Frontier Airlines 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

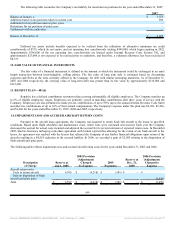

In December 2007, the FASB issued SFAS No. 160, Non-controlling Interests in Consolidated Financial Statements—an

amendment of Accounting Research Bulletin No. 51 (SFAS 160). SFAS 160 establishes accounting and reporting standards for

ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the

parent and to the non-controlling interest, changes in a parent's ownership interest, and the valuation of retained non-controlling equity

investments when a subsidiary is deconsolidated. SFAS 160 also establishes disclosure requirements that clearly identify and

distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS 160 is effective for fiscal years

beginning after December 15, 2008. The Company has not yet completed its assessment of the impact of this statement on its

consolidated financial statements.

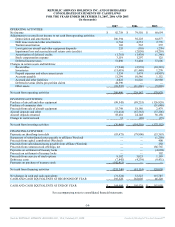

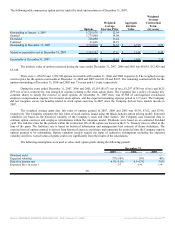

3. AIRCRAFT AND OTHER EQUIPMENT

At December 31, 2007, the Company had a total fleet of 225 aircraft (219 in operations and three leased and three subleased

to an airline in Mexico), including 17 ERJ-135 aircraft, 15 ERJ-140 aircraft, 68 ERJ-145 aircraft, 76 ERJ-170 aircraft, 25 ERJ-175

aircraft and 24 CRJ-200 aircraft. The Company owns 15 ERJ-135 aircraft, 11 ERJ-140 aircraft, 30 ERJ-145 aircraft, 56 ERJ-170

aircraft, 22 ERJ-175 aircraft, and leases the other 91 aircraft under operating lease agreements.

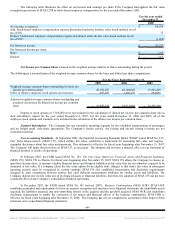

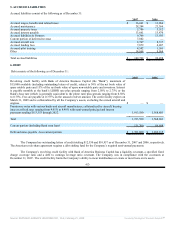

Aircraft and other equipment consist of the following as of December 31:

2007 2006

Aircraft $ 2,498,306 $ 1,994,907

Flight equipment 104,475 87,625

Furniture and equipment 6,808 5,718

Leasehold improvements 14,585 11,115

Total aircraft and other equipment 2,624,174 2,099,365

Less accumulated depreciation and amortization (315,448) (209,648)

Aircraft and other equipment—net $ 2,308,726 $ 1,889,717

Aircraft, other equipment and slot depreciation and amortization expense for the years ended December 31, 2007, 2006 and

2005 was $106,594, $92,228 and $64,877, respectively.

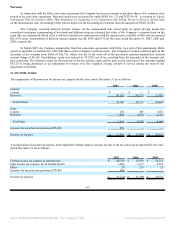

4. INTANGIBLE AND OTHER ASSETS

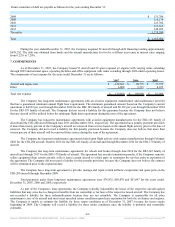

Intangible and other assets consist of the following as of December 31:

2007 2005

Prepaid aircraft rent $ 32,077 $ 29,062

Aircraft deposits 65,382 71,571

Deferred warrant charge, net (see Note 10) — 6,470

Debt issue costs, net 22,271 17,560

Commuter slots, net 46,664 47,052

Other 30,946 20,570

$ 197,340 $ 192,285

The Company purchased commuter slots at Ronald Reagan Washington National Airport (“DCA”) and New

York LaGuardia Airport (“LGA”) in 2005 from US Airways. The licensing agreement with the Company and US Airways for the

LGA commuter slots expired on December 31, 2006, but we maintain a security interest in the LGA slots if US Airways fails to

perform under the current licensing agreement. The LGA commuter slots were amortized over a 15 month life ending December 31,

2006, and the DCA commuter slots are amortized on a straight line basis over a 25 year expected life to an estimated residual value.

Amortization was approximately $3,671 in 2006 and $388 in 2007. The Company assigned the right of use for these commuter slots to

US Airways which will continue to be operated by US Airways Express carriers until the expiration or termination of the amended

and restated Chautauqua Jet Service Agreement (“JSA”) dated as of April 26, 2005 between US Airways and Chautauqua or the

Republic JSA, whichever is later, at an agreed rate. Prior to the expiration of the agreement to license the commuter slots, US Airways

has the right to repurchase all, but not less than all, of the DCA commuter slots at a predetermined price.

-61-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠