Energizer 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT PAGE 15

savings had no impact on the 2008 versus 2007 comparative as the

costs were not included in the Company’s results for either year.

Interest and Other Financing Items Interest expense for 2009

decreased $36.6 due primarily to lower average borrowings. Other

financing items, which includes interest income and foreign exchange

gains and losses from the Company’s worldwide affiliates, were

unfavorable $10.3 for the fiscal year due primarily to exchange losses

incurred as the U.S. dollar based payables for our foreign affiliates were

unfavorably impacted by the rapid and significant strengthening of the

U.S. dollar versus most local currencies during the first fiscal quarter.

Interest expense for fiscal 2008 increased $90.1 on higher average

borrowings resulting from the Playtex acquisition. Other financing

expense was unfavorable $25.2 due primarily to exchange losses in

fiscal 2008 compared to exchange gains in fiscal 2007, and lower

interest income in fiscal 2008 of $8.4 due to lower cash balances as

a result of the Playtex acquisition.

Income Taxes Income taxes, which include federal, state and foreign

taxes, were 33.1%, 30.4% and 26.0% of earnings before income

taxes in 2009, 2008 and 2007, respectively. Income taxes include

the following items which impact the overall tax rate:

■ Adjustments were recorded in each of the three years to revise

previously recorded tax accruals to reflect refinement of estimates

of tax attributes to amounts in filed returns, settlement of tax audits

and other tax adjustments. Such adjustments increased the income

tax provision by $1.5 in 2009 and by $1.1 in 2008 and decreased

the income tax provision by $7.9 in 2007.

■ A tax benefit of $1.4 was recorded in 2009 associated with the

write-up and subsequent sale of inventory acquired in the Edge/

Skintimate shave preparation acquisition. A similar tax benefit of

$11.0 was recorded in 2008 associated with the write-up and

subsequent sale of inventory acquired in the Playtex acquisition.

■ In 2007, $4.3 of tax benefits related to prior years’ losses were

recorded. These benefits related to foreign countries where our

subsidiary subsequently began to generate earnings and could

reasonably expect future profitability sufficient to utilize tax loss

carry-forwards prior to expiration. Improved profitability in Mexico

accounts for the bulk of the benefits recognized.

■ Legislation enacted in Germany in August 2007 reduced the tax rate

applicable to the Company’s subsidiaries in Germany for fiscal 2008

and beyond. Thus, an adjustment of $9.7 was made to reduce

deferred tax liabilities in fiscal 2007.

The Company’s effective tax rate is highly sensitive to country mix, from

which earnings or losses are derived. Declines in earnings in lower tax

rate countries, earnings increases in higher tax rate countries, repatria-

tion of foreign earnings or operating losses in the future could increase

future tax rates. Additionally, adjustments to prior year tax accrual

estimates could increase or decrease future tax provisions.

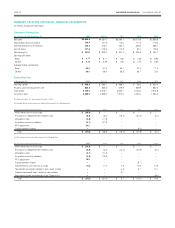

Liquidity and Capital Resources

On May 20, 2009, the Company completed the sale of an additional

10.925 million shares of common stock for $49.00 per share. Net

proceeds from the sale of the additional shares were $510.2. The

Company used $275 of the net proceeds to complete the purchase of

the shave preparation brands on June 5, 2009 and used $100 to repay

private placement notes, which matured on June 30, 2009. The remain-

ing proceeds have contributed significantly to the increase in cash on

hand at September 30, 2009 and the repayment of an additional $200

of private placement notes on September 28, 2009.

Operating Activities Cash flow from operations is the primary funding

source for operating needs and capital investments. Cash flow from

operations was $489.2 in 2009, an increase of $22.7 as compared to

2008. Cash flow from operations was $466.5 in 2008, an increase of

$21.2 as compared to $445.3 for 2007. The increase in cash flow from

operations in 2009 was due primarily to lower assets used in opera-

tions partially offset by lower liabilities. The increase in 2008 was due

to higher cash flow before changes in working capital due primarily to

changes in deferred taxes.

The most significant driver of the higher cash flow from operations

in 2009 was accounts receivable, which was lower by $106.7 at

September 30, 2009, excluding the impact of acquired brands. This

decrease was due to lower net sales as compared to the prior period

and improved accounts receivable aging. This decrease in accounts

receivable coupled with lower inventories on a year over year basis

of $21.8 more than offset a reduction in accounts payable and other

current liabilities, which were collectively lower by $109.5 due primarily

to reduced advertising and promotional accruals resulting from lower

spending and lower accruals for compensation and benefits including

the impact of the change in PTO policy.

Investing Activities Net cash used by investing activities was $412.2,

$1,994.5 and $82.3 in 2009, 2008 and 2007, respectively. Capital

expenditures were $139.7, $160.0 and $88.6 in 2009, 2008 and 2007,

respectively. These expenditures were funded by cash flow from opera-

tions. Capital expenditures increased in 2008 as compared to 2007

due to production related spending and Playtex related spending. See

Note 18 to the Consolidated Financial Statements for capital expendi-

tures by segment. On June 5, 2009, the Company paid $275.0 for the

acquisition of the shave preparation brands. On October 1, 2007, the

first day of fiscal 2008, the Company paid $1,875.7 for the acquisition

of Playtex. See “Financing Activities” below for discussion of the financ-

ing of the Playtex transaction. At September 30, 2007, the Company

held a net-cash settled prepaid share option with a major multinational

financial institution to mitigate the impact of changes in the Company’s

deferred compensation liabilities. In December 2007, the prepaid

feature was removed from the transaction and the Company received

cash of $60.5, which was used to repay existing debt. Of the $60.5

received in fiscal 2008, $46.0 was a return of investment and was clas-

sified within investing activities on the Statement of Cash Flows. The

remaining $14.5 was a return on investment and was classified as a

cash inflow from operating activities on the Statement of Cash Flows.