Frontier Airlines 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

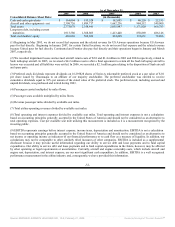

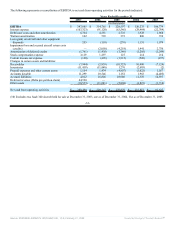

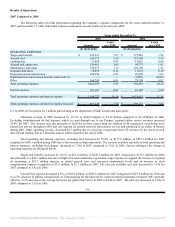

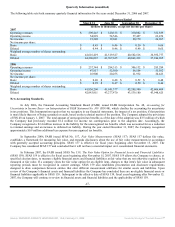

Landing fees increased by 27.8%, or $11.7 million, to $53.7 million in 2007 compared to $42.0 million in 2006. The increase

is due mainly to a 16% increase in departures, a 3% increase in the average landing weight and a 7% increase in the average fee

charged by airports. Our fixed-fee agreements provide for a direct reimbursement of landing fees. The unit cost was 0.47¢ in 2007

compared to 0.46¢ in 2006.

Aircraft and engine rent increased by 31.9%, or $30.2 million, to $125.0 million in 2007 compared to $94.8 million in 2006

due to a $22.2 million increase in aircraft rents of CRJ-200 aircraft, which are on short-term leases and an $11.1 million increase in

aircraft rents of 70-seat aircraft, and is partially offset by the effect of the purchase of five previously leased 50-seat aircraft in the

third quarter of 2006. The unit cost increased to 1.08¢ for 2007 compared to 1.03¢ for 2006.

Maintenance and repair expenses increased by 23.8%, or $25.0 million, to $130.2 million in 2007 compared to $105.2

million for 2006 due mainly to the addition of 49 aircraft in 2007, which resulted in a $16.6 million increase in long-term maintenance

agreement expenses. Additionally, repair expenses on parts not under warranty or not included under long term contracts increased

$5.6 million. Scheduled heavy maintenance events also increased by $1.2 million. The unit cost was down slightly to 1.13¢ in 2007

compared to 1.15¢ in 2006.

Insurance and taxes increased 7.9%, or $1.4 million, to $19.0 million in 2007 compared to $17.7 million in 2006. Property

taxes increased $1.7 million and the increase in operations was more than offset by a decline in the average insurance rates year over.

Our fixed-fee agreements generally provide for a direct reimbursement of insurance and property taxes. The unit cost decreased to

0.16¢ in 2007 compared to 0.19¢ in 2006.

Depreciation and amortization increased 15.6%, or $14.4 million, to $106.6 million in 2007 compared to $92.2 million in

2006 due mainly to $15.2 million of additional depreciation on regional jet aircraft due to the purchase of 11 aircraft in 2007 and the

full year effect of 16 regional jet aircraft purchased in 2006. Additionally, amortization for takeoff and landing slots decreased $3.3

million from 2006 due to slots at LaGuardia airport expiring at the end of 2006. The unit cost decreased to 0.93¢ in 2007 compared to

1.01¢ in 2006.

Impairment loss and accrued return costs was a ($2.1) million benefit in 2006, which represented the gain on the disposition

of Saab aircraft and spare parts.

Other expenses increased 31.5%, or $25.1 million, to $104.8 million in 2007 from $79.7 million in 2006, due primarily to

$15.8 million of increases in flight crew training and travel expenses and $7.6 million of increases in passenger catering costs and

other operational expenses to support the increased regional jet operations and increased pilot attrition. The unit cost increased to

0.91¢ in 2007 compared to 0.87¢ in 2006.

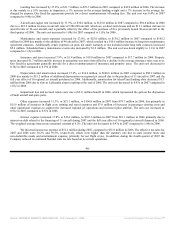

Interest expense increased 17.8% or $16.2 million, to $107.3 million in 2007 from $91.1 million in 2006 primarily due to

interest on debt related to the financing of 11 aircraft during 2007 and the full year effect of 16 regional jet aircraft financed in 2006.

The weighted average interest rate remained constant at 6.2%. The unit cost decreased to 0.93¢ in 2007 compared to 1.00¢ in 2006.

We incurred income tax expense of $51.2 million during 2007, compared to $51.9 million in 2006. The effective tax rates for

2007 and 2006 were 38.2% and 39.5%, respectively, which were higher than the statutory rate due to state income taxes and

non-deductible meals and entertainment expense, primarily for our flight crews. In addition, during the fourth quarter of 2007 the

Company reduced its estimated blended state tax rate based on its current operations.

-40-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠