Energizer 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT PAGE 31

concentration risk within or across the plan asset categories and

disclosure on fair value measurements similar to those required

in the accounting guidance related to Fair Value Measurements.

These disclosures will be applied on a prospective basis beginning

October 1, 2009 for Energizer.

On June 30, 2009, we adopted new accounting guidance on sub-

sequent events. This new guidance is intended to establish general

standards of accounting for and disclosure of events that occur after

the balance sheet date but before financial statements are issued.

This new guidance requires the disclosure of the date through

which an entity has evaluated subsequent events and the basis

for that date. The Company has included this disclosure in Note 1

of the Notes to Consolidated Financial Statements.

On June 30, 2009, we adopted new accounting guidance on interim

disclosures about Fair Value of Financial Instruments. This guidance

requires companies to include disclosures about the fair value of its

financial instruments whenever it issues summarized financial informa-

tion for interim reporting periods. These disclosures include the fair

value of all financial instruments for which it is practicable to estimate

that value and the methods and significant assumptions used to

estimate the fair value of financial instruments. The Company has

included this disclosure in Note 14 of the Notes to Consolidated

Financial Statements.

On September 30, 2009, we adopted new accounting guidance for

the “FASB Accounting Standards Codification” as the single official

source of authoritative, nongovernmental U.S. Generally Accepted

Accounting Principles (GAAP). The Codification is applied to all of

the Notes to Consolidated Financial Statements.

3. Shave Preparation Acquisition

On June 5, 2009, the Company completed its acquisition of the Edge

and Skintimate shave preparation brands (the Acquisition) from S.C.

Johnson & Son, Inc. (SCJ) for $275.0. The Acquisition was funded

with proceeds from the completed common stock offering on May

20, 2009. See Note 13 of the Notes to Consolidated Financial State-

ments for further information. As leading brands in the U.S. men’s

and women’s shave preparation category, Edge and Skintimate are

a logical adjacency to the Company’s existing wet shave business

conducted in the United States (U.S.) under the Schick brand. The

Acquisition consists primarily of intellectual property, finished goods

inventory and equipment directly associated with the manufacture

of the shave preparation products. SCJ will continue to manufacture

product for Energizer under a supply agreement with an initial term of

3 years, with two optional one-year renewals. No SCJ employees are

employed by Energizer and there are no contigent payments, options

or commitments associated with the Acquisition.

We have determined the fair values of assets acquired and liabilities

assumed for purposes of allocating the purchase price, in accordance

with accounting guidance for business combinations. For purposes of

the final allocation, the Company has estimated a fair value adjustment

for inventory based on the estimated selling price of the finished goods

acquired at the closing date less the sum of (a) costs of disposal and

(b) a reasonable profit allowance for the selling effort of the acquiring

entity. The fair value adjustment for the acquired equipment was

established using a cost approach. The fair values of the identifiable

intangible assets were estimated using various valuation methods

including discounted cash flows using both an income and

cost approach.

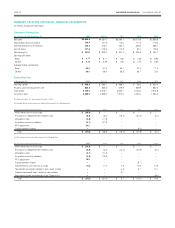

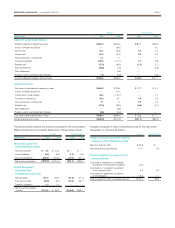

The allocation of the purchase price is as follows:

Inventory $ 12.2

Goodwill 120.9

Other intangible assets 135.0

Property, plant and equipment, net 8.0

Other current liabilities (1.1)

Net assets acquired $275.0

The purchased identifiable intangible assets are as follows:

Total

Amortization

Period

Tradenames/Brands $114.5 indefinite-lived

Patents 11.5 5 years

Customer Relationships 9.0 10 years

Total $135.0

4. Goodwill and Intangible Assets

Goodwill and intangible assets deemed to have an indefinite life are

not amortized, but reviewed annually for impairment of value. The

Company monitors changing business conditions, which may indicate

that the remaining useful life of goodwill and other intangible assets

may warrant revision or carrying amounts may require adjustment. As

part of its business planning cycle, the Company performed its annual

impairment test in the fourth quarter of fiscal 2009, 2008 and 2007.

Impairment testing was performed for each of the Company’s reporting

units: Household Products, Wet Shave and Playtex. No impairments

were identified and no adjustments were deemed necessary.

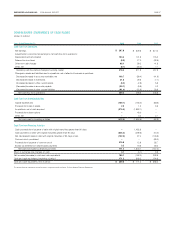

The following table represents the carrying amount of goodwill by

segment at September 30, 2009:

Household

Products

Personal

Care

Total

Balance at October 1, 2008 $38.8 $1,167.6 $1,206.4

Acquisitions – 119.3 119.3

Cumulative translation

adjustment (1.7) 2.2 0.5

Balance at September 30,

2009 $37.1 $1,289.1 $1,326.2

The Company had indefinite-lived trademarks and tradenames of

$1,709.2 at September 30, 2009 and $1,591.0 at September 30, 2008.

Changes in indefinite-lived trademarks and tradenames are due primarily

to the valuation of assets acquired in the shave preparation acquisition and

changes in foreign currency translation.

Total amortizable intangible assets at September 30, 2009 are as follows:

Gross

Carrying

Amount

Accumulated

Amortization

Net

Tradenames $ 11.8 $ (7.9) $ 3.9

Technology and patents 53.4 (24.5) 28.9

Customer-related 64.5 (17.9) 46.6

Total amortizable intangible

assets $129.7 $(50.3) $79.4