Frontier Airlines 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

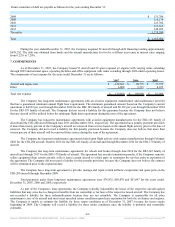

The Company recognizes lease revenue for subleases of six ERJ-145 aircraft subleased to an airline in Mexico under

operating leases which expire in 2013 and 2015. In addition, the Company recognizes license revenue from US Airways for commuter

slots that were purchased by the Company in 2005 and were utilized by US Airways through 2006 for the New-York LaGuardia

commuter slots, and through 2016 for the Ronald Reagan Washington National commuter slots. Revenues from subleases and the

commuter slots are recognized when earned and included in other operating revenue.

The Company records any tax assessed by a governmental authority that is directly imposed on a revenue-producing

transaction between the Company and its customers on a net basis. These taxes are currently not material to the Company’s

consolidated financial statements.

Warrants—Warrants issued to non-employees and Partners are accounted for under SFAS No. 123(R), Share-Based

Payment, and EITF 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in

Conjunction with Selling, Goods or Services,at fair value on the measurement date as deferred charges and credits to stockholders’

equity. Warrants surrendered in a non-monetary transaction are recorded at fair value on the measurement date as reductions to

deferred warrant charges and stockholders’ equity. The deferred charges for warrants were amortized as a reduction of regional airline

services revenue over the terms of the code-share agreements. In March 2007, the Company amended its agreements with Delta

and in return for these amended terms, Delta agreed to surrender its warrants for 3,435,000 shares of the Company’s common stock,

and the Company was granted a pre-petitioned, unsecured, general claim in the amount of $91,000 in Delta's Chapter 11 bankruptcy

case. In April 2007, the Company sold the $91,000 pre-petition claim to a third party for $44,590 in cash.

As a result of the Delta amendment, in March 2007, the Company recorded a deferred credit of $44,590, which represented

the net realizable value of the pre-petition claim on the approval date by the Bankruptcy Court. In addition, the Company recorded a

deferred gain on the surrender of the warrants from Delta of $42,735, which was net of the write-off of the previously reported

unamortized deferred warrant charge of $6,369. Stockholders' equity was reduced by $32,892, net of tax, resulting from the surrender

of the warrants and their retirement. The deferred credits for the proceeds of the pre-petition claim and the gain on the surrender of the

warrants totaling $87,325 will be amortized as an adjustment to revenue over the weighted average aircraft in service during the term

of the agreements with Delta.

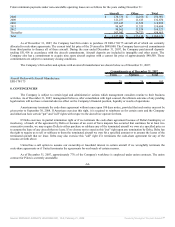

Stock Compensation—The Company maintains stock-based compensation plans which allow for the issuance of

nonqualified stock options to officers, other key employees of the Company, and to members of the Board of Directors. Prior to 2006,

the Company accounted for the stock option plans under the provisions of Accounting Principles Board Opinion No. 25, Accounting

for Stock Issued to Employees, and related Interpretations, whereby, stock options granted that had an exercise price below the market

value were recorded as stock compensation expense. Effective January 1, 2006, the Company adopted the fair value recognition

provisions of SFAS No. 123(R), Share-Based Payment (SFAS 123R). This statement applies to all awards granted after the effective

date and to modifications, repurchases or cancellations of existing awards. Additionally, under the modified prospective method of

adoption, the Company recognizes compensation expense for the portion of outstanding awards on the adoption date for which the

requisite service period has not yet been rendered based on the grant-date fair value of those awards calculated under SFAS 123R. The

standard also requires that forfeitures be estimated over the vesting period of an award, rather than being recognized as a reduction of

compensation expense when the forfeiture actually occurs.

-59-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠