Energizer 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

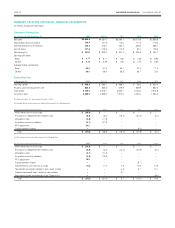

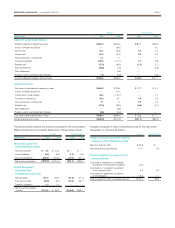

ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT PAGE 29

1. Basis of Presentation

Preparation of the financial statements in conformity with generally

accepted accounting principles in the U.S. (GAAP) requires Energizer

Holdings, Inc. and its subsidiaries (the Company) to make estimates

and assumptions that affect the reported amounts of assets and

liabilities, disclosure of contingent assets and liabilities and the reported

amounts of revenues and expenses. On an ongoing basis, the

Company evaluates its estimates, including those related to customer

programs and incentives, product returns, bad debts, inventories,

intangible and other long-lived assets, income taxes, financing,

pensions and other postretirement benefits, contingencies and

acquisitions. Actual results could differ from those estimates.

The Company has evaluated subsequent events through the date of

this report, November 25, 2009, and has determined that no disclo-

sure is necessary.

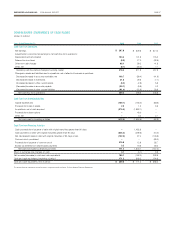

2. Summary of Significant Accounting Policies

The Company’s significant accounting policies, which conform

to GAAP and are applied on a consistent basis among all years

presented, except as indicated, are described below.

Principles of Consolidation The financial statements include the

accounts of the Company and its majority-owned subsidiaries. All

significant intercompany transactions are eliminated. Investments in

affiliated companies, 20% through 50% owned, are accounted for

under the equity method.

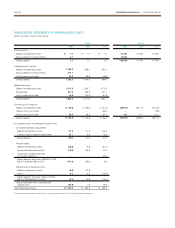

Foreign Currency Translation Financial statements of foreign opera-

tions where the local currency is the functional currency are translated

using end-of-period exchange rates for assets and liabilities, and aver-

age exchange rates during the period for results of operations. Related

translation adjustments are reported as a component within accumu-

lated other comprehensive income in the shareholders’ equity section

of the Consolidated Balance Sheets.

For foreign operations where the U.S. dollar is the functional currency

and for countries that are considered highly inflationary, translation

practices differ in that inventories, properties, accumulated deprecia-

tion and depreciation expense are translated at historical rates of

exchange, and related translation adjustments are included in earnings.

Gains and losses from foreign currency transactions are generally

included in earnings.

We are closely monitoring the inflation rate in one of our Latin

American affiliates to determine if it meets the accounting definition

of highly inflationary due to recent inflation trends. For this affiliate,

we monitor a blended inflation index to measure three year inflation,

which utilizes a government published Consumer Price Index (CPI)

through December 31, 2007 and a more recently developed National

Consumer Price Index (NCPI) beginning in January 2008. The CPI

measurement was a more limited measure, while the NCPI attempts

to capture inflation across the country as a whole. As of July 1, 2009,

the beginning of our current interim reporting period, this country was

not considered highly inflationary. As we do in all cases where inflation

trends indicate the potential for classification as highly inflationary, we

will continue to monitor this Latin American country going forward as

inflation remains a significant issue. It is difficult to determine, what if

any, impact will occur to the financial statements of our affiliate if this

particular country is considered highly inflationary due to the fact that

the official exchange rate versus the U.S. dollar has been fixed for an

extended period.

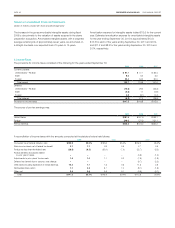

Financial Instruments and Derivative Securities The Company

uses financial instruments, from time to time, in the management

of foreign currency, interest rate and other risks that are inherent to

its business operations. Such instruments are not held or issued for

trading purposes.

Foreign exchange (F/X) instruments, including currency forwards,

purchased options and zero-cost option collars, are used primarily to

reduce transaction exposures and, to a lesser extent, to manage other

translation exposures. F/X instruments used are selected based on

their risk reduction attributes and the related market conditions.

The Company has designated certain foreign currency contracts as

cash flow hedges for accounting purposes as of September 30, 2009.

The Company also holds a contract with an embedded derivative

instrument to mitigate the risk of its deferred compensation liabilities,

as discussed further in Note 14.

The Company uses raw materials that are subject to price volatility. The

Company uses hedging instruments as it desires to reduce exposure

to variability in cash flows associated with future purchases of zinc or

other commodities. For further discussion of such instruments, see

Note 14.

Cash Equivalents For purposes of the Consolidated Statements of

Cash Flows, cash equivalents are all considered to be highly liquid

investments with a maturity of three months or less when purchased.

Accounts Receivable Valuation Accounts receivable are stated at

their net realizable value. The allowance for doubtful accounts reflects

the Company’s best estimate of probable losses inherent in the

receivables portfolio determined on the basis of historical experience,

specific allowances for known troubled accounts and other currently

available information. Bad debt expense is included in selling, general

and administrative (SG&A) expense in the Consolidated Statements

of Earnings.

Inventories Inventories are valued at the lower of cost or market,

with cost generally being determined using average cost or the first-in,

first-out (FIFO) method.

As part of the shave preparation acquisition in 2009 and the Playtex

acquisition in 2008, the Company recorded a fair value adjustment of

$3.7 and $27.5, respectively, to bring the carrying value of the inven-

tory purchased to an amount which approximated the estimated selling

price of the finished goods on hand at the acquisition closing date less

the sum of (a) costs of disposal and (b) a reasonable profit allowance

for the selling effort of the acquiring entity. As the inventory was sold

during the fourth quarter of fiscal 2009 as it relates to the shave prepa-

ration acquisition, and during the first and second quarters of fiscal

2008, as it relates to the Playtex acquisition, the adjustments were

charged to cost of products sold.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)