Energizer 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT PAGE 39

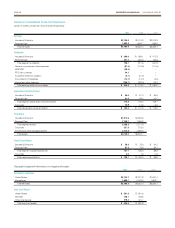

10. Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends

participation eligibility to substantially all U.S. employees. The

Company matches 50% of participants’ before-tax contributions

up to 6% of eligible compensation. In addition, participants can

make after-tax contributions into the plan. The participant’s after-tax

contribution of 1% of eligible compensation is matched with a 325%

Company contribution to the participant’s pension plan account.

Effective January 1, 2010, the Company will no longer match the

1% after tax contribution with a 325% Company contribution to the

participant’s pension plan account. Amounts charged to expense

during fiscal 2009, 2008, and 2007 were $8.1, $8.5, and $5.6,

respectively, and are reflected in SG&A and cost of products sold

in the Consolidated Statements of Earnings. The increase in

expense for 2008 was due primarily to the addition of Playtex.

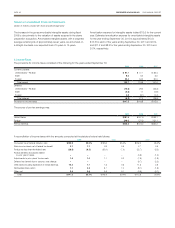

11. Debt

Notes payable at September 30, 2009 and 2008 consisted of notes

payable to financial institutions with original maturities of less than one

year of $169.1 and $264.4, respectively, and had a weighted-average

interest rate of 3.5% and 4.7%, respectively.

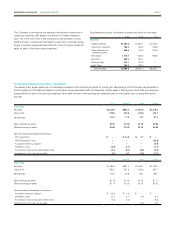

The detail of long-term debt at September 30 for the year indicated is

as follows:

2009 2008

Private Placement, fixed interest rates ranging

from 3.6% to 6.6%, due 2010 to 2017 $1,930.0

$2,230.0

Term Loan, variable interest at LIBOR + 75

basis points, or 1.0%, due 2012 459.5 465.5

Total long-term debt, including current maturities 2,389.5 2,695.5

Less current portion 101.0 106.0

Total long-term debt $2,288.5 $2,589.5

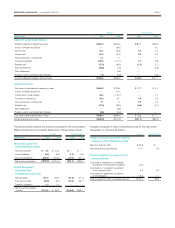

The Company maintains total committed debt facilities of $3,048.6, of

which $477.4 remained available as of September 30, 2009.

During the second quarter of fiscal 2009, the Company entered into

interest rate swap agreements with two major multinational financial

institutions that fixed the variable benchmark component (LIBOR) of

the Company’s interest rate on $300 of the Company’s variable rate

debt through December 2012 at an interest rate of 1.9%.

Under the terms of the Company’s credit agreements, the ratio of the

Company’s indebtedness to its EBITDA, as defined in the agreements,

cannot be greater than 4.00 to 1, and may not remain above 3.50 to

1 for more than four consecutive quarters. If and so long as the ratio

is above 3.50 to 1 for any period, the Company is required to pay

additional interest expense for the period in which the ratio exceeds

3.50 to 1. The interest rate margin and certain fees vary depending

on the indebtedness to EBITDA ratio. Under the Company’s private

placement note agreements, the ratio of indebtedness to EBITDA

may not exceed 4.0 to 1. However, if the ratio is above 3.50 to 1, the

Company is required to pay an additional 75 basis points in interest

for the period in which the ratio exceeds 3.50 to 1. In addition, under

the credit agreements, the ratio of its current year EBIT, as defined

in the agreements, to total interest expense must exceed 3.00 to 1.

The Company’s ratio of indebtedness to its EBITDA was 3.14 to 1,

and the ratio of its EBIT to total interest expense was 4.40 to 1, as of

September 30, 2009. Each of the calculations at September 30, 2009

was pro forma for the shave preparation acquisition. The Company

anticipates that it will remain in compliance with its debt covenants for

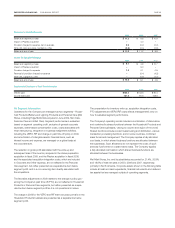

the foreseeable future. The impact on EBITDA resulting from the VERO

and RIF charges in the fourth quarter of 2009 had a negative impact on

the ratio of indebtedness to EBITDA as such charges are not excluded

from the calculation of EBITDA under the terms of the agreements.

The VERO and RIF charges will negatively impact trailing twelve month

EBITDA, which is used in the ratio, through the third quarter of fiscal

2010, after which it will roll out of the calculation. Savings from the

VERO and RIF programs will somewhat mitigate the negative EBITDA

impact of the restructuring charges as they are realized during this time

frame, and will remain a positive impact on the ratio going forward. If

the Company fails to comply with the financial covenants referred to

above or with other requirements of the credit agreements or private

placement note agreements, the lenders would have the right to accel-

erate the maturity of the debt. Acceleration under one of these facilities

would trigger cross defaults on other borrowings.

On May 5, 2009, the Company amended and renewed its existing

receivables securitization program, under which the Company sells

interests in certain accounts receivable, and which provides funding

to the Company of up to $200 with two large financial institutions.

The sales of the receivables are affected through a bankruptcy remote

special purpose subsidiary of the Company, Energizer Receivables

Funding Corporation (ERFC). Funds received under this financ-

ing arrangement are treated as borrowings rather than proceeds

of accounts receivables sold for accounting purposes. However,

borrowings under the program are not considered debt for covenant

compliance purposes under the Company’s credit agreements and

private placement note agreements. The program is subject to renewal

annually on the anniversary date. At September 30, 2009, a total of

$147.5 was outstanding under this financing arrangement.