Energizer 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

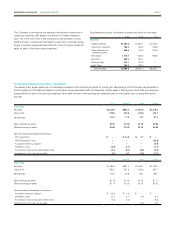

PAGE 40 ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT

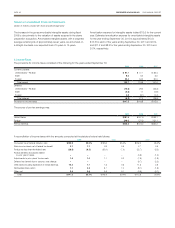

The counterparties to long-term committed borrowings consist of

a number of major international financial institutions. The Company

continually monitors positions with, and credit ratings of, counterparties

both internally and by using outside ratings agencies. The Company

has staggered long-term borrowing maturities through 2017 to reduce

refinancing risk in any single year and to optimize the use of cash flow

for repayment.

Aggregate maturities on long-term debt at September 30, 2009 are as

follows: $101.0 in 2010, $266.0 in 2011, $231.0 in 2012, $701.5 in

2013, $190.0 in 2014 and $900.0 thereafter. At this time, the Company

intends to repay only scheduled debt maturities over the course of the

next fiscal year with the intent to preserve committed liquidity.

12. Preferred Stock

The Company’s Articles of Incorporation authorize the Company to

issue up to 10 million shares of $0.01 par value of preferred stock.

During the three years ended September 30, 2009, there were no

shares of preferred stock outstanding.

13. Shareholders’ Equity

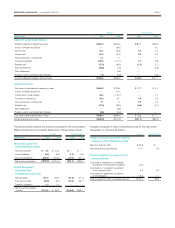

On May 20, 2009, the Company completed the sale of an additional

10.925 million shares of common stock for $49.00 per share. Net

proceeds from the sale of the additional shares were $510.2. The

Company used $275 of the net proceeds to complete the purchase

of the shave preparation brands on June 5, 2009 and used $100 to

repay private placement notes, which matured on June 30, 2009. The

remaining proceeds have contributed significantly to the increase in

cash on hand at September 30, 2009 and the repayment of an addi-

tional $200 of private placement notes on September 30, 2009.

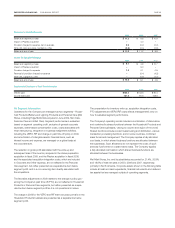

On March 16, 2000, the Board of Directors declared a dividend of

one share purchase right (Right) for each outstanding share of ENR

common stock. Each Right entitles a shareholder of ENR stock to

purchase an additional share of ENR stock at an exercise price of

$150.00, which price is subject to anti-dilution adjustments. Rights,

however, may only be exercised if a person or group has acquired, or

commenced a public tender for 20% or more of the outstanding ENR

stock, unless the acquisition is pursuant to a tender or exchange offer

for all outstanding shares of ENR stock and a majority of the Board of

Directors determines that the price and terms of the offer are adequate

and in the best interests of shareholders (a Permitted Offer). At the time

that 20% or more of the outstanding ENR stock is actually acquired

(other than in connection with a Permitted Offer), the exercise price of

each Right will be adjusted so that the holder (other than the person

or member of the group that made the acquisition) may then purchase

a share of ENR stock at one-third of its then-current market price. If

the Company merges with any other person or group after the Rights

become exercisable, a holder of a Right may purchase, at the exercise

price, common stock of the surviving entity having a value equal to

twice the exercise price. If the Company transfers 50% or more of its

assets or earnings power to any other person or group after the Rights

become exercisable, a holder of a Right may purchase, at the exercise

price, common stock of the acquiring entity having a value equal to

twice the exercise price.

The Company can redeem the Rights at a price of $0.01 per Right at

any time prior to the time a person or group actually acquires 20% or

more of the outstanding ENR stock (other than in connection with a

Permitted Offer). In addition, following the acquisition by a person or

group of at least 20%, but not more than 50% of the outstanding ENR

stock (other than in connection with a Permitted Offer), the Company

may exchange each Right for one share of ENR stock. The Company’s

Board of Directors may amend the terms of the Rights at any time prior

to the time a person or group acquires 20% or more of the outstanding

ENR stock (other than in connection with a Permitted Offer) and may

amend the terms to lower the threshold for exercise of the Rights. If the

threshold is reduced, it cannot be lowered to a percentage that is less

than 10% or, if any shareholder holds 10% or more of the outstanding

ENR stock at that time, the reduced threshold must be greater than

the percentage held by that shareholder. The Rights will expire

on April 1, 2010.

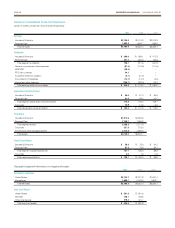

At September 30, 2009, there were 300 million shares of ENR stock

authorized, of which approximately 3.1 million shares were reserved for

issuance under the 2000 Incentive Stock Plan and 0.3 million shares

were reserved for issuance under the 2009 Incentive Stock Plan.

Beginning in September 2000, the Company’s Board of Directors has

approved a series of resolutions authorizing the repurchase of shares

of ENR common stock, with no commitments by the Company to

repurchase such shares. On July 24, 2006, the Board of Directors

approved the repurchase of up to an additional 10 million shares and

8 million shares remain under such authorization as of September 30,

2009. There were no shares repurchased during fiscal year 2009.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)