Frontier Airlines 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

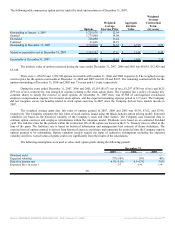

Warrants

In connection with the Delta code-share agreement, the Company had issued warrants to purchase shares of its common stock

related to the code-share agreement. Warrants issued were accounted for under SFAS No. 123 and EITF 96-18, Accounting for Equity

Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services, at fair value

on the measurement date. Accordingly, there was no impact on the accounting for warrants from the adoption of SFAS 123(R).

The Company recorded deferred warrant charges on the measurement date based upon an option pricing model that

considered continuous compounding of dividends and dilution using an estimated fair value of the Company’s common stock on the

grant date, an estimated dividend yield, a risk-free interest rate commensurate with the warrant term, volatility of 40% and an expected

life of 10 years. Amortization of deferred warrant charges was $0, $565 and $372 for the years ended December 31, 2007, 2006 and

2005, respectively.

In March 2007, the Company amended its fixed-fee code-share agreements with Delta. As a part of this amendment, Delta

agreed to surrender its warrants for 3,435,000 shares of the Company’s common stock. The Company recorded a deferred gain on the

surrender of the warrants from Delta of $42,735, which was net of the write-off of the previously reported unamortized deferred

warrant charge of $6,369. Stockholders' equity was reduced by $32,892, net of tax, resulting from the surrender of the warrants and

their retirement. The deferred credits for the proceeds of the pre-petition claim and the gain on the surrender of the warrants totaling

$87,325 is being amortized as an adjustment to revenue over the weighted average aircraft in service during the term of the

agreements with Delta.

11. INCOME TAXES

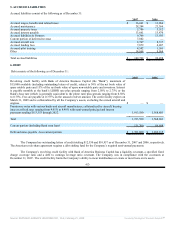

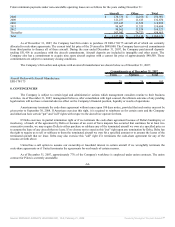

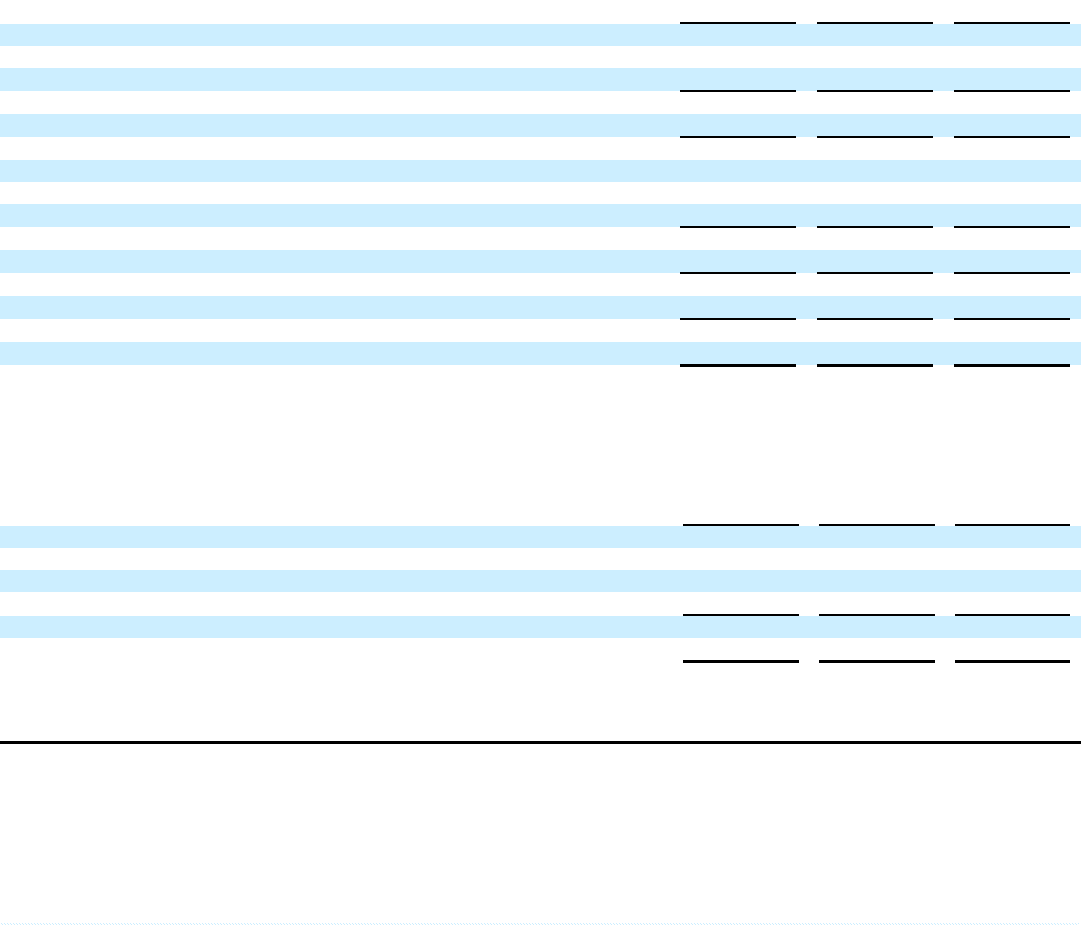

The components of the provision for income tax expense for the years ended December 31 are as follows:

2007 2006 2005

Federal:

Current $ — $ — $ —

Deferred 45,102 43,171 32,855

Total Federal 45,102 43,171 32,855

State:

Current 120 495 1,915

Deferred 5,094 8,233 4,751

Total State 5,214 8,728 6,666

Expense for uncertain tax positions (FIN 48) 894 — —

Income tax expense $ 51,210 $ 51,899 $ 39,521

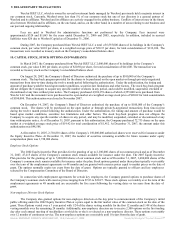

A reconciliation of income tax expense at the applicable federal statutory income tax rate to the tax provision as reported for the years

ended December 31 are as follows:

2007 2006 2005

Federal income tax expense at statutory rate $ 46,799 $ 45,993 $ 35,163

State income tax expense, net of federal benefit 3,489 5,673 4,333

Other 28 233 25

Expense for uncertain tax positions (FIN 48) 894 − −

Income tax expense $ 51,210 $ 51,899 $ 39,521

-67-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠