Frontier Airlines 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

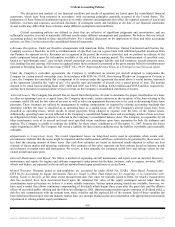

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The

preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets and

liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities at the date of our financial statements.

Actual results may differ from these estimates under different assumptions and conditions.

Critical accounting policies are defined as those that are reflective of significant judgments and uncertainties, and are

sufficiently sensitive to result in materially different results under different assumptions and conditions. We believe that our critical

accounting policies are limited to those described below. For a detailed discussion on the application of these and other accounting

policies, see Note 2 in the notes to the consolidated financial statements.

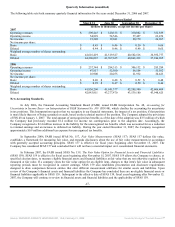

• Revenue Recognition. Under our fixed-fee arrangements with American, Delta, USAirways, United, Continental and Frontier, the

Company receives a fixed-fee, as well as reimbursement of specified costs on a gross basis with additional possible incentives from

our Partners for superior service. Revenues are recognized in the period the service is provided, and we perform an estimate of the

profit component based upon the information available at the end of the accounting period. The reimbursement of specified costs,

known as “pass-through costs”, may include aircraft ownership cost, passenger liability and hull insurance, aircraft property taxes,

fuel, landing fees and catering. All revenue recognized under these contracts is presented at the gross amount billed for reimbursement

pursuant to Emerging Issues Tax Force Issue (“EITF”) No. 99-19 Reporting Revenue Gross as a Principal versus Net as an Agent.

Under the Company’s code-share agreements, the Company is reimbursed an amount per aircraft designed to compensate the

Company for certain aircraft ownership costs. In accordance with EITF No. 01-08, Determining Whether an Arrangement Contains a

Lease, the Company has concluded that a component of its revenue under the agreement discussed above is rental income, inasmuch

as the agreement identifies the “right of use” of a specific type and number of aircraft over a stated period of time. The amount

deemed to be rental income during fiscal 2007, 2006 and 2005 was $310.3 million, $258.6 million and $189.8 million, respectively,

and has been included in regional airline services revenue on the Company’s consolidated statements of income.

•Aircraft Leases. The Company has aircraft that are leased from third parties. In order to determine the proper classification of a lease

as either an operating lease or a capital lease, the Company must make certain estimates at the inception of the lease relating to the

economic useful life and the fair value of an asset as well as select an appropriate discount rate to be used in discounting future lease

payments. These estimates are utilized by management in making computations as required by existing accounting standards that

determine whether the lease is classified as an operating lease or a capital lease. All of the Company’s aircraft leases have been

classified as operating leases, which results in rental payments being charged to expense over the term of the related leases.

Additionally, operating leases are not reflected in the Company’s consolidated balance sheet and accordingly, neither a lease asset nor

an obligation for future lease payments is reflected in the Company’s consolidated balance sheet. The Company is responsible for all

other maintenance costs of its aircraft and must meet specified return conditions upon lease expiration for both the airframes and

engines. The Company is unable to estimate the liability for these return conditions as of December 31, 2007, because the leases

expire beginning in 2009. The Company will record a liability for these return conditions once the liability is probable and reasonably

estimable.

•Impairments to Long-Lived Assets. We record impairment losses on long-lived assets used in operations when events and

circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are

less than the carrying amount of those items. Our cash flow estimates are based on historical results adjusted to reflect our best

estimate of future market and operating conditions. Our estimates of fair value represent our best estimate based on industry trends

and reference to market rates and transactions. We review, at least annually, the estimated useful lives and salvage values for our

owned aircraft and spare parts.

•Aircraft Maintenance and Repair. We follow a method of expensing aircraft maintenance and repair costs as incurred. However,

maintenance and repairs for engines and airframe components under power-by-the-hour contracts, such as engines, avionics, APUs,

wheels and brakes, are expensed as the aircraft are operated based upon actual hours or cycles flown.

•Issued Warrants. Warrants issued to non-employees are accounted for under SFAS No. 123(R), Share-Based Payments,and

EITF 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with

Selling, Goods or Services, at fair value on the measurement date. Fair value for warrants issued to Delta, for which a measurement

date has occurred, have been determined based upon the estimated fair value of the equity instrument issued rather than the

consideration received because we believe it is more reliably measured. Various option pricing models are available; however, we

have used a model that allows continuous compounding of dividends which begins three years after the grant date and the dilutive

effects of our initial public offering and the follow-on offerings in 2005. Option pricing models require estimates of dividend yield, a

risk free rate commensurate with the warrant term, stock volatility and the expected life of the warrant. Each of these variables has

been determined based upon relevant industry market data, our strategic business plan and consultation with appropriate professionals

experienced in valuing similar equity instruments.

-45-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠