Frontier Airlines 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

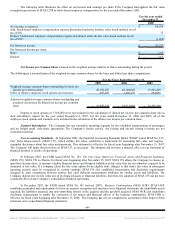

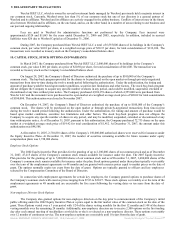

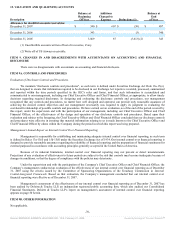

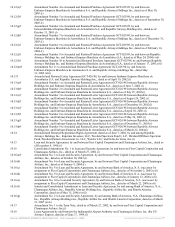

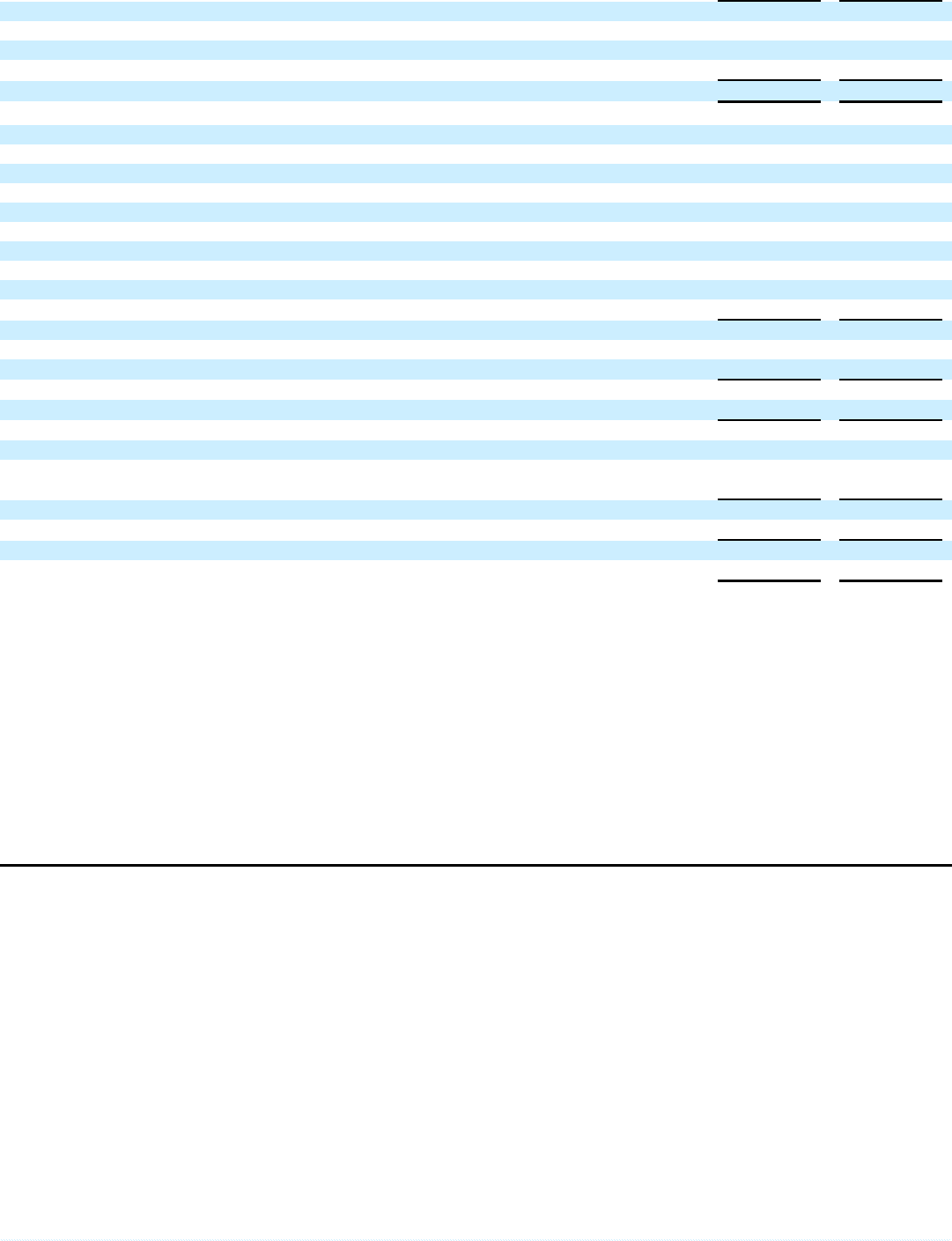

The components of deferred tax assets and liabilities as of December 31 are as follows:

2007 2006

DEFERRED TAX ASSETS

Current:

Nondeductible reserves and accruals $ 7,510 $ 3,467

Total current deferred tax assets $ 7,510 $ 3,467

Noncurrent:

Nondeductible accruals and deferred revenue $ 30,561 $ 5,304

Treasury locks 2,006 2,585

Stock option excess tax benefits 2,661 2,661

Alternative minimum tax credit 759 636

Deferred gain on Delta warrant 14,147 —

Net operating loss carryforward, net of liability for uncertain tax positions (FIN 48) 152,806 149,360

Prepaid rent 20,867 14,894

Share-based compensation 1,744 540

Deferred credits and sale leaseback gain 10,474 8,446

Total 236,025 184,426

Valuation allowance (8,119) (8,119)

Total noncurrent deferred tax assets 227,906 176,307

DEFERRED TAX LIABILITIES

Noncurrent:

Slot amortization (3,880) (2,272)

Accelerated depreciation and fixed asset basis differences for tax purposes (408,330) (314,921)

Total noncurrent deferred tax liabilities (412,210) (317,193)

Total net noncurrent deferred tax liabilities $ (184,304) $ (140,886)

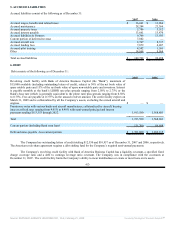

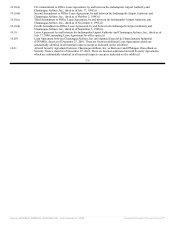

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes – An

Interpretation of FASB 109 (FIN 48). The Company adopted the provisions of FIN 48 on January 1, 2007. The total amount of

unrecognized tax benefits as of the date of the adoption was $3,515, of which the Company had previously recorded $1,148 for

income tax contingencies prior to adoption. Accordingly, the Company recognized a $2,367 increase in the liability for the

unrecognized tax benefits which was accounted for as a reduction to retained earnings and an increase to deferred tax liability. During

the year ended December 31, 2007, the Company recognized approximately $894 additional tax expense for unrecognized tax

benefits. All of the unrecognized tax benefits as of December 31, 2007, if recognized, would affect the effective tax rate. The

Company monitors ongoing tax cases related to its unrecognized tax benefits. If an unfavorable tax case judgment is rendered, the

Company may increase its tax liability for the unrecognized tax benefits by up to $1,500. In addition, the Company’s 2001 through

2007 tax years remain subject to examination by major tax jurisdictions due to our net operating loss carryforwards.

-68-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠