Frontier Airlines 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

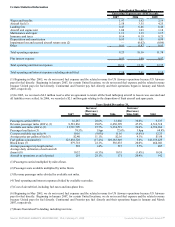

At December 31, 2007, the Company had $12.5 million of outstanding letters of credit.

During 2007, the Company acquired 22 aircraft through debt financing totaling $438.3 million. The debt was obtained from

banks and the aircraft manufacturer for 12 to 15 year terms at interest rates ranging from 6.22% to 7.28%.

As of December 31, 2007, we leased nine spare regional jet engines from General Electric Capital Aviation Services,

five spare regional jet engines from RRPF Engine Leasing (US) LLC and eight regional jet engines from Miyabi Engine Leasing.

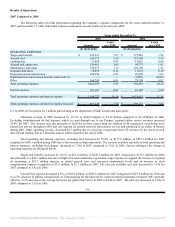

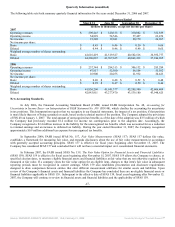

Net cash from operating activities was $170.9 million, $229.1 and $280.5 million for the years ended December 31, 2005,

2006 and 2007, respectively. The increase from operating activities is primarily due to the continued growth of our business. For 2007,

net cash from operating activities is primarily net income of $82.7 million, depreciation and amortization of $106.6 million, the

change in deferred income taxes of $51.1 million, the Delta pre-petition claim of $44.6 million partially offset by increases of $11.4

million in inventories. For 2006, net cash from operating activities is primarily net income of $79.5 million, depreciation and

amortization of $92.2 million, the change in deferred income taxes of $51.4 million, the increase in accrued liabilities of $16.8 million

partially offset by increases of $11.4 million in inventories. For 2005, net cash from operating activities is primarily net income of

$60.7 million, depreciation and amortization of $68.0 million, the change in deferred income taxes of $37.6 million and the increase in

accrued liabilities of $29.0 million.

Net cash from investing activities was $(175.2) million, $(114.5) million and $(76.5) million for the years ended

December 31, 2005, 2006 and 2007, respectively. In 2007, we purchased 22 regional jet aircraft. Net aircraft deposits decreased $7.3

million in 2007. Net aircraft deposits increased $43.4 million in 2006. In 2005, we purchased 35 aircraft and paid $51.6 million for

commuter slots.

Net cash from financing activities was $120.1 million, $(81.1) million and $(235.5) million for the years ended December 31,

2005, 2006 and 2007, respectively. In 2007 we made debt payments of $93.5 million and repurchased $142.4 million of our common

stock. In 2006 we made debt payments of $79.9 million. In 2005 we completed two follow on public stock offering providing $186.8

million and made debt payments of $53.4 million.

During 2007, we purchased 7,066,894 shares of our common stock on the market or through privately negotiated transactions

at a weighted average purchase price of $20.15 for total consideration of $142.4 million. We purchased 4,555,000 of these shares

through four privately negotiated transactions with our former majority shareholder, WexAir RJET LLC, for total consideration of

$132.1 million.

In December 2007, our Board of Directors authorized the purchase of up to $100 million of our common stock. The shares

will be purchased on the open market or through privately negotiated transactions from time-to-time during the twelve month period

following the authorization. Under the authorization, the timing and amount of purchase would be based on market conditions,

securities law limitations and other factors. The stock buy-back program does not obligate us to acquire any specific number of shares

in any period, and may be modified, suspended, extended or discontinued at any time without prior notice. At December 31, 2007, the

amount under this authorization was $98.6 million

We currently anticipate that our available cash resources, cash generated from operations and anticipated third party funding

arrangements will be sufficient to meet our anticipated working capital and capital expenditure requirements for at least the next 12

months.

Aircraft Leases and Other Off-Balance Sheet Arrangements

We have significant obligations for aircraft and engines that are classified as operating leases and, therefore, are not reflected

as liabilities on our balance sheet. Aircraft leases expire between 2009 and 2023. As of December 31, 2007, our total mandatory

payments under operating leases for aircraft aggregated approximately $1.1 billion and total minimum annual aircraft rental payments

for the next 12 months under all non-cancelable operating leases is approximately $138.7 million. Other non-cancelable operating

leases consist of engines, terminal space, operating facilities, office space and office equipment. The leases expire through 2026. As of

December 31, 2007, our total mandatory payments under other non-cancelable operating leases aggregated approximately

$133.1 million. Total minimum annual other rental payments for the next 12 months are approximately $12.2 million.

Purchase Commitments

As of December 31, 2007, the Company had firm orders to purchase 29 ERJ-170/175 aircraft. The current total list price of

the 29 aircraft is $899 million. During the year ended December 31, 2007, the Company made aircraft deposits in accordance with the

aircraft commitments of $51.4 million. The Company also has a commitment to acquire nine spare aircraft engines with a current list

price of approximately $40.5 million. These commitments are subject to customary closing conditions.

In January 2007, the Company and Frontier entered into an agreement, whereby, Republic will operate for Frontier 17

ERJ-170 aircraft. Nine of the 17 aircraft are currently in service and the remaining eight aircraft will be transitioned from our current

Partners.

We expect to fund future capital commitments through internally generated funds, third-party aircraft financings, and debt

and other financings.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠