Frontier Airlines 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

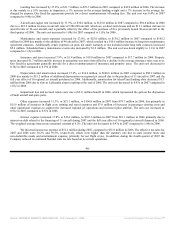

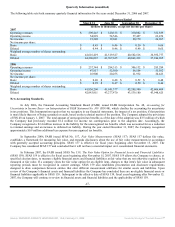

•Deferred gain - Delta Pre-Petition Claim and Surrendered Warrants . As a result of the Delta amendment, in March 2007, we

recorded a deferred credit of $44,590, which represented the net realizable value of the pre-petition claim on the approval date by the

Bankruptcy Court. In addition, we recorded a deferred gain on the surrender of the warrants from Delta of $42,735, which was net of

the write-off of the previously reported unamortized deferred warrant charge of $6,369. The deferred credits for the proceeds of the

pre-petition claim and the gain on the surrender of the warrants totaling $87,325 will be amortized as an adjustment to revenue

over the weighted average aircraft in service during the term of the agreements with Delta.

•Income Taxes. The Company has generated significant net operating losses (“NOLs”) for federal income tax purposes primarily from

accelerated depreciation on owned aircraft. In July 2005, Wexford Capital LLC’s ownership percentage of the Company was reduced

to less than 50% as a result of a follow-on offering of our common stock. As a result of this decrease in ownership, the utilization of

NOLs generated prior to July 2005 are subject to an annual limitation under Internal Revenue Code Section 382 (“IRC 382”). The

annual limitation is based upon the enterprise value of the Company on the IRC 382 ownership change date multiplied by the

applicable long-term tax exempt rate. If the utilization of pre July 2005 NOLs becomes uncertain in future years, we will be required

to record a valuation allowance for the NOLs not expected to be utilized.

•Intangible Commuter Slots. The Company acquired commuter slots during 2005 at the New York-LaGuardia and Ronald Reagan

Washington National airports from US Airways. The licensing agreement with the Company and US Airways for the LaGuardia

commuter slots expired on December 31, 2006, but we maintain a security interest in the LaGuardia slots if US Airways fails to

perform under the current licensing agreement. The estimated useful lives of these commuter slots were determined based upon the

period of time cash flows are expected to be generated by the commuter slots and by researching the estimated useful lives of

commuter slots or similar intangibles by other airlines. In addition, an estimated residual value was determined using estimates of the

expected fair value of the commuter slots at the end of the expected useful life. The residual value will be assessed annually for

impairment. The estimated useful lives are also reviewed annually.

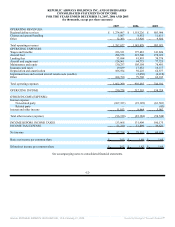

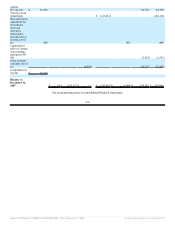

•Reportable Segments. The Company’s only reportable segment is scheduled transportation of passengers and air freight under

code-share agreements. In addition, the Company has charter service, aircraft leasing and commuter slot licensing fee revenues. These

activities aggregated represent less than 10% of consolidated revenues, operating income and assets. If these activities become more

significant in future years, additional reportable segments would need to be disclosed.

-46-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠