Frontier Airlines 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our current growth plans may be materially adversely affected by substantial risks, some of which are outside of our control.

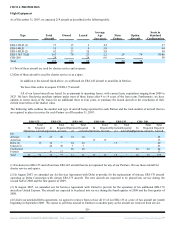

We plan to acquire an additional 29 ERJ-170/175 aircraft by the end of 2008, all of which are subject to firm orders. At

December 31, 2007, we had agreements to place all of the 29 aircraft into service with our Partners. We have financing commitments

in place for all of these firm orders. If we are incorrect in our assessment of the profitability and feasibility of our growth plans, if

circumstances change in a way that was unforeseen by us or if we are unable to consummate financing for these aircraft, we may not

be able to grow as planned.

Under our code-share agreements, we are obligated to place in service an additional 29 aircraft through March 2009, at an

aggregate cost, excluding the cost of acquiring the aircraft and related parts, to us of approximately $6.4 million. These costs, which

are related to the acquisition of these aircraft, include the acquisition of related additional ground and maintenance facilities and

support equipment, the employment of approximately 500 additional employees and the integration of those aircraft, facilities and

employees into our existing operations.

As of December 31, 2007, we had options to purchase an aggregate of 74 aircraft from Embraer. If we choose to exercise

options to purchase aircraft from Embraer prior to obtaining a commitment from existing or future partners to place the aircraft in

service, we will be obligated to purchase the aircraft from Embraer and to bear the cost of operation even if we cannot place the

aircraft in service with a code-share partner, which could have a material adverse effect on our financial condition, results of

operations and the price of our common stock.

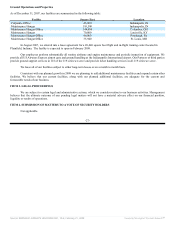

Our ability to manage our growth effectively and efficiently requires us to continue to accurately forecast our equipment and

human resources needs and to continue to expend funds to improve our operating, financial and management controls, reporting

systems, procurement process and procedures. In addition, we must effectively expand, train and manage our employee base, which

could be costly. Our growth will place a significant strain on our management and other corporate resources. If we are unable to

manage our anticipated growth effectively and efficiently, our business could be harmed.

Our growth plans may be adversely affected by our code-share agreements with American and Delta. Chautauqua’s

American agreement requires us to provide regional airline services exclusively for American at its St. Louis hub and within 50 statute

miles of that hub. This agreement also prohibits us from providing competing regional hub services at Memphis, Nashville and Kansas

City and means that, without American's consent, we are prohibited from operating flights under our own flight designator code or on

behalf of any other air carrier providing "hub" services in or out of these airports. Chautauqua's Delta agreement prohibits it from

conducting code-share flying into several major metropolitan airports, except under its existing code-share agreements with American

and US Airways. Republic Airline’s Delta agreement prohibits it from conducting code share flying into several major metropolitan

airports, except under its existing code-share agreement with United. Pursuant to the terms of Chautauqua's and Republic Airline’s

code-share agreement with Delta, we are prohibited from operating aircraft other than for Delta except for (1) those we operates for

our existing Partners, (2) the additional aircraft it may operate under its existing agreements and (3) aircraft subject to other limited

exceptions. Furthermore, pursuant to the terms of our code-share agreements with United, except for our current code-share flying,

Shuttle America and Chautauqua are prohibited from operating 50 seat or larger aircraft or turboprops from United’s current hub

airports. United’s hub airports are Denver, Washington Dulles, Los Angeles, Chicago O'Hare, Seattle and San Francisco.

Our Partners may be restricted in increasing the level of business that they conduct with us, thereby limiting our growth.

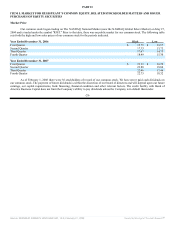

In general, the pilots' unions of certain major airlines have negotiated collective bargaining agreements that restrict the

number and/or size of regional aircraft that a particular carrier may operate. A "scope" clause in US Airways' current collective

bargaining agreement with its pilots prevents US Airways from using more than 465 aircraft not flown by its pilots in its operations.

There are no quantity limitations in the US Airways “scope” limitations for small aircraft. For purposes of this “scope” restriction, a

small regional jet is defined as any aircraft configured with 78 or fewer seats. For purposes of this limitation, a large regional jet is an

aircraft configured with 79 to 90 passenger seats. US Airways can outsource up to an additional 55 aircraft, including the ERJ-175 and

CRJ-900, configured with more than 78 seats but less than 90 seats, subject to certain limitations. We cannot assure you that US

Airways will contract with us to fly any additional aircraft. Our pilots union limited their approval to 80 additional aircraft for US

Airways, which includes the 28 ERJ-170s obtained from US Airways, the 20 ERJ-175s added during 2007 and the incremental ten

aircraft that will be placed in service in 2008. A "scope" clause in American's current collective bargaining agreement with its pilots

limits it from operating aircraft having 51 or more seats. A "scope" clause in Delta's current collective bargaining agreement with its

pilots restricts it from operating aircraft having more than 70 to 76 seats and limits it from operating more than 175, or under certain

circumstances, 200 aircraft having 70 to 76 seats. United’s "scope" limitations restrict it from operating aircraft configured with more

than 70 seats or any aircraft weighing more than 83,000 pounds. Continental’s “scope” limitations restrict it from operating aircraft

configured with more than 51 seats.

-19-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠