Frontier Airlines 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

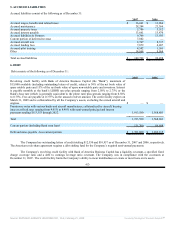

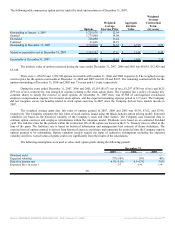

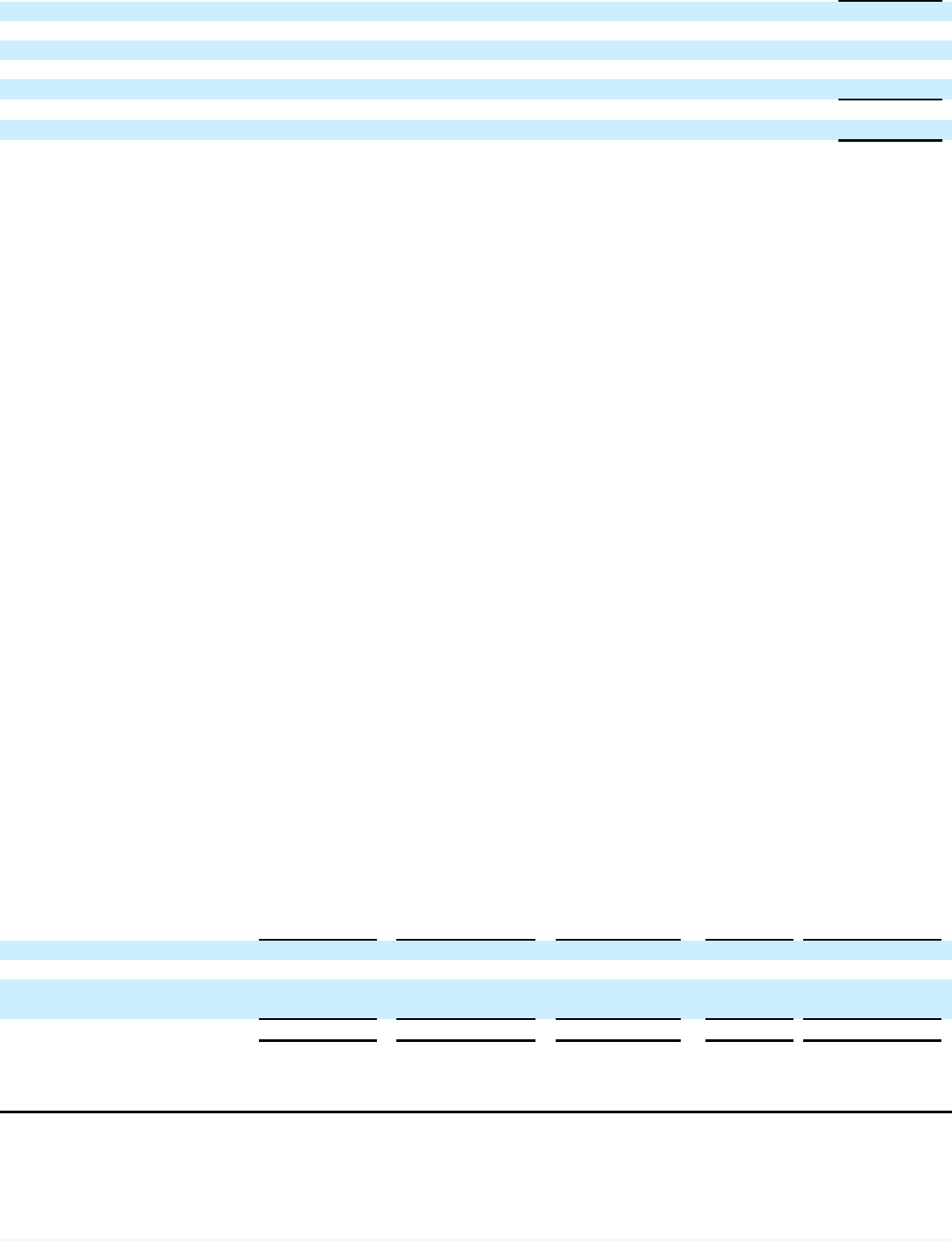

The following table reconciles the Company’s tax liability for uncertain tax positions for the year ended December 31, 2007:

2007

Balance at January 1, $ 3,515

Additions based on tax positions taken in current year 894

Additions for tax positions taken in prior years −

Reductions for tax positions of prior years −

Settlements with tax authorities −

Balance at December 31, $ 4,409

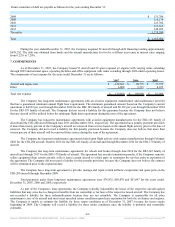

Deferred tax assets include benefits expected to be realized from the utilization of alternative minimum tax credit

carryforwards of $759, which do not expire, and net operating loss carryforwards totaling $449,000, which begin expiring in 2022.

Approximately $396,000 of the net operating loss carryforwards are limited under Internal Revenue Code Section 382, and

approximately $23,000 is not expected to be realized prior to expiration, and therefore, a valuation allowance has been recorded of

$8,119.

12. FAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value of a financial instrument is defined as the amount at which the instrument could be exchanged in an arm's

length transaction between knowledgeable, willing parties. The fair value of long term debt is estimated based on discounting

expected cash flows at the rates currently offered to the Company for debt with similar remaining maturities. As of December 31,

2007 and 2006 respectively, the carrying value of long-term debt was greater than its fair value by approximately $136,800 and

$112,200.

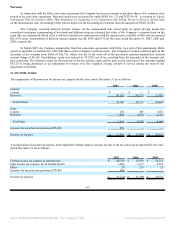

13. BENEFIT PLAN—401(k)

Republic has a defined contribution retirement plan covering substantially all eligible employees. The Company matches up

to 6% of eligible employees' wages. Employees are generally vested in matching contributions after three years of service with the

Company. Employees are also permitted to make pre-tax contributions of up to 90% (up to the annual Internal Revenue Code limit)

and after-tax contributions of up to 10% of their annual compensation. The Company's expense under this plan was $2,941, $2,266,

and $1,660 for the years ended December 31, 2007, 2006 and 2005, respectively.

14. IMPAIRMENT LOSS AND ACCRUED AIRCRAFT RETURN COSTS

Pursuant to the aircraft lease agreements, the Company was required to return Saab 340 aircraft to the lessor in specified

conditions. Based upon flight schedules and maintenance costs, return costs were estimated and accrued. Each year the Company

decreased the accrual for actual costs incurred and adjusted the accrual for its revised estimate of expected return costs. In December

2005, Shuttle America’s turboprop code-share agreement with United expired thus allowing for the return of our Saab aircraft to the

lessor. An agreement was reached with the lessors that released the Company of any further financial obligations upon return of the

aircraft resulting in a $4,218 reduction in the accrued liability. In 2006, we recorded a gain of $2,050 relating to the disposition of

Saab aircraft and spare parts.

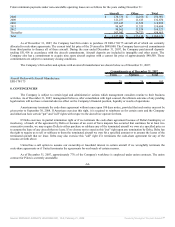

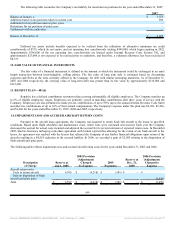

The following table reflects impairment costs and accrued aircraft return costs for the years ended December 31, 2005 and 2006.

Description

of Charge

Reserve at

Jan 1, 2005

2005 Provision

(Adjustment)

Charged

To Expense

2005

Payments

Reserve at

Dec. 31,

2005

2006 Provision

(Adjustment)

Charged to

Expense

Aircraft return costs:

Costs to return aircraft $ 4,599 $ (4,218) $ (381) $ — $

Gain on disposition of Saab

aircraft and spare parts (2,050)

Total $ 4,599 $ (4,218) $ (381) $ — $ (2,050)

-69-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠