Frontier Airlines 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

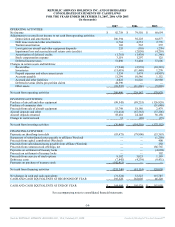

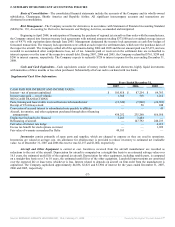

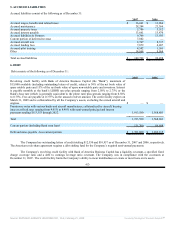

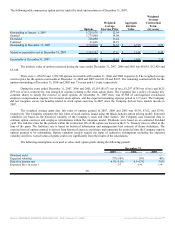

5. ACCRUED LIABILITIES

Accrued liabilities consist of the following as of December 31:

2007 2006

Accrued wages, benefits and related taxes $ 16,061 $ 13,966

Accrued maintenance 28,244 23,366

Accrued property taxes 5,706 3,512

Accrued interest payable 13,661 13,470

Accrued liabilities to Partners 9,766 13,935

Current portion of deferred revenue 7,882 —

Accrued aircraft rent 2,747 8,337

Accrued landing fees 7,079 4,407

Accrued pilot training 4,582 1,501

Other 14,064 9,964

Total accrued liabilities $ 109,792 $ 92,458

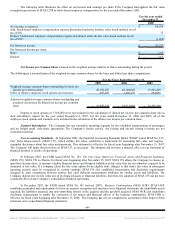

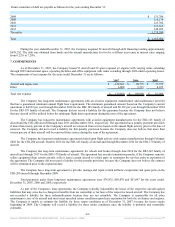

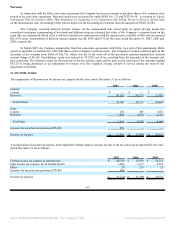

6. DEBT

Debt consists of the following as of December 31:

2007 2006

Revolving credit facility with Bank of America Business Capital (the “Bank”), maximum of

$15,000 available (including outstanding letters of credit), subject to 30% of the net book value of

spare rotable parts and 15% of the net book value of spare non-rotable parts and inventory. Interest

is payable monthly at the bank’s LIBOR rate plus spreads ranging from 2.50% to 2.75% or the

Bank’s base rate (which is generally equivalent to the prime rate) plus spreads ranging from 0.50%

to 0.75%. Fees are payable at 0.375% on the unused revolver amount. The credit facility expires on

March 31, 2009 and is collateralized by all the Company’s assets, excluding the owned aircraft and

engines. $ — $ —

Promissory notes with various banks and aircraft manufacturer, collateralized by aircraft, bearing

interest at fixed rates ranging from 4.01% to 8.49% with semi-annual principal and interest

payments totaling $113,353 through 2022. 1,913,580 1,568,803

Total 1,913,580 1,568,803

Current portion (including Bank term loan) 131,700 86,688

Debt and notes payable - less current portion $ 1,781,880 $ 1,482,115

The Company has outstanding letters of credit totaling $12,550 and $10,957 as of December 31, 2007 and 2006, respectively.

The American code-share agreement requires a debt sinking fund for the Company’s required semi-annual payments.

The Company’s revolving credit facility with Bank of America Business Capital has a liquidity covenant, a specified fixed

charge coverage ratio and a debt to earnings leverage ratio covenant. The Company was in compliance with the covenants at

December 31, 2007. The credit facility limits the Company’s ability to incur indebtedness or create or incur liens on its assets.

-62-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 21, 2008 Powered by Morningstar® Document Research℠