Frontier Airlines 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

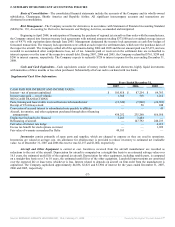

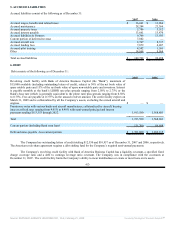

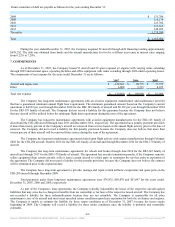

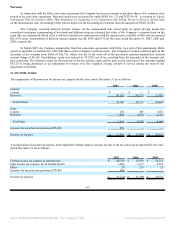

Future maturities of debt are payable as follows for the years ending December 31:

2008 $ 131,700

2009 116,278

2010 123,702

2011 131,612

2012 140,039

Thereafter 1,270,249

Total $ 1,913,580

During the year ended December 31, 2007, the Company acquired 22 aircraft through debt financing totaling approximately

$438,252. The debt was obtained from banks and the aircraft manufacturer for twelve to fifteen year terms at interest rates ranging

from 6.22% to 7.28%.

7. COMMITMENTS

As of December 31, 2007, the Company leased 91 aircraft and 22 spare regional jet engines with varying terms extending

through 2029 and terminal space, operating facilities and office equipment with terms extending through 2026 under operating leases.

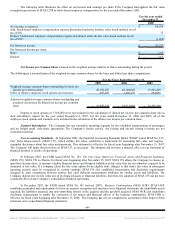

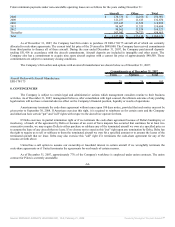

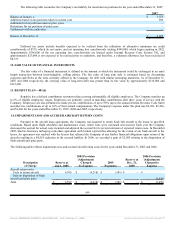

The components of rent expense for the years ended December 31 are as follows:

2007 2006 2005

Aircraft and engine rent $ 124,961 $ 94,773 $ 77,725

Other 6,008 5,315 4,225

Total rent expense $ 130,969 $ 100,088 $ 81,950

The Company has long-term maintenance agreements with an avionics equipment manufacturer and maintenance provider

that has a guaranteed minimum annual flight hour requirement. The minimum guaranteed amount based on the Company's current

operations is $4,852 per year through December 2014 for the ERJ-145 family of aircraft and $8,161 per year through December 2014

for the ERJ-170 family of aircraft. The Company did not record a liability for this guarantee because the Company does not believe

that any aircraft will be utilized below the minimum flight hour requirement during the term of the agreement.

The Company has long-term maintenance agreements with aviation equipment manufacturers for the ERJ-145 family of

aircraft and the CRJ-200 aircraft through June 2013 and December 2012, respectively. The agreement has a penalty payment provision

if more than twenty percent of the Company's aircraft are removed from service based on the annual flight activity prior to the date of

removal. The Company did not record a liability for this penalty provision because the Company does not believe that more than

twenty percent of their aircraft will be removed from service during the term of the agreement.

The Company has long-term maintenance agreements based upon flight activity with engine manufacturers through February

2010 for the CRJ-200 aircraft, October 2012 for the ERJ-145 family of aircraft and through December 2014 for the ERJ-170 family of

aircraft.

The Company has long-term maintenance agreements for wheels and brakes through June 2014 for the ERJ-145 family of

aircraft and through 2017 for the ERJ-170 family of aircraft. The agreement has an early termination penalty, if the Company removes

sellers equipment from certain aircraft, sells or leases certain aircraft to a third party or terminates the services prior to expiration of

the agreement. The Company did not record a liability for this penalty provision, because the Company does not believe the contract

will be terminated prior to the expiration date.

The Company has a long-term agreement to provide, manage and repair certain airframe components and spare parts on the

CRJ-200 aircraft through December 2009.

Total payments under these long-term maintenance agreements were $76,832, $56,070 and $53,647 for the years ended

December 31, 2007, 2006 and 2005, respectively.

As part of the Company's lease agreements, the Company typically indemnifies the lessor of the respective aircraft against

liabilities that may arise due to changes in benefits from tax ownership or tax laws of the respective leased aircraft. The Company has

not recorded a liability for these indemnifications because they are not estimable. The Company is responsible for all other

maintenance costs of its aircraft and must meet specified return conditions upon lease expiration for both the air frames and engines.

The Company is unable to estimate the liability for these return conditions as of December 31, 2007, because the leases expire

beginning in 2009. The Company will record a liability for these return conditions once the liability is probable and reasonably

estimable.

-63-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠