Energizer 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 36 ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT

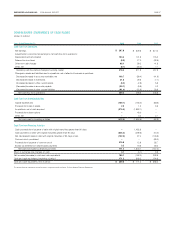

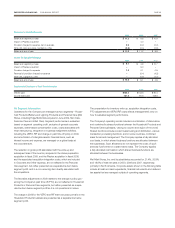

The following table summarizes RSE activity during the current year

(shares in millions):

Shares

Weighted-

Average

Grant Date

Fair Value

Nonvested RSE at October 1, 2008 1.20 $82.24

Granted 0.95 63.20

Vested (0.31) 60.81

Cancelled (0.01) 103.75

Nonvested RSE at September 30, 2009 1.83 $75.95

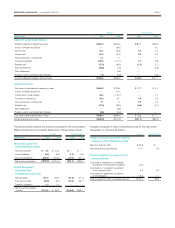

As of September 30, 2009, there was an estimated $34.6 of total

unrecognized compensation costs related to RSE granted to date,

which will be recognized over a weighted-average period of approxi-

mately 1.1 years. The amount recognized will vary as vesting for a

portion of the awards depends on the achievement of the established

CAGR targets. The weighted-average fair value for RSE granted in

2009, 2008 and 2007 was $63.20, $116.08 and $73.68, respectively.

The fair value of RSE vested in 2009, 2008 and 2007 was $18.0,

$10.4 and $9.2, respectively.

In October 2009, the Company granted RSE awards to key employees

which included approximately 266,300 shares that vest ratably over

four years. At the same time, the Company granted two RSE awards

to key senior executives. One grant includes approximately 145,900

shares and vests on the third anniversary of the date of grant. The sec-

ond grant includes approximately 339,700 shares which vests on the

date that the Company publicly releases its earnings for its 2012 fiscal

year contingent upon the Company’s CAGR for the three year period

ending on September 30, 2012. Under the terms of the award, 100%

of the grant vests if a CAGR of at least 12% is achieved, with smaller

percentages vesting if the Company achieves a CAGR between 5%

and 12%. The total award expected to vest will be amortized over the

vesting period.

Other Share-Based Compensation During the quarter ended

December 31, 2005, the Board of Directors approved an award for

officers of the Company. This award totaled 196,800 share equivalents

and had the same features as the restricted stock award granted

to senior executives in October 2006 as discussed above, but was

settled in cash and mandatorily deferred until the individual’s retirement

or other termination of employment. During 2007, 20,000 shares were

forfeited. All remaining 176,800 share equivalents fully vested as of

October 30, 2008 and the Company recorded pre-tax income of

$4.4 in the first quarter of fiscal 2009 to reflect the mark-to-market

for this grant from October 1, 2008 through the October 30, 2008

vesting date.

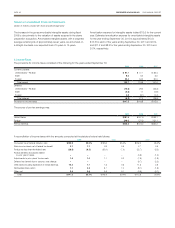

9. Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering

substantially all of its employees in the U.S. and certain employees

in other countries. The plans provide retirement benefits based,

in certain circumstances, on years of service and on earnings.

The Company also sponsors or participates in a number of other

non-U.S. pension arrangements, including various retirement and

termination benefit plans, some of which are required by local law or

coordinated with government-sponsored plans, which are not signifi-

cant in the aggregate and therefore are not included in the information

presented in the following tables.

The Company currently provides other postretirement benefits,

consisting of health care and life insurance benefits for certain groups

of retired employees. Certain retirees are eligible for a fixed subsidy,

provided by the Company, toward their total cost of health care

benefits. Retiree contributions for health care benefits are adjusted

periodically to cover the entire increase in total plan costs. Cost trend

rates no longer materially impact the Company’s future cost of the

plan due to the fixed nature of the subsidy.

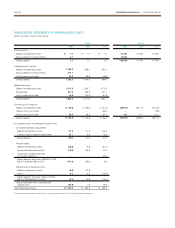

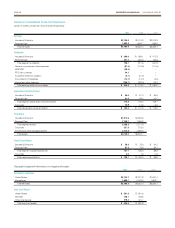

The following tables present the benefit obligation, plan assets

and funded status of the plans:

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)