Frontier Airlines 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

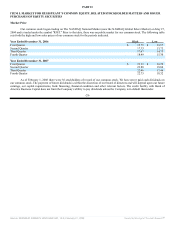

Risks Related To Our Common Stock

Our stock price is volatile.

Since our common stock began trading on The NASDAQ National Market (now the NASDAQ Global Select Market) on

May 27, 2004, the market price of our common stock has ranged from a low of $8.15 to a high of $23.88 per share. The market price

of our common stock may continue to fluctuate substantially due to a variety of factors, many of which are beyond our control,

including:

• announcements concerning our Partners, competitors, the airline industry or the economy in general;

• strategic actions by us, our Partners or our competitors, such as acquisitions or restructurings;

• media reports and publications about the safety of our aircraft or the aircraft types we operate;

• new regulatory pronouncements and changes in regulatory guidelines;

• general and industry specific economic conditions, including the price of oil;

• changes in financial estimates or recommendations by securities analysts;

• sales of our common stock or other actions by investors with significant shareholdings or our Partners; and

• general market conditions.

The stock markets in general have experienced substantial volatility that has often been unrelated to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

In the past, stockholders have sometimes instituted securities class action litigation against companies following periods of

volatility in the market price of their securities. Any similar litigation against us could result in substantial costs, divert management's

attention and resources and harm our business.

Future sales of our common stock by our stockholders could depress the price of our common stock.

Sales of a large number of shares of our common stock or the availability of a large number of shares for sale could

adversely affect the market price of our common stock and could impair our ability to raise funds in additional stock offerings.

Our incorporation documents and Delaware law have provisions that could delay or prevent a change in control of our

company, which could negatively affect your investment.

Our certificate of incorporation and bylaws and Delaware law contain provisions that could delay or prevent a change in

control of our company that stockholders may consider favorable. Certain of these provisions:

• authorize the issuance of up to 5,000,000 shares of preferred stock that can be created and issued by our board of directors

without prior stockholder approval, commonly referred to as "blank check" preferred stock, with rights senior to those of our

common stock;

• limit the persons who can call special stockholder meetings;

• provide that a supermajority vote of our stockholders is required to amend our certificate of incorporation or bylaws; and

-24-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠