Energizer 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 38 ENERGIZER HOLDINGS INC. 2009 ANNUAL REPORT

The Company expects to contribute $19.0 to its pension plans

and $2.7 to its postretirement plans in 2010.

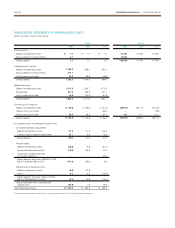

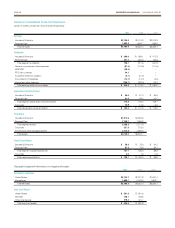

The Company’s expected future benefit payments are as follows:

For The Years Ending September 30, Pension Postretirement

2010 $51.3 $3.3

2011 49.9 3.3

2012 53.7 3.2

2013 58.5 3.1

2014 61.9 3.0

2015 to 2019 372.1 13.8

The accumulated benefit obligation for defined benefit pension plans

was $895.7 and $716.8 at September 30, 2009 and 2008, respec-

tively. In 2009, the accumulated benefit obligation was in excess of

plan assets for the U.S. pension plan resulting in the increase noted on

the following table, which shows pension plans with an accumulated

benefit obligation in excess of plan assets.

September 30, 2009 2008

Projected benefit obligation $833.9 $189.2

Accumulated benefit obligation 807.8 162.9

Fair value of plan assets 596.8 45.8

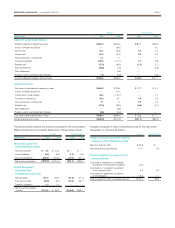

Pension plan assets in the U.S. plan represent 78% of assets in all of

the Company’s defined benefit pension plans. Investment policy for the

U.S. plan includes a mandate to diversify assets and invest in a variety of

asset classes to achieve that goal. The U.S. plan’s assets are currently

invested in several funds representing most standard equity and debt

security classes. The broad target allocations are: (a) equities, includ-

ing U.S. and foreign: 62%, (b) debt securities, U.S. bonds: 35% and (c)

other: 3%. The U.S. plan held no shares of ENR stock at September 30,

2009. Investment objectives are similar for non-U.S. pension arrange-

ments, subject to local regulations.

Amounts expected to be amortized from accumulated other

comprehensive income into net period benefit cost during the year

ending September 30, 2010, are as follows:

Pension Postretirement

Net actuarial (loss)/gain (7.5) 1.5

Prior service credit 6.1 2.5

Initial net obligation (0.2) –

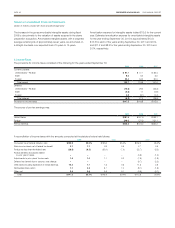

The following table presents assumptions, which reflect weighted-

averages for the component plans, used in determining the above

information:

Pension Postretirement

September 30, 2009 2008 2009 2008

Plan obligations:

Discount rate 5.6% 7.0% 5.9% 7.5%

Compensation increase

rate 3.8% 4.2% 3.5% 3.9%

Net periodic benefit cost:

Discount rate 7.0% 5.9% 7.5% 6.0%

Expected long-term

rate of return on

plan assets 8.0% 8.0% 3.7% 3.7%

Compensation increase

rate 4.2% 4.0% 3.9% 3.5%

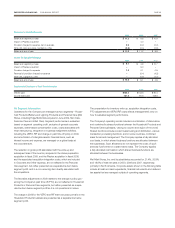

The expected return on plan assets was determined based on historical

and expected future returns of the various asset classes, using the target

allocations described below. Specifically, the expected return on equities

(U.S. and foreign combined) is 9.6%, and the expected return on debt

securities (including higher-quality and lower-quality bonds) is 5.1%.

Effective as of the end of calendar 2009, the pension benefit earned to

date by active participants under the U.S. pension plan will be frozen

and future retirement benefits will accrue to active participants using a

new retirement accumulation formula. Under this new formula, active

participants will earn a retirement benefit equal to 6% per annum of their

pensionable earnings during a calendar year. In addition, an interest

credit will be applied to the benefits earned under this revised formula at

a rate equal to a 30 year U.S. Treasury note. Finally, active participants

that meet certain age and service criteria as of December 31, 2009, will

receive a transitional benefit in addition to the pension credit of 6% per

annum. This transitional benefit will provide an additional pension credit

of 2% to 4% per annum of pensionable earnings plus the applicable

interest credit, through 2014. These changes resulted in a reduction of

our projected benefit obligation of $46.8.

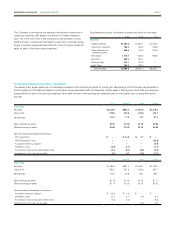

The following table presents pension and postretirement expense:

Pension Postretirement

For The Years Ended September 30, 2009 2008 2007 2009 2008 2007

Service cost $ 31.7 $ 33.9 $ 29.9 $ 0.4 $ 0.4 $0.4

Interest cost 52.4 50.6 41.3 2.6 2.5 2.8

Expected return on plan assets (60.7) (63.3) (53.2) – (0.1) (0.1)

Amortization of unrecognized prior service cost (2.9) (0.6) (1.1) (2.5) (2.1) (2.2)

Amortization of unrecognized transition asset 0.4 0.5 0.4 – – –

Recognized net actuarial loss/(gain) 2.9 3.8 6.9 (1.6) (2.1) (0.3)

Settlement loss recognized 3.2 – – – – –

Net periodic benefit cost $ 27.0 $ 24.9 $ 24.2 $(1.1) $(1.4) $0.6

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)