balance rate US... -

Page 149

...- banks ...- customers...Total...Hong Kong Certificates of deposit ...Time deposits: - banks ...- customers...Total...Rest of Asia-Pacific Certificates of deposit ...Time deposits: - banks ...- customers...Total...North America Certificates of deposit ...Time deposits: - banks ...- customers...Total... -

Page 150

...information (continued) Short-term borrowings HSBC includes short-term borrowings within customer accounts, deposits by banks and debt securities in issue and does not show short-term borrowings separately on the balance sheet. Short-term borrowings are defined by the SEC as Federal funds purchased... -

Page 151

...1998. Chairman of HSBC Private Equity (Asia) Limited and a Director of MTR Corporation Limited, Inchcape plc, Inmarsat Ventures Plc, Convenience Retail Asia Limited, VTech Holdings Ltd. and The Wharf (Holdings) Limited. Chairman of the Hong Kong/Japan Business Co-operation Committee and the Advisory... -

Page 152

... Corporation Limited since 1995. S K Green Age 54. Executive Director, Corporate, Investment Banking and Markets. An executive Director since 1998. Joined HSBC in 1982. Group Treasurer from 1992 to 1998. Chairman of HSBC Investment Bank Holdings plc and a Director of HSBC Bank plc, CCF S.A., HSBC... -

Page 153

...1998. A Director of HSBC Investment Bank Holdings plc and HSBC Private Banking Holdings (Suisse) S.A. Senior Management R J Arena Age 54. Group General Manager, Global e-business. Joined HSBC in 1999. Appointed a Group General Manager in 2000. C C R Bannister Age 44 . Chief Executive Officer, Group... -

Page 154

HSBC HOLDINGS PLC Board of Directors and Senior Management (continued) A P Hope Age 56. Group General Manager, Insurance. Joined HSBC in 1971. Appointed a Group General Manager in 1996. D D J John Age 52. Chief Operating Officer and Director, HSBC Bank plc. Joined HSBC in 1972. Appointed a Group ... -

Page 155

... range of banking and related financial services through an international network of over 8,000 offices in 80 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. Taken together, the five largest customers of HSBC do not account for more... -

Page 156

... 2002, HSBC QUEST Trustee (UK) Limited, the corporate trustee of the QUEST, subscribed for 6,147,311 ordinary shares of US$0.50 each at market values ranging from £6.61 to £8.43, using funds from those employees who exercised options under the HSBC Holdings Savings-Related Share Option Plan. In... -

Page 157

... the Directors' Remuneration Report. All-Employee share plans The HSBC Holdings Savings-Related Share Option Plan, HSBC Holdings Savings-Related Share Option Plan: Overseas Section, and previously the HSBC Holdings Savings-Related Share Option Scheme: USA Section, are all-employee share plans under... -

Page 158

...The closing price per share on 1 May 2002 was £8.08. The weighted average closing price of the securities immediately before the dates on which options were exercised was £7.43. HSBC Holdings Savings-Related Share Option Plan: Overseas Section HSBC Holdings ordinary shares of US$0.50 each Date of... -

Page 159

...whether the performance condition is met. The terms of the HSBC Holdings Group Share Option Plan were amended in 2001 so that the exercise price of options granted under the Plan in 2002 and beyond would be the higher of the average market value of the ordinary shares on the five business days prior... -

Page 160

... closing price of the securities immediately before the dates on which options were exercised was £8.08. The HSBC Holdings Executive Share Option Scheme was replaced by the HSBC Holdings Group Share Option Plan on 26 May 2000. No options have been granted under the Scheme since that date. HSBC... -

Page 161

... 2002 HSBC Holdings General Employee Benefit Trust held 35,745,555 HSBC Holdings ordinary shares of US$0.50 each which may be exchanged for CCF shares arising from the exercise of options. Banque Chaix shares of â,¬16 each Date of award 28 Oct 1997 10 Jul 1998 21 Jun 1999 7 Jun 2000 Exercise price... -

Page 162

HSBC HOLDINGS PLC Report of the Directors (continued) Banque du Louvre shares of no par value Date of award 31 Mar 1999 7 Sep 2001 Exercise price(â,¬) 68.65 154.75 Exercisable from 1 Jul 2000 7 Sep 2005 Exercisable until 31 Mar 2009 7 Oct 2007 Options at 1 January 2002 17,600 78,600 Options ... -

Page 163

... book value of land and buildings has decreased by US$359 million. Further details are included in Note 25 of the 'Notes on the Financial Statements' . Board of Directors The objectives of the management structures within HSBC, headed by the Board of Directors of HSBC Holdings and led by the Group... -

Page 164

... Services Authority and with the provisions of Appendix 14 to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong. Board Committees The Board has appointed a number of committees consisting of certain Directors and Group General Managers. The following are the principal... -

Page 165

...local management as required for the type of business and geographical location of each subsidiary. • Systems and procedures are in place in HSBC to identify, control and report on the major risks including credit, changes in the market prices of financial instruments, liquidity, operational error... -

Page 166

... measures and employee relations. The policy manuals address risk issues in detail and cooperation between head office departments and businesses is required to ensure a strong adherence to HSBC' s risk management system and its corporate social responsibility practices. Internal controls are an... -

Page 167

... systems to quantify the key direct environmental impact of its principal operations around the world. This third party scrutiny of the environmental reporting system supports HSBC's internal risk management procedures. HSBC is a participant in the Dow Jones Sustainability, FTSE4Good and Business... -

Page 168

... Share Plan are set out on pages 183 to 185 of the Directors' Remuneration Report. Non-beneficial. Interests held by private investment companies. Interests at 27 September 2002 - date of appointment. Redeemed on 31 July 2002. Sir John Bond has a personal interest in £290,000 of HSBC Capital... -

Page 169

...daily purchases of goods and services received from such creditors, calculated in accordance with the Companies Act 1985, as amended by Statutory Instrument 1997/571. Employee involvement HSBC Holdings continues to regard communication with its employees as a key aspect of its policies. Information... -

Page 170

... 16(1) of the Securities (Disclosure of Interests) Ordinance. Dealings in HSBC Holdings plc shares Save for dealings by HSBC Investment Bank plc (until 29 November 2002) and HSBC Bank plc (since 30 November 2002) trading as intermediaries in HSBC Holdings' shares in London, and the redemption... -

Page 171

...continue in office. The Group Audit Committee and the Board recommend that it be reappointed. A resolution proposing the reappointment of KPMG Audit Plc as auditor of HSBC Holdings and giving authority to the Directors to determine its remuneration will be submitted to the forthcoming Annual General... -

Page 172

... form of long-term share plan since 1996, to follow a policy of moving progressively from defined benefit to defined contribution Group pension schemes for new employees only. • • Basic salary and benefits Salaries are reviewed annually in the context of individual and business performance... -

Page 173

... Group Share Option Plan and HSBC Holdings savings-related share option plans. These options are exercisable between 2003 and 2012 at prices ranging from £2.1727 to £8.712. Directors' fees Directors' fees are regularly reviewed and compared with other large international companies. The current... -

Page 174

... performance taking account of, as appropriate, results against plan of the business unit or performance of the support function for which the individual has responsibility; and Group performance measured by operating profit before tax against plan. The Remuneration Committee has discretion... -

Page 175

...be added to annual remuneration. While the accrued pension has increased marginally, after excluding the impact of inflation in Canada and movements in exchange rates, the transfer value has decreased. Restricted Share Plan The Remuneration Committee has proposed to the Trustee of the HSBC Holdings... -

Page 176

... Total Shareholder Return (TSR) is defined as the growth in share value and declared dividend income during the relevant period. In calculating TSR, dividend income is assumed to be reinvested in the underlying shares. No share options will be granted under the HSBC Holdings Group Share Option Plan... -

Page 177

...of: 1. a peer group of nine banks (ABN AMRO Holding N.V., Citigroup Inc., Deutsche Bank A.G., J. P. Morgan Chase & Co., Lloyds TSB Group plc, Oversea-Chinese Banking Corporation Limited, Mitsubishi Tokyo Financial Group Inc., Standard Chartered PLC, The Bank of East Asia, Limited) weighted by market... -

Page 178

...Remuneration Report Regulations 2002, the following graphs show HSBC Holdings' TSR performance against the Financial Times Stock Exchange (FTSE) 100 Index, the Morgan Stanley Capital International (MSCI) World Index and Morgan Stanley Capital International (MSCI) Financials Index. Total Shareholder... -

Page 179

...% 190% 180% 170% 160% 150% 140% 130% 120% 110% 100% 90% 80% Dec 1997 Dec 1998 Dec 1999 Dec 2000 Dec 2001 Dec 2002 HSBC TSR MSCI World Index Total Shareholder Return (£) 220% 210% 200% 190% 180% 170% 160% 150% 140% 130% 120% 110% 100% 90% 80% Dec 1997 Dec 1998 Dec 1999 Dec 2000... -

Page 180

... Service contracts and terms of appointment HSBC' s policy is to employ executive Directors on one-year rolling contracts, although on recruitment longer initial terms may be approved by the Remuneration Committee. The Remuneration Committee will, consistent with the best interests of the Company... -

Page 181

... appointed for fixed terms not exceeding three years, subject to their reelection by shareholders at the subsequent Annual General Meeting. Non-executive Directors have no service contract and are not eligible to participate in HSBC's share plans. Non-executive Directors' terms of appointment will... -

Page 182

... into the pension scheme has been increased by the amount of £175,000 (2001: £nil) which would otherwise have been paid. Includes fees as non-executive Chairman of HSBC Private Equity (Asia) Limited and as a non-executive Director of The Hongkong and Shanghai Banking Corporation Limited. Includes... -

Page 183

...are provided through an executive allowance paid to fund personal pension arrangements set at 30 per cent of basic salary. This is supplemented through the HSBC Holdings plc Funded Unapproved Retirement Benefits Scheme on a defined contribution basis with an employer contribution during 2002 of £80... -

Page 184

... number of HSBC Holdings ordinary shares of US$0.50 each set against their respective names. The options were awarded for nil consideration at exercise prices equivalent to the market value at the date of award, except that options awarded under the HSBC Holdings savings-related share option plans... -

Page 185

... Consumer Price Index) plus 2 per cent per annum. This condition has been satisfied. Options awarded under the HSBC Holdings Savings-Related Share Option Plan. Options awarded under the HSBC Holdings Group Share Option Plan. In accordance with agreements made at the time of the acquisition of CCF... -

Page 186

HSBC HOLDINGS PLC Directors' Remuneration Report (continued) CCF S.A. shares of â,¬5 each Options held at 1 January 2002 Exercise price per share(â,¬) Options held at 31 December 2002 Equivalent HSBC Holdings ordinary shares of US$0.50 each at 31 December 2002 Exercisable until Date of award ... -

Page 187

... the performance tests described in the 'Report of the Directors' in the 1998, 1999, 2000 and 2001 Annual Report and Accounts respectively being satisfied. 1 2 3 4 Includes additional shares arising from scrip dividends. In accordance with the performance conditions over the three-year period to... -

Page 188

HSBC HOLDINGS PLC Directors' Remuneration Report (continued) On behalf of the Board Sir Mark Moody-Stuart, Chairman of Remuneration Committee 3 March 2003 186 -

Page 189

...respective responsibilities of the Directors and of the Auditors in relation to the financial statements. The Directors are required by the Companies Act 1985 to prepare financial statements for each financial year which give a true and fair view of the state of affairs of HSBC Holdings plc together... -

Page 190

...and controls, or form an opinion on the effectiveness of HSBC' s corporate governance procedures or its risk and control procedures. We read the other information contained in the Annual Report, including the corporate governance statement and the unaudited part of the directors' remuneration report... -

Page 191

... of HSBC Holdings and HSBC as at 31 December 2002 and of the profit of HSBC for the year then ended; and the financial statements and the part of the directors' remuneration report required to be audited have been properly prepared in accordance with the Companies Act 1985. • United States... -

Page 192

HSBC HOLDINGS PLC Financial Statements Consolidated profit and loss account for the year ended 31 December 2002 Note Interest receivable - interest receivable and similar income arising from debt securities...- other interest receivable and similar income ...Interest payable ...Net interest income... -

Page 193

... of collection from other banks ...Treasury bills and other eligible bills ...Hong Kong SAR Government certificates of indebtedness...Loans and advances to banks...Loans and advances to customers ...Debt securities ...Equity shares ...Interests in joint ventures : gross assets...: gross liabilities... -

Page 194

... Statements (continued) HSBC Holdings balance sheet at 31 December 2002 Notes FIXED ASSETS Tangible assets...Investments - shares in HSBC undertakings...- loans to HSBC undertakings ...- other investments other than loans ...- own shares...CURRENT ASSETS Debtors - money market deposits with HSBC... -

Page 195

... financial year attributable to shareholders ...Dividends...Other recognised gains and losses relating to the year ...New share capital subscribed, net of costs...New share capital issued in connection with the acquisition of CCF ...Reserve in respect of obligations under CCF share options...Amounts... -

Page 196

HSBC HOLDINGS PLC Financial Statements (continued) Consolidated cash flow statement for the year ended 31 December 2002 Note Net cash inflow from operating activities Dividends received from associates Returns on investments and servicing of finance: Interest paid on finance leases and similar ... -

Page 197

... II of the UK Companies Act 1985 ('the Act' ) relating to banking groups. The consolidated financial statements comply with Schedule 9 and the financial statements of HSBC Holdings comply with Schedule 4 to the Act. As permitted by Section 230 of the Act, no profit and loss account is presented for... -

Page 198

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) Profit and loss account - tax on profit on ordinary activities Figures in US$m Under previous policy...Adoption of FRS 19...Under new policy...HSBC 2001 (1,574) (414) (1,988) 2000 (2,238) (171) (2,409) HSBC Holdings 2001 183 (112) 71 ... -

Page 199

...for additional UK tax on remittances from overseas, such provisions not being allowable under FRS19; and reduction in the deferred tax asset under FRS19 relating to general bad debt provisions in line with the reduction in the underlying general provisions. The increase in HSBC Holdings' tax charge... -

Page 200

... of interest being paid at some future date, interest on non-performing loans is charged to the customer' s account. However, the interest is not credited to the profit and loss account but to an interest suspense account in the balance sheet which is netted against the relevant loan. On receipt of... -

Page 201

... disposal of investments' . Other treasury bills, debt securities, equity shares and short positions in securities are included in the balance sheet at market value. Changes in the market value of such assets and liabilities are recognised in the profit and loss account as 'Dealing profits' as they... -

Page 202

..., are included in 'Loans and advances to banks' or 'Loans and advances to customers' . Finance charges receivable are recognised over the periods of the leases so as to give a constant rate of return on the net cash investment in the leases, taking into account tax payments and receipts associated... -

Page 203

... of these benefits relating to current and retired employees which is being charged to the profit and loss account in equal instalments over 20 years. (i) Foreign currencies (i) Assets and liabilities denominated in foreign currencies are translated into US dollars at the rates of exchange ruling at... -

Page 204

... long-term assurance funds. These are determined annually in consultation with independent actuaries and are included in 'Other assets' . Changes in the value placed on HSBC' s interest in long-term assurance business are calculated on a post-tax basis and reported in the profit and loss account as... -

Page 205

... instruments 2002 Dividend and net Dealing interest profits income 2001 Dividend and net Dealing interest profits income 2000 Dividend and net Dealing interest profits income Total Total Total Foreign exchange ...Interest rate derivatives ...Debt securities...Equities and other trading ... US... -

Page 206

...account long-term rates of returns on the underlying investments assessed with an appropriate degree of prudence. In Hong Kong, the HSBC Group Hong Kong Local Staff Retirement Benefit Scheme covers employees of the Hongkong and Shanghai Banking Corporation Limited and certain other employees of HSBC... -

Page 207

...a discount rate of 7.25% per annum and average salary increases of 4.0% per annum. The HSBC Bank (UK) Pension Scheme, The HSBC Group Hong Kong Local Staff Retirement Benefits Scheme and the HSBC Bank USA Pension Plan cover 37% (2001: 42%, 2000: 45%) of HSBC' s employees. The pension cost for defined... -

Page 208

... of return are: HSBC Bank (UK) Pension Scheme Expected rate of return at 31 Value at 31 December December 2002 2002 % US$m Equities ...Bonds ...Property...Other ...Total market value of assets...Present value of scheme liabilities . Deficit in the schemes...Related deferred tax asset ...Net pension... -

Page 209

... HSBC Group Hong Kong Local Staff Retirement Benefit Scheme are closed to new entrants. For these schemes the current service cost will increase as the members of the scheme approach retirement under the projected unit credit method. HSBC Bank (UK) Pension Scheme Expected rate of return at 31 Value... -

Page 210

...the HSBC Bank (UK) Pension Scheme. HSBC Holdings is unable to identify its share of the underlying assets and liabilities of this scheme attributable to its employees. (iii) Post-retirement healthcare benefits HSBC also provides post-retirement healthcare benefits under schemes, mainly in the United... -

Page 211

... through an annual charge based on the likely level of vesting of shares, apportioned over the period of service to which the award relates. Details of Directors' remuneration, share options and conditional awards under the Restricted Share Plan are included in the 'Report of the Directors' on pages... -

Page 212

...of information for publication, including work in connection with securities issuance - reviews and reporting under regulatory requirements (including interim profits review) Total independent attestation Acquisition due diligence Total audit-related services Taxation services Other Services - group... -

Page 213

... activities before tax is stated after: 2002 US$m (a) Income Aggregate rentals receivable, including capital repayments, under - finance leases and hire purchase contracts...- operating leases...Income from listed investments ...Profits less losses on debt securities and equities dealing Gains on... -

Page 214

... the countries in which they operate. Analysis of overall tax charge: 2002 US$m Taxation at UK corporate tax rate of 30% (2001: 30%; 2000: 30%) ...Impact of differently taxed overseas profits in principal locations Tax free gains...Argentine losses unrelieved ...Goodwill amortisation ...Prior period... -

Page 215

... 57 5 17 9 8,865 Average number of shares in issue ...Savings-related Share Option Plan ...Executive Share Option Scheme...Restricted Share Plan ...CCF share options...Average number of shares in issue assuming dilution ... Of the total number of employee share options existing at 31 December 2002... -

Page 216

...of gross unrealised gains and losses for available-for-sale treasury bills and other eligible bills: Carrying value US$m 31 December 2002 US Treasury and Government agencies ...UK Government...Hong Kong SAR Government ...Other governments...Corporate debt and other securities...2,888 740 2,898 5,344... -

Page 217

...Gross unrealised losses US$m - (15) - (6) (24) (45) Market valuation US$m 2,304 3,019 2,183 4,911 498 12,915 Carrying value US$m 31 December 2000 US Treasury and Government agencies ...UK Government...Hong Kong SAR Government ...Other governments...Corporate debt and other securities...2,165 2,716... -

Page 218

... The Hong Kong Special Administrative Region currency notes in circulation are secured by the deposit of funds in respect of which the Government of the Hong Kong Special Administrative Region certificates of indebtedness are held. 14 Credit risk management HSBC' s credit risk management process... -

Page 219

... Securitisation Limited' s entire share capital is held by Clover Holdings Limited. Clover Funding' s entire share capital is held by Clover Holdings Limited. Clover Holdings Limited' s entire share capital is held by trustees under the terms of a trust for charitable purposes. HSBC recognised net... -

Page 220

... previous years...Charge/(credit) to profit and loss account...Interest suspended during the year...Suspended interest recovered...Acquisition of subsidiaries...Exchange and other movements ...At 31 December 2002 ...Included in: Loans and advances to banks (Note 15)...Loans and advances to customers... -

Page 221

... previous years ...Charge/(credit) to profit and loss account...Interest suspended during the year...Suspended interest recovered ...Acquisition of subsidiaries ...Exchange and other movements ...At 31 December 2000...Included in: Loans and advances to banks...Loans and advances to customers... 219 -

Page 222

... customers: Residential mortgages ...Hong Kong SAR Government Home Ownership Scheme...Other personal ...Total personal ...Commercial, industrial and international trade ...Commercial real estate ...Other property related...Government ...Other commercial* ...Total corporate and commercial ...Non-bank... -

Page 223

19 Debt securities 2002 Book value Market valuation 2001 Book value Market valuation 2000 Book value Market valuation US$m Issued by public bodies Investment securities: - government securities and US government agencies...- other public sector securities 42,706 5,369 48,075 US$m US$m US$m US$m... -

Page 224

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) 2002 Book value Market valuation 2001 Book value Market valuation 2000 Book value Market valuation US$m Investment securities: - listed on a recognised UK exchange ...- listed in Hong Kong ...- listed elsewhere...- unlisted... US$m... -

Page 225

... book value of investment securities, analysed by type of borrower, is as follows: Available-for-sale US Treasury and Government agencies ...UK Government...Hong Kong SAR governments ...Other governments...Asset-backed securities ...Corporate debt and other securities...Held-to-maturity US Treasury... -

Page 226

... unrealised Carrying Market unrealised gains losses Held-to-maturity value valuation US$m US$m US$m US$m 31 December 2002 US Treasury and Government agencies ...3,918 234 (1) 4,151 Obligations of US state and political sub-divisions ...711 45 (1) 755 - - - - Corporate debt and other securities 4,629... -

Page 227

... five years ten years Amount Yield Amount Yield After ten years Amount Yield No fixed maturity Amount Yield Available-for-sale US Treasury and Government agencies...UK Government ...Hong Kong SAR governments...Other governments Asset-backed securities ...Corporate debt and other securities ... US... -

Page 228

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) 20 Equity shares 2002 Book value Market valuation 2001 Book value Market valuation 2000 Book value Market valuation US$m Investment securities: - listed on a recognised UK exchange ...- listed in Hong Kong ...- listed elsewhere...- ... -

Page 229

... from the investment book to the trading book. The cost of investment securities purchased during the year ended 31 December 2002 was US$1,753 million (2001: US$1,670 million; 2000: US$1,822 million). 21 Interests in joint ventures 2002 US$m At 1 January 2002 ...Additions and acquisitions of... -

Page 230

... Financiero Bital ...Mexico Mexico Principal activity Asset management Pensions Insurance All of the above interests in joint ventures are owned by subsidiaries of HSBC Holdings. All of the above make their financial statements up to 31 December. The principal countries of operation are the same... -

Page 231

... British Bank...Wells Fargo HSBC Trade Bank, N.A...World Finance International Limited * # ¶ (a) Shares in banks ...Other ... 2001 US$m 718 338 1,056 521 535 1,056 Country of incorporation Hong Kong England Principal activity Property Investment Banking HSBC' s interest in equity capital 24... -

Page 232

...PLC Notes on the Financial Statements (continued) (c) The associates listed above have no loan capital, except for British Arab Commercial Bank Limited which has issued US$44.5 million of subordinated unsecured loan stock in which HSBC has a 34.66 per cent interest; Barrowgate Limited which has HK... -

Page 233

... Statements on pages 195 to 197. Additions represent goodwill arising on acquisitions and increases of holdings in subsidiaries and businesses during 2002. Positive goodwill is being amortised over periods of up to 20 years. Negative goodwill is being credited to the profit and loss account... -

Page 234

...Charge to the profit and loss account ...Exchange and other movements...Accumulated depreciation at 31 December 2002 ...Net book value at 31 December 2002 ...Net book value at 31 December 2001 ...US$m 3,030 58 44 (116 ) 53 (67 ) (41 ) (7 ) 161 3,115 Long leasehold land and buildings US$m 3,245 131... -

Page 235

...5,963 - - - - - - HSBC values its non-investment properties on an annual basis. In September 2002, except as noted below, HSBC' s freehold and long leasehold properties, together with all leasehold properties in Hong Kong, were revalued on an existing use basis or open market value as appropriate... -

Page 236

HSBC HOLDINGS PLC Notes on the Financial Statements (continued) (d) Investment properties The valuation at which investment properties are included in tangible fixed assets, together with the net book value of these properties calculated under the historical cost basis, is as follows: 2002 At ... -

Page 237

...the Directors' Remuneration Report on pages 173 to 177. At 31 December 2002, the trust held 4,664,315 ordinary shares (2001: 3,230,422 ordinary shares) with a market value at that date of US$51,610,678 (2001: US$37,735,716) in respect of these conditional awards. (ii) US$497 million of HSBC Holdings... -

Page 238

... Limited ...HSBC Trinkaus & Burkhardt KGaA (partnership limited by shares, 73.47% owned) . Hong Kong Hang Seng Bank Limited (62.14% owned) ...The Hongkong and Shanghai Banking Corporation Limited ...HSBC Insurance (Asia) Limited ...HSBC Life (International) Limited...Issued equity capital Principal... -

Page 239

...whose financial statements are made up to 30 June annually. The principal countries of operation are the same as the countries of incorporation except for HSBC Bank Middle East which operates mainly in the Middle East, and HSBC Life (International) Limited which operates mainly in Hong Kong. All the... -

Page 240

... subsidiary of HSBC, acquired certain business operations from the trade finance business of State Street Corporation' s Global Trade Banking Division for a cash consideration of US$nil. Goodwill of US$7 million arose on this acquisition. vii. Increases in stakes in a number of existing subsidiaries... -

Page 241

... paid are set out in the following table: Accounting policy alignments US$m Book value US$m At date of acquisition: Cash and balances at central banks ...Treasury bills and other eligible bills...Loans and advances to banks ...Loans and advances to customers ...Debt securities ...Equity shares... -

Page 242

... of the net tangible assets relating to long-term assurance and retirement funds is analysed as follows: 2002 US$m 234 4,436 3,690 2,131 78 (213) 10,356 2001 US$m 318 3,381 3,863 2,298 46 (194) 9,712 Loans and advances to banks - with HSBC companies...Debt securities ...Equity shares...Other assets... -

Page 243

... and Mexico, which are now included in North America. Figures for 2001 have been restated to reflect this change. The geographical analysis of deposits is based on the location of the office in which the deposits are recorded and excludes balances with HSBC companies. 29 Customer accounts 2002... -

Page 244

...: - government securities ...- other public sector securities...- other debt securities ...Equity shares...Liabilities, including losses, resulting from off-balance-sheet interest rate, exchange rate and equities contracts which are marked-to-market ...Current taxation ...Obligations under finance... -

Page 245

... ...Charge/(release) to profit and loss account (Note 8)...Movements arising from acquisitions and disposals...Exchange and other movements ...At 31 December 2002 ...HSBC 2002 US$m Included in 'Provisions for liabilities and charges' ...Included in 'Other assets' (Note 27) ...Net deferred taxation... -

Page 246