Frontier Airlines 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

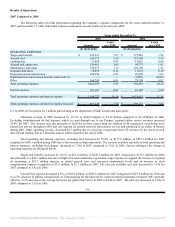

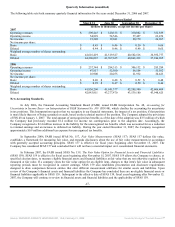

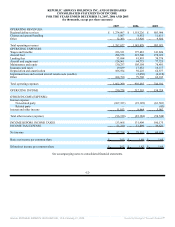

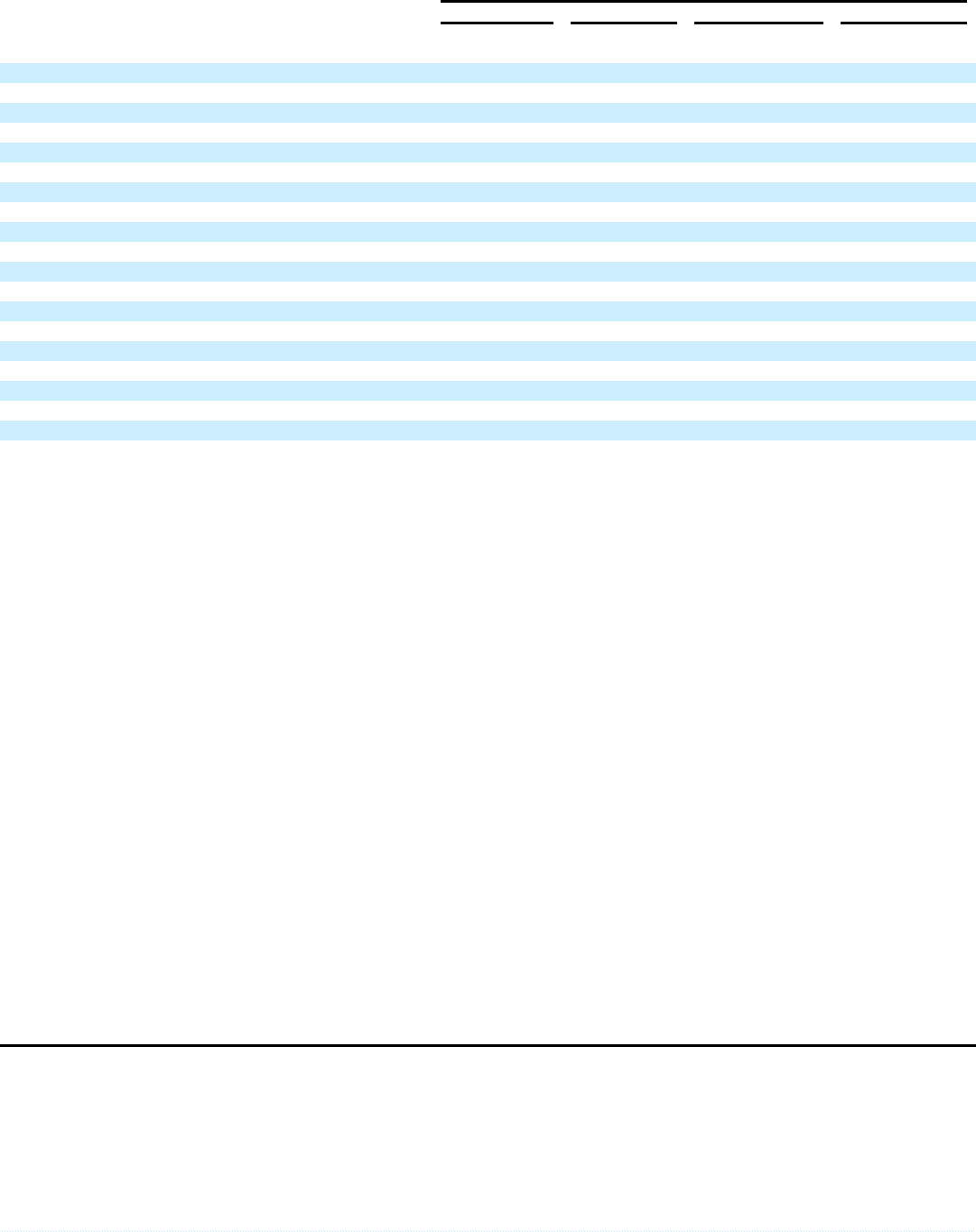

Quarterly Information (unaudited)

The following table sets forth summary quarterly financial information for the years ended December 31, 2006 and 2007.

Quarters Ended

March 31 June 30 September 30 December 31

(dollars in thousands, except net income per share)

2007

Operating revenues $ 290,443 $ 320,313 $ 330,082 $ 351,839

Operating income 54,829 54,546 57,427 63,476

Net income 19,280 19,041 20,170 24,267

Net income per share:

Basic $ 0.45 $ 0.46 $ 0.50 $ 0.66

Diluted $ 0.44 $ 0.46 $ 0.49 $ 0.65

Weighted average number of shares outstanding:

Basic 42,616,419 41,319,327 40,582,516 36,932,777

Diluted 44,306,067 41,707,625 40,868,412 37,246,265

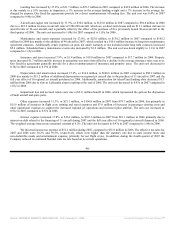

2006

Operating revenues $ 257,344 $ 284,313 $ 306,132 $ 295,289

Operating income 47,917 52,560 56,554 55,562

Net income 16,900 20,255 21,932 20,423

Net income per share:

Basic $ 0.40 $ 0.48 $ 0.52 $ 0.48

Diluted $ 0.39 $ 0.47 $ 0.50 $ 0.46

Weighted average number of shares outstanding:

Basic 41,836,296 41,941,377 42,205,300 42,606,404

Diluted 42,943,911 43,277,470 43,539,180 43,948,625

New Accounting Standards

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109 (FIN 48), which clarifies the accounting for uncertainty

in tax positions. This Interpretation requires that we recognize in our financial statements, the impact of a tax position, if that position

is more likely than not of being sustained on audit, based on the technical merits of the position. The Company adopted the provisions

of FIN 48 on January 1, 2007. The total amount of unrecognized tax benefits as of the date of the adoption was $3.5 million of which

the Company had previously recorded $1.2 million for income tax contingencies prior to the adoption date. Accordingly, the

Company recognized a $2.4 million increase in the liability for the unrecognized tax benefits which was accounted for as a reduction

to retained earnings and an increase to deferred tax liability. During the year ended December 31, 2007, the Company recognized

approximately $0.9 million additional tax expense for unrecognized tax benefits.

In September 2006, FASB issued SFAS No. 157, Fair Value Measurements (SFAS 157). SFAS 157 defines fair value,

establishes a framework for measuring fair value, and expands disclosures about the use of fair value measurements in accordance

with generally accepted accounting principles. SFAS 157 is effective for fiscal years beginning after November 15, 2007. The

Company has considered SFAS 157 and concluded that it will not have a material impact on it consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities

(SFAS 159). SFAS 159 is effective for fiscal years beginning after November 15, 2007. SFAS 159 allows the Company to choose, at

specified election dates, to measure eligible financial assets and financial liabilities at fair value that are not otherwise required to be

measured at fair value. If a company elects the fair value option for an eligible item, changes to that item's fair value in subsequent

reporting periods must be recognized in current earnings. SFAS 159 also establishes presentation and disclosure requirements

designed to draw comparison between entities that elect different measurement attributes for similar assets and liabilities. Upon

review of the Company’s financial assets and financial liabilities the Company has concluded there are no eligible financial assets or

financial liabilities applicable to SFAS 159. Subsequent to the effective date of SFAS 159, fiscal years beginning after November 15,

2007, the Company will continue to review its financial assets and financial liabilities and the applicability of SFAS 159.

-47-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠