Frontier Airlines 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

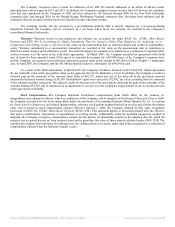

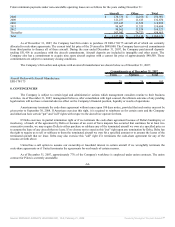

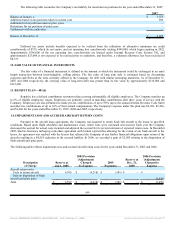

The following table summarizes option activity under the stock option plans as of December 31, 2007:

Options

Weighted

Average

Exercise Price

Aggregate

Intrinsic

Value

Weighted

Average

Contractual

Term

(in years)

Outstanding at January 1, 2007 1,725,576 $ 12.54

Granted 1,775,000 19.04

Exercised 728,090 11.24

Forfeited 61,668 14.19

Outstanding at December 31, 2007 2,710,818 $ 16.81 $ 6,728 8.80

Vested or expected to vest at December 31, 2007 2,263,533 $ 17.11 $ 5,618 8.80

Exercisable at December 31, 2007 1,029,995 $ 14.63 $ 5,104 7.58

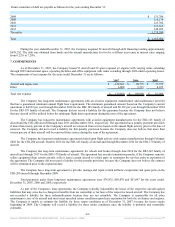

The intrinsic value of options exercised during the years ended December 31, 2007, 2006 and 2005 was $6,081, $12,429 and

$5,140.

There were 1,199,052 and 1,709,700 options exercisable at December 31, 2006 and 2005 respectively. The weighted average

exercise price for the options exercisable at December 31, 2006 and 2005 was $11.92 and $4.07. The remaining contractual life for the

options outstanding at December 31, 2006 and 2005 was 7.6 years and 6.3 years, respectively.

During the years ended December 31, 2007, 2006 and 2005, $3,119 ($1,871 net of tax), $1,297 ($785 net of tax) and $125

($75 net of tax), respectively, was charged to expense relating to the stock option plans. The Company has a policy of issuing new

common shares to satisfy the exercise of stock options. At December 31, 2007 there was $7,808 of unrecognized stock-based

employee compensation expense for unvested stock options, and the expected remaining expense period is 3.9 years. The Company

did not recognize excess tax benefits related to stock option exercises in 2007 since the Company did not have taxable income in

2007.

The weighted average grant date fair value of options granted in 2007, 2006 and 2005 was $5.30, $7.62, and $3.98,

respectively. The Company estimates the fair value of stock options issued using the Black-Scholes option pricing model. Expected

volatilities are based on the historical volatility of the Company’s stock and other factors. The Company uses historical data to

estimate option exercises and employee terminations within the valuation model. Dividends were based on an estimated dividend

yield. The risk-free rates for the periods within the contractual life of the option are based on the U.S. Treasury rates in effect at the

time of the grant. The forfeiture rate is based on historical information and managements best estimate of future forfeitures. The

expected term of options granted is derived from historical exercise experience and represents the period of time the Company expects

options granted to be outstanding. Option valuation models require the input of subjective assumptions including the expected

volatility and lives. Actual values of grants could vary significantly from the results of the calculations.

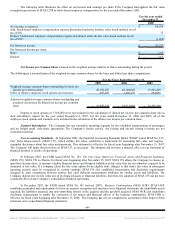

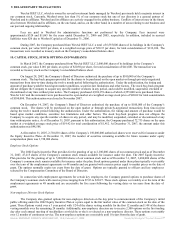

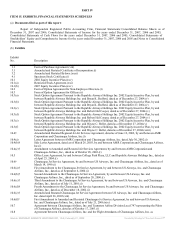

The following assumptions were used to value stock option grants during the following periods:

December 31,

2007 2006 2005

Dividend yield — — —

Expected volatility 37%-38% 38% 40%

Risk-free interest rate 4.3%-5.1% 4.5-4.7% 3.9%

Expected life ( in years ) 2-7 1-4 1-4

-66-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠