Frontier Airlines 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

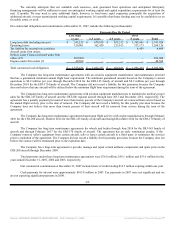

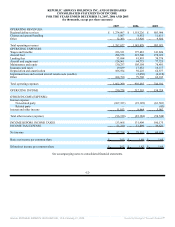

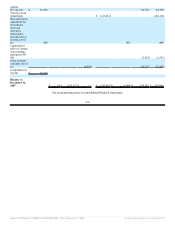

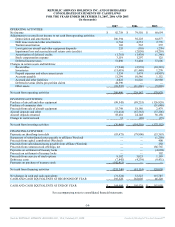

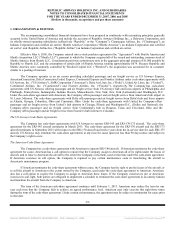

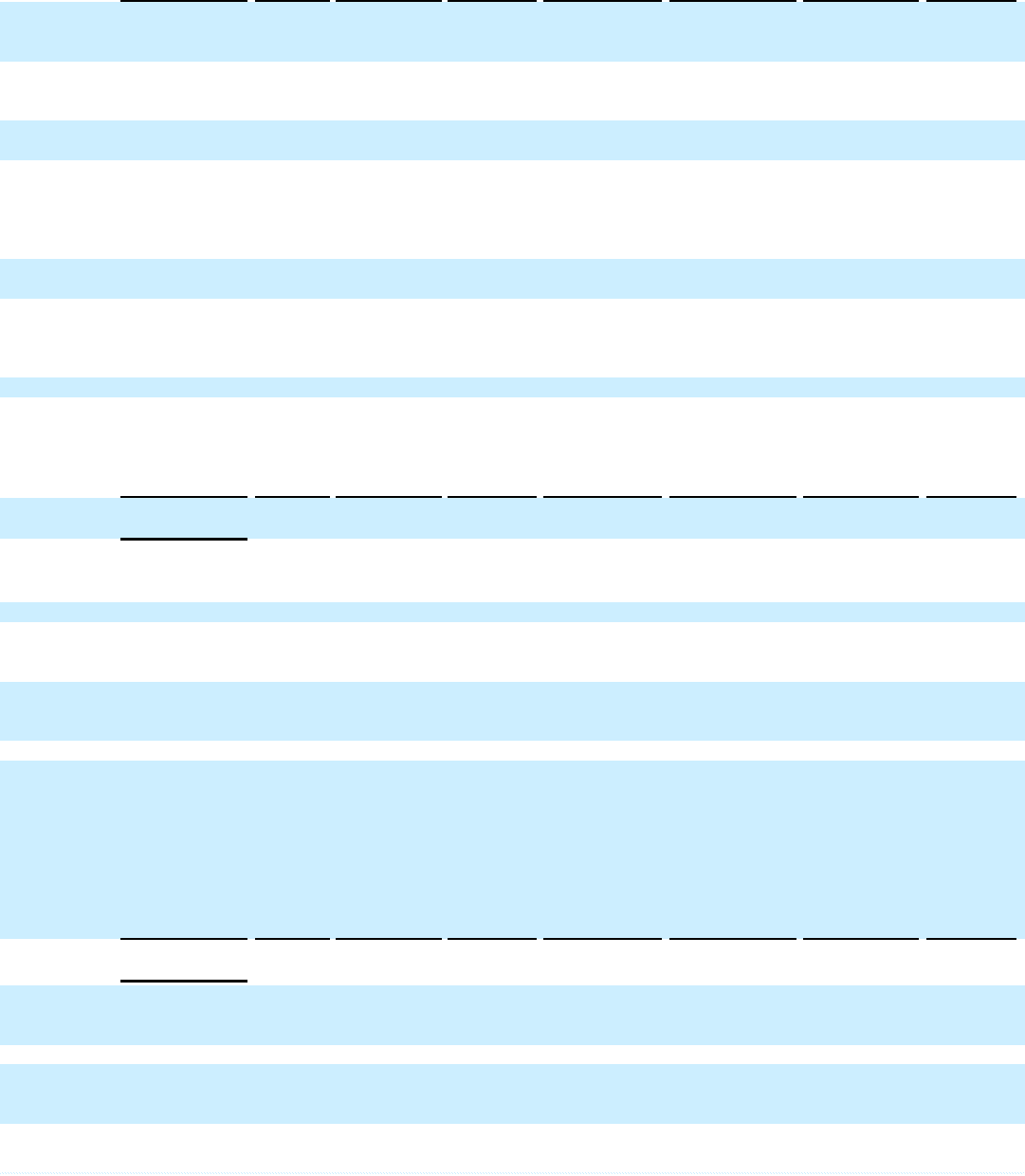

REPUBLIC AIRWAYS HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2007, 2006 AND 2005

(In thousands)

Other

Comprehensive

Income (Loss)

Common

Stock

Additional

Paid-In

Capital Warrants

Treasury

Stock

Accumulated

Other

Comprehensive

Loss

Accumulated

Earnings Total

Balance at

January 1,

2005 $ 26 $ 87,120 $ 8,574 $ (4,168) $ 83,099 $ 174,651

Stock

compensation

expense 125 125

Common stock

offerings, net 16 186,749 186,765

Exercise of

employee stock

options,

including excess

tax benefit 3,111 3,111

Capital

contribution 400 400

Distribution to

WexAir LLC

for Shuttle

America merger (1,000) (1,000)

Net income $ 60,654 60,654 60,654

Unrealized

losses on

derivative

instruments, net

of tax (8) (8) (8)

Comprehensive

income $ 60,646

Balance at

December 31,

2005 42 277,505 8,574 (4,176) 142,753 424,698

Stock

compensation

expense 1,297 1,297

Exercise of

employee stock

options 1 3,024 3,025

Net income $ 79,510 79,510 79,510

Reclassification

adjustment for

net realized

losses on

derivative

instruments,

included in net

income, net of

tax 299 299 299

Comprehensive

income $ 79,809

Balance at

December 31,

2006 43 281,826 8,574 (3,877) 222,263 508,829

Stock

compensation

expense 3,119 3,119

Exercise of

employee stock

8,182 8,182

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠