Energizer 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 42 ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

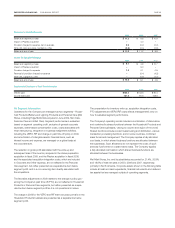

Cash Flow Hedges The Company maintains a number of cash

flow hedging programs, as discussed above, to reduce risks related

to commodity, foreign currency and interest rate risk. Each of these

derivative instruments have a high correlation to the underlying

exposure being hedged and have been deemed highly effective

in offsetting the associated risk.

Derivatives not Designated in Hedging Relationships The

Company holds a share option with a major multinational financial

institution to mitigate the impact of changes in certain of the

Company’s deferred compensation liabilities, which are tied to

the Company’s common stock price. Period activity related to

the share option is classified in the same category in the cash flow

statement as the period activity associated with the Company’s

deferred compensation liability, which was cash flow from operations.

In addition, the Company enters into foreign currency derivative

contracts which are not designated as cash flow hedges for

accounting purposes to hedge existing balance sheet exposures.

Any losses on these contracts would be fully offset by exchange

gains on the underlying exposures, thus they are not subject to

significant market risk.

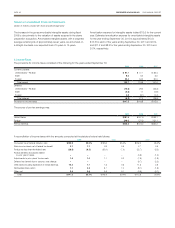

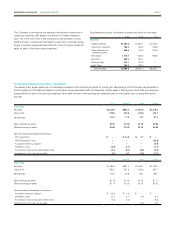

The following table provides fair values, and amounts of gains and

losses on derivative instruments classified as cash flow hedges as

of and for the twelve months ended September 30, 2009.

At September

30, 2009

For Twelve Months Ended

September 30, 2009

Derivatives designated

as Cash Flow Hedging

Relationships

Fair Value

Asset

(Liability)

(1) (2)

Gain/(Loss)

Recognized

in OCI on

Derivative (3)

Gain/(Loss)

Reclassified From

OCI into Income

(Effective Portion)

(4) (5)

Foreign currency contracts $(15.3) $(16.8) $ (1.5)

Commodity contracts (6) 6.1 2.1 (20.6)

Interest rate contracts 3.4 3.4 –

Total $ (5.8) $(11.3) $(22.1)

(1) All derivative assets are presented in other current assets or other assets.

(2) All derivative liabilities are presented in other current liabilities or other liabilities.

(3) OCI is defined as other comprehensive income.

(4) Gain/(Loss) reclassified to Income was recorded as follows: Foreign currency contracts

in other financing, net, commodity contracts in cost of products sold.

(5) Each of these derivative instruments has a high correlation to the underlying exposure being

hedged and has been deemed highly effective in offsetting the associated risk. The ineffective

portion recognized in income was insignificant to the year ended September 30, 2009.

(6) For the year ended September 30, 2009, $13.8 of losses associated with the Company’s settled

commodity contracts were capitalized to inventory. The charge taken to cost of products sold as a

result of inventory being sold was $20.6 for the year ended September 30, 2009.

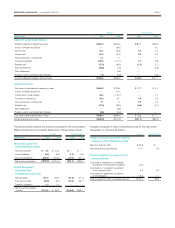

The following table provides fair values, and amounts of gains and

losses on derivative instruments not classified as cash flow hedges

as of and for the twelve months ended September 30, 2009.

Derivatives not designated

as Cash Flow Hedging

Relationships

Fair Value

Asset

(Liability)

For Twelve

Months Ended

September 30,

2009

Gain (Loss)

Recognized

in Income

on Derivative

Income Statement

Classification

Share option $2.0 $(3.0) SG&A

Foreign currency

contracts (1.0) (1.5)

other

financing, net

Total $1.0 $(4.5)

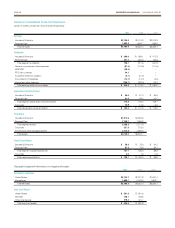

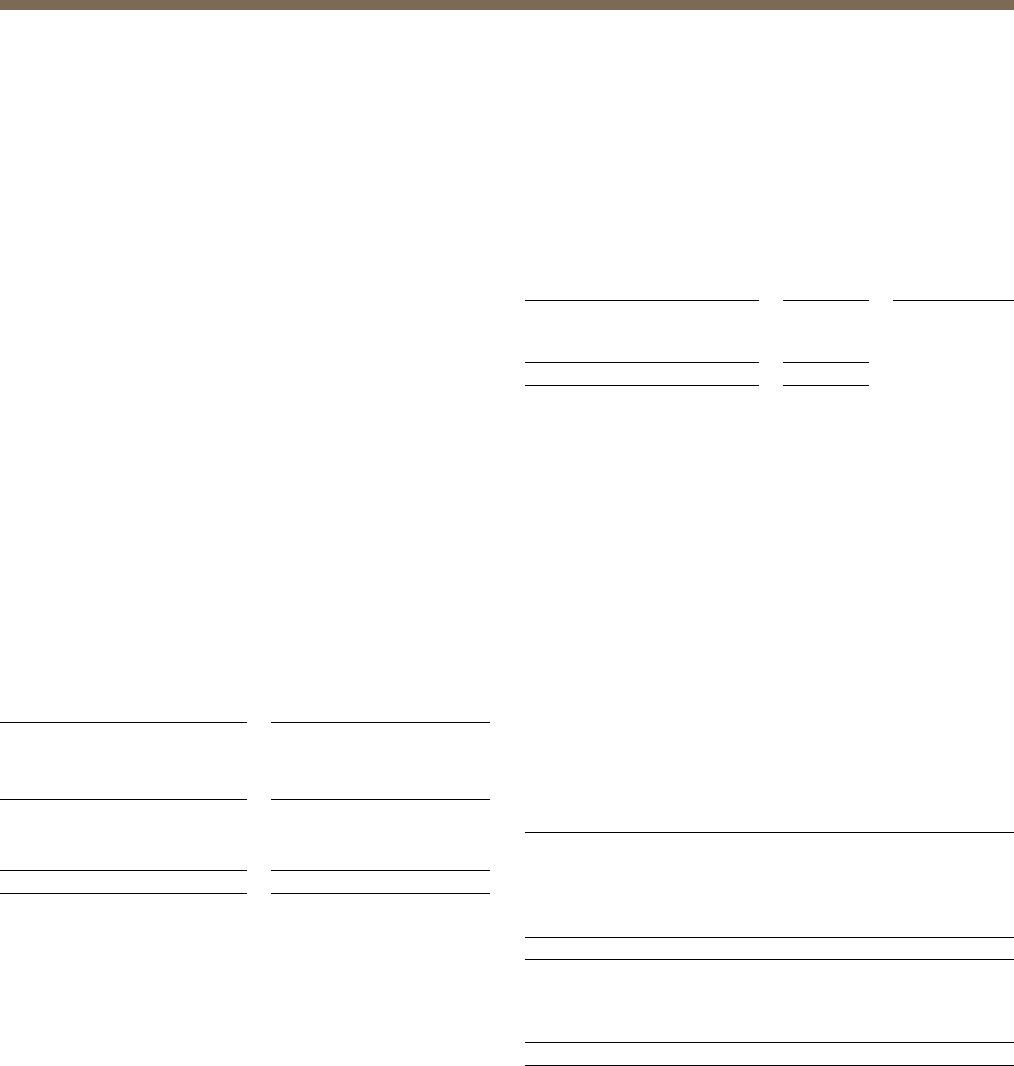

Fair Value Hierarchy New accounting guidance on fair value

measurements for certain financial assets and liabilities requires

that assets and liabilities carried at fair value be classified in one

of the following three categories:

Level 1: Quoted market prices in active markets for identical assets

or liabilities.

Level 2: Observable market based inputs or unobservable inputs

that are corroborated by market data.

Level 3: Unobservable inputs reflecting the reporting entity’s own

assumptions or external inputs from inactive markets.

Under the fair value accounting guidance hierarchy, an entity is required

to maximize the use of quoted market prices and minimize the use

of unobservable inputs. The following table sets forth the Company’s

financial assets and liabilities, which are carried at fair value, as of

September 30, 2009 that are measured on a recurring basis during

the period, segregated by level within the fair value hierarchy:

Level 1 Level 2 Level 3 Total

Assets at fair value:

Share Option $ – $ 2.0 $ – $ 2.0

Derivatives – Interest Rate

Swap

– 3.4 – 3.4

Derivatives – Commodity – 6.1 – 6.1

Total Assets at fair value $ – $ 11.5 $ – $ 11.5

Liabilities at fair value:

Derivatives – Foreign

Exchange $ – $ 16.3 $ – $ 16.3

Deferred Compensation – 124.3 – 124.3

Total Liabilities at fair value $ – $140.6 $ – $140.6