Frontier Airlines 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation—The consolidated financial statements include the accounts of the Company and its wholly-owned

subsidiaries, Chautauqua, Shuttle America and Republic Airline. All significant intercompany accounts and transactions are

eliminated in consolidation.

Risk Management—The Company accounts for derivatives in accordance with Statement of Financial Accounting Standard

(SFAS) No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended and interpreted.

Beginning in April 2004, in anticipation of financing the purchase of regional jet aircraft on firm order with the manufacturer,

the Company entered into fourteen treasury lock agreements with notional amounts totaling $373,500 and a weighted average interest

rate of 4.47% with expiration dates through June 2005. Management designated the treasury lock agreements as cash flow hedges of

forecasted transactions. The treasury lock agreements were settled at each respective settlement date, which were the purchase dates of

the respective aircraft. The Company settled all of the agreements during 2004 and 2005 and the net amount paid was $7,472, and was

recorded in accumulated other comprehensive loss, net of tax. Amounts paid or received on the settlement date are reclassified to

interest expense over the term of the respective aircraft debt. During 2007, 2006 and 2005, the Company reclassified $761, $299 and

$286 to interest expense, respectively. The Company expects to reclassify $720 to interest expense for the year ending December 31,

2008.

Cash and Cash Equivalents—Cash equivalents consist of money market funds and short-term, highly liquid investments

with maturities of three months or less when purchased. Substantially all of our cash is on hand with two banks.

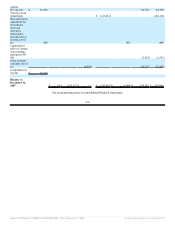

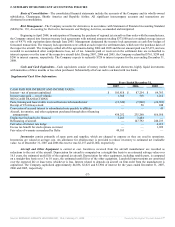

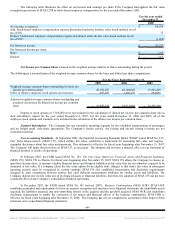

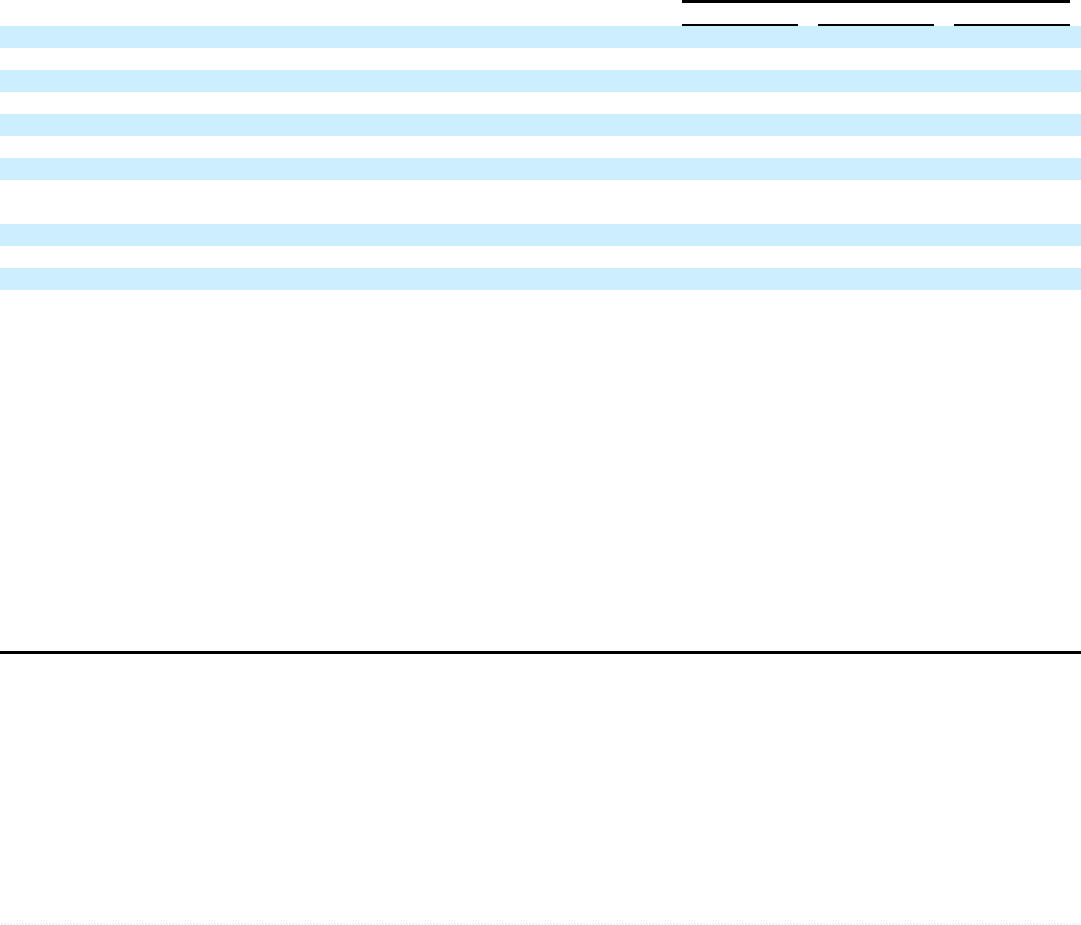

Supplemental Cash Flow Information:

Years Ended December 31,

2007 2006 2005

CASH PAID FOR INTEREST AND INCOME TAXES:

Interest—net of amount capitalized $ 105,818 $ 87,254 $ 64,763

Income taxes paid — net of refunds 1,388 518 1,212

NON-CASH TRANSACTIONS:

Parts, training and lease credits received from aircraft manufacturer (12,540) (7,860) (26,381)

Receipt of US Airways stock — 50 248

Conversion of accrued interest to subordinated note payable to affiliate — — 43

Aircraft, inventories, and other equipment purchased through direct financing

arrangements 438,252 235,260 616,010

Engine received and to be financed 3,281 3,464 —

Refinancing of aircraft — 147,792 240,235

Fair value of interest rate hedge — — 4,012

Excess tax benefit for stock options exercised — — 1,922

Fair value of warrants surrendered by Delta 49,103 — —

Inventories consist primarily of spare parts and supplies, which are charged to expense as they are used in operations.

Inventories are valued at average cost. An allowance for obsolescence is provided to reduce inventory to estimated net realizable

value. As of December 31, 2007 and 2006 this reserve was $2,157 and $1,004, respectively.

Aircraft and Other Equipment is carried at cost. Incentives received from the aircraft manufacturer are recorded as

reductions to the cost of the aircraft. Depreciation for aircraft is computed on a straight-line basis to an estimated salvage value over

16.5 years, the estimated useful life of the regional jet aircraft. Depreciation for other equipment, including rotable parts, is computed

on a straight-line basis over 3 to 10 years, the estimated useful lives of the other equipment. Leasehold improvements are amortized

over the expected life or lease term, whichever is less. Interest related to deposits on aircraft on firm order from the manufacturer is

capitalized. The Company capitalized approximately $4,056, $2,021 and $1,904 of interest for the years ended December 31, 2007,

2006 and 2005, respectively.

-57-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠