Energizer 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

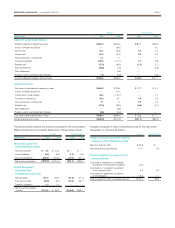

PAGE 34 ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT

In 2009, total pre-tax charges related to the VERO and RIF were $38.6,

which represented employee separation and related costs. Virtually

all of these costs in 2009 were recorded in SG&A expense. We do

not expect any material charges related to this VERO and RIF in fiscal

2010. To date, payments of $5.8 have been made related to the VERO

and RIF. We expect that the majority of the remaining payments of

$32.8 will be made by the end of the second quarter of fiscal 2010.

In the current global recessionary environment, we continue to see

cautious retailer inventory investments and unfavorable device trends,

primarily in developed markets. It remains difficult to determine how

much of the recent category weakness is due to each of these factors

as well as other category and competitive dynamics. The Company

believes this restructuring plan is advisable to reduce the Company’s

overhead cost structure for its Household Products business, right-size

manufacturing and sales operations in light of market conditions and

ensure alignment with its overall investment strategies. The VERO

resulted in the voluntary separation of 289 hourly and 101 salaried U.S.

colleagues and the RIF resulted in the termination of 46 colleagues in

the U.S. and certain foreign affiliates.

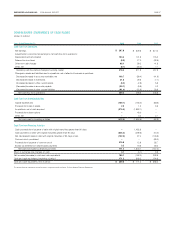

7. Earnings Per Share

For each period presented below, basic earnings per share is based on

the average number of shares outstanding during the period. Diluted

earnings per share is based on the average number of shares used for

the basic earnings per share calculation, adjusted for the dilutive effect

of stock options and restricted stock equivalents.

The following table sets forth the computation of basic and diluted

earnings per share (shares in millions):

For The Years Ended September 30, 2009 2008

2007

Numerator:

Net earnings for basic and

dilutive earnings per share

$297.8

$329.3

$321.4

Denominator:

Weighted-average shares –

basic

62.4

57.6 56.7

Effect of dilutive securities:

Stock options 0.4 0.7 1.0

Restricted stock equivalents 0.3 0.6 0.6

Total dilutive securities 0.7 1.3 1.6

Weighted-average shares –

diluted

63.1

58.9

58.3

Basic net earnings per share $ 4.77 $ 5.71 $ 5.67

Diluted net earnings per share $ 4.72 $ 5.59 $ 5.51

At September 30, 2009, approximately 0.8 million of the Company’s

outstanding restricted stock equivalents were not included in the

diluted net earnings per share calculation because to do so would

have been anti-dilutive. In the event the potentially dilutive securities are

anti-dilutive on net earnings per share (i.e., have the effect of increas-

ing EPS), the impact of the potentially dilutive securities is not included

in the computation. There were approximately 0.4 million anti-dilutive

securities for the year ended September 30, 2008 and no anti-dilutive

securities for the year ended September 30, 2007.

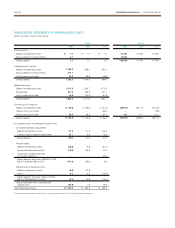

8. Share-Based Payments

The Company’s Incentive Stock Plan was initially adopted by the Board

of Directors in March 2000 and approved by shareholders at the 2001

Annual Meeting of Shareholders. This plan was superseded in Janu-

ary 2009 as the Board of Directors approved a new plan, which was

approved by shareholders at the 2009 Annual Meeting of Sharehold-

ers. New awards granted after January 2009 will be issued under the

recently adopted plan. Under the recently adopted plan, awards of

restricted stock, restricted stock equivalents or options to purchase the

Company’s common stock (ENR stock) may be granted to directors,

officers and key employees. A maximum of 4.0 million shares of ENR

stock was approved to be issued under the recently adopted plan. For

purposes of determining the number of shares available for future issu-

ance under the recently adopted plan, awards of restricted stock and

restricted stock equivalents will reduce the shares available for future

issuance by 1.95 for every one share awarded. Options awarded will

reduce the number of shares available for future issuance on a one

for one basis. At September 30, 2009, there were 3.4 million shares

available for future awards under the recently adopted plan. At

September 30, 2008 and 2007, there were 2.8 million and 3.3 million

shares, respectively, available for future awards under the original plan

adopted in March 2001. Since the original plan has been superseded,

no further shares under this original plan were available for future

awards after the adoption of the recently approved plan.

Options are granted at the market price on the grant date and gener-

ally have vested ratably over three to seven years. These awards

typically have a maximum term of 10 years. Restricted stock and

restricted stock equivalent awards may also be granted. Option shares

and prices, and restricted stock and stock equivalent awards, are

adjusted in conjunction with stock splits and other recapitalizations so

that the holder is in the same economic position before and after these

equity transactions.

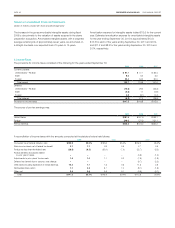

The Company permits deferrals of bonus and salary and for direc-

tors, retainers and fees, under the terms of its Deferred Compensation

Plan. Under this plan, employees or directors deferring amounts into

the Energizer Common Stock Unit Fund are credited with a number

of stock equivalents based on the fair value of ENR stock at the time

of deferral. In addition, the participants are credited with an additional

number of stock equivalents, equal to 25% for employees and 33

1/3% for directors, of the amount deferred. This additional company

match vests immediately for directors and three years from the date

of initial crediting for employees. Amounts deferred into the Energizer

Common Stock Unit Fund, and vested company matching deferrals,

may be transferred to other investment options offered under the plan

after specified restriction periods. At the time of termination of employ-

ment, or for directors, at the time of termination of service on the

Board, or at such other time for distribution, which may be elected in

advance by the participant, the number of equivalents then vested and

credited to the participant’s account is determined and an amount in

cash equal to the fair value of an equivalent number of shares of ENR

stock is paid to the participant. This plan is reflected in Other Liabilities

on the Consolidated Balance Sheets.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)