Frontier Airlines 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

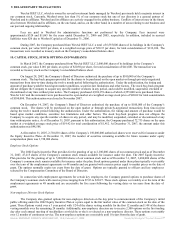

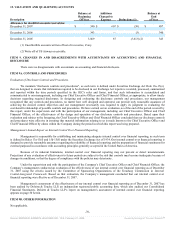

9. RELATED PARTY TRANSACTIONS

WexAir RJET LLC, which is owned by several investment funds managed by Wexford, previously held a majority interest in

our common stock. Currently, Wexford owns less than 1% of our common stock but one of our directors is a general partner of

Wexford and its affiliates. Wexford and its affiliates are actively engaged in the airline business. Conflicts of interest may in the future

arise between Wexford and its affiliates, on the one hand, and us, on the other hand, in a number of areas relating to our business and

our past and ongoing relationships.

Fees are paid to Wexford for administrative functions not performed by the Company. Fees incurred were

approximately $324 and $1,065 for the years ended December 31, 2006 and 2005, respectively. In addition, included in accrued

liabilities were $26 due to Wexford Capital as of December 31, 2006.

During 2007, the Company purchased from WexAir RJET LLC a total of 6,555,000 shares of its holdings in the Company’s

common stock, par value $.001 per share, at a weighted average price of $20.15 per share, for total consideration of $132,100. The

transactions were recorded as treasury stock on the Company’s consolidated balance sheet.

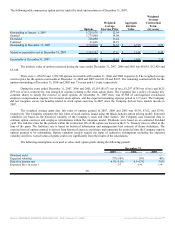

10. CAPITAL STOCK, STOCK OPTIONS AND WARRANTS

In March 2007, the Company purchased from WexAir RJET LLC 2,000,000 shares of its holdings in the Company’s

common stock, par value $.001 per share, at a price of $20.50 per share, for total consideration of $41,000. The transaction was

recorded as treasury stock on the Company’s consolidated balance sheet.

On August 28, 2007, the Company’s Board of Directors authorized the purchase of up to $100,000 of the Company’s

common stock. The buy-back program provided for the shares to be purchased on the open market or through privately-negotiated

transactions from time-to-time during the twelve month period following the authorization. Under the authorization, the timing and

amount of purchase would be based upon market conditions, securities law limitations and other factors. The stock buy-back program

did not obligate the Company to acquire any specific number of shares in any period, and could be modified, suspended, extended or

discontinued at any time without prior notice. The Company purchased 4,994,159 shares of which 4,555,000 were purchased from

WexAir LLC and the remainder were purchased on the open market at a weighted average stock price of $20.02 for total consideration

of $100,000. This authorization was closed in November 2007.

On December 14, 2007, the Company’s Board of Directors authorized the purchase of up to $100,000 of the Company’s

common stock. The shares will be purchased on the open market or through privately-negotiated transactions from time-to-time

during the twelve month period following the authorization. Under the authorization, the timing and amount of purchase would be

based upon market conditions, securities law limitations and other factors. The stock buy-back program does not obligate the

Company to acquire any specific number of shares in any period, and may be modified, suspended, extended or discontinued at any

time without prior notice. As of December 31, 2007, pursuant to this authorization, the Company purchased 72,735 shares on the open

market at a weighted average stock price of $19.42 for total consideration of $1,412. At December 31, 2007, the amount under this

authorization was $98,588.

At December 31, 2007, 2,710,818 shares of the Company’s 150,000,000 authorized shares were reserved for issuances under

the Equity Incentive Plans. At December 31, 2007, the number of securities remaining available for future issuance under equity

compensation plans was 3,728,000 shares.

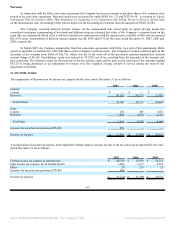

Employee Stock Options

The 2002 Equity Incentive Plan provides for the granting of up to 2,180,000 shares of our common stock and as of December

31, 2007, 47,215 shares of the Company’s common stock remain available for issuance under the plan. The 2007 Equity Incentive

Plan provides for the granting of up to 5,000,000 shares of our common stock and as of December 31, 2007, 3,680,000 shares of the

Company’s common stock remain available for issuance under the plan. Stock options granted under these plans typically vest ratably

over the term of the employment agreements or 48 months and are granted with exercise prices equal to market prices on the date of

grant. The options normally expire ten years from the date of grant. Options are typically granted to officers and key employees

selected by the Compensation Committee of the Board of Directors.

In connection with employment agreements for certain key employees, the Company granted options to purchase shares of

the Company's common stock with exercise prices ranging from $7.83 to $20.27. These stock options vest ratably over the term of the

employment agreements or 48 months and are exercisable for five years following the vesting dates or ten years from the date of

grant.

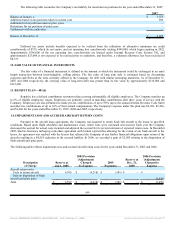

Non-employee Director Stock Options

The Company also granted options for non-employee directors on the day prior to commencement of the Company’s initial

public offering under the 2002 Equity Incentive Plan at a price equal to the fair market value of the common stock on the date of the

grant. These Options vested over a 3 year period with 1/24 of the shares vesting monthly for the first 12 months and 1/48 of the shares

vesting monthly over the remaining 24 months. Additionally, non-employee directors are to receive 2,500 options on the first trading

day after each annual meeting of stockholders at which he or she is re-elected as a non-employee director. These options vest ratably

over 12 months of continuous service. The non-employee options are exercisable until 10 years from the date of grant.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠