Energizer 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT PAGE 13

The Company’s operating model includes a combination of stand-

alone and combined business functions between Household Products

and Personal Care, varying by country and region of the world. Shared

functions include product warehousing and distribution, various trans-

action processing functions, and, in some countries, a combined sales

force and management. Such allocations do not represent the costs

of such services if performed on a stand-alone basis. The Company

applies a fully allocated cost basis, in which shared business functions

are allocated between the businesses.

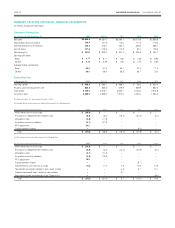

HOUSE HOL D P ROD UCT S

2009 2008 2007

Net sales $2,109.5 $2,474.3 $2,376.3

Segment profit $ 398.6 $ 489.1 $ 472.3

For the year ended September 30, 2009, net sales were $2,109.5,

down $364.8, or 15% including the impact of approximately $144

of unfavorable currency. Absent currency, sales decreased approxi-

mately $220, or 9%, due to lower sales volume across all geographic

areas, but most notably in the U.S. We estimate the premium battery

category declined approximately 9% in fiscal 2009 as consumers

cut spending and retailers reduced inventory levels during the year

in response to the economic downturn. In addition, we estimate that

year over year sales were negatively impacted by approximately $55

of shipments in the prior year related to hurricanes and early holiday

shipments ahead of an announced price increase, which were not

repeated in fiscal 2009.

Segment profit decreased $90.5, including approximately $76 of

unfavorable currency. Excluding the impact of unfavorable currency,

segment profit declined approximately $14 as lower gross margin

from volume declines was significantly offset by reduced spending in

advertising/promotion and overheads, which collectively decreased

approximately $45 as compared to fiscal 2008, and favorable pricing

and product mix.

For the year ended September 30, 2008, sales increased $98.0,

inclusive of approximately $88 of favorable currency versus fiscal 2007.

Absent currency, sales increased $10, as favorable pricing and product

mix were partially offset by lower sales volume. Soft overall category

demand in most of the developed world was nearly offset by fiscal

2008 sales to meet hurricane demand and early holiday season buy-in

within the U.S. and volume growth in Central and Eastern Europe and

Latin America. Overall pricing and price mix was favorable $15.8 as

compared to fiscal 2007 as list price increases taken to offset rising

material costs were partially offset by sales shifting to larger pack sizes,

which sell at lower per unit prices.

Segment profit in fiscal 2008 increased $16.8 but declined approxi-

mately $35 after excluding favorable currency impacts as compared

to fiscal 2007 as the benefit of higher pricing was more than offset by

unfavorable product cost of $63.2 due primarily to higher commodity

material costs and unfavorable production volumes. Excluding

currency impacts, higher SG&A expenses were nearly offset by

lower A&P spending.

Looking forward, we remain cautious regarding consumption in the

battery category as retailer inventory investment remains uncertain, the

speed of the economic recovery, especially as it relates to consumer

spending, is slow and device trends in the battery category remain

difficult to assess given the recent economic downturn.

As noted previously, the significant unfavorable currency environment

in fiscal 2009 coupled with the economic downturn reduced segment

profit in Household Products measurably. In response to these factors,

the Company reduced spending in both advertising and promotion and

overheads, in the short term, to somewhat mitigate the negative impact

of currency and the economy on segment profit. For fiscal 2010, we

expect to return to more historical investment levels for advertising and

promotion and increase funding for other targeted growth initiatives

after a year of aggressive cost containment.

Funding for these efforts will come partially from lower commodities,

raw materials and other input costs, which are estimated to be favor-

able approximately $12 to $14 in 2010 compared to 2009 average

costs based on current market conditions. In addition, we expect

segment profit to be positively impacted by favorable currency as

compared to fiscal 2009 in the range of $40 to $43, net of the impact

of hedging activities, based on current exchange rates.

PE RSO NAL CA RE

2009 2008 2007

Net sales $1,890.3 $1,856.7 $988.8

Segment profit $ 341.1 $ 322.5 $155.5

Net sales for the fiscal year were $1,890.3, an increase of $33.6, or

2%, including the impact of approximately $80 of unfavorable currency.

Excluding the impact of unfavorable currency, sales increased approxi-

mately 6% due to the shave preparation acquisition, which added $57,

or 3%, and higher sales of Wet Shave, Infant Care and Skin Care prod-

ucts partially offset by lower sales of Feminine Care. Wet Shave sales

increased 3%, excluding the acquisition and currency, driven by the

launch of Quattro for Women Trimmer in the second quarter, and higher

disposable and Quattro men’s systems sales, partially offset by ongoing

declines in legacy system products. Infant Care sales increased 7%

driven by Diaper Genie, cups and soothing products. Skin Care sales

increased 4% on higher sales of Wet Ones, and higher sales for sun care

primarily in international markets. Feminine Care sales decreased 2% as

higher sales of Playtex Sport were offset by lower sales of Gentle Glide,

due, in part, to increased competitive activity.

Segment profit for the fiscal year was $341.1, an increase of $18.6 or

6% inclusive of unfavorable currency of approximately $20. Excluding

currency, segment profit grew approximately $39 or 12% due to

incremental Playtex synergies of approximately $32, lower A&P of

approximately $17, and the inclusion of the shave preparation

acquisition, which added $4, partially offset by higher product

costs and unfavorable product mix.