Energizer 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 3

40 percent of profit. We have a similar geographic balance, with 49 percent of sales and 57 percent of

profits currently generated outside the United States. Global in scope, we maintain commercial and

production operations in 49 countries and sell our products in over 180 countries around the world.

HOUSEHOLD PRODUCTS

The Household Products Division faced significant challenges during the year. In particular, historically high

prices for raw materials including zinc, nickel and manganese ore, which translated into increased costs

totaling approximately $60 million for fiscal 2008. In addition, we experienced lower volumes due primarily

to global economic sluggishness that has impacted battery sales throughout most of the developed world.

These impacts were partially offset with price increases, improved product mix from our performance batter-

ies, controlled promotional spending and cost reductions from our continuous improvement program based

on LEAN concepts. Identifying and eliminating non-value added activities in our battery group, we improved

productivity 45 percent over the last four years – with batteries produced per operations associate climbing

from 1.1 million to 1.5 million. Based on that success, we are continuing to roll out this behavioral philosophy

to other areas of the company.

Today, Energizer is uniquely positioned to meet the growing demand for portable power with the

industry’s most comprehensive portfolio of battery technology – designed to let consumers select the right

battery that not only fits the device but also their lifestyle. Using this broad portfolio, we successfully employ

a trade-up strategy to drive top-line growth. In less developed world markets, we encourage trade-up from

price batteries to premium batteries; in more developed markets, where growth of high-tech devices is

particularly strong, consumers are increasingly trading-up from premium batteries to performance batteries.

This shift is clearly reflected in our sales – performance batteries accounted for 57 percent of the division’s

net sales growth over the last three years and premium batteries generated 34 percent of growth, while less

profitable price batteries declined 8 percent. We have achieved similar success via trade-up in lighting

products, with that business accounting for 11 percent of net sales growth over the same period.

Performance batteries. Sales of performance batteries grew 19 percent last year, driven by our continued

leadership in lithium and rechargeables, which best address the high-drain power needs of high-tech devices.

Sales of lithium batteries continue to grow in excess of 25 percent per year, led by our original Energizer®

Ultimate Lithium, the world’s longest-lasting AA and AAA batteries in high-tech devices – enhanced to now

last up to eight times longer in digital cameras compared to Energizer® Max®*. Employing a new segmented

approach to lithium, we recently launched Energizer® Advanced Lithium as a lower-cost option designed to

introduce consumers to lithium technology and performance.

To meet this accelerating demand, we doubled the production capacity at our Vermont lithium plant

twice since 2004, but have now outgrown that facility. During the year, we began construction of a second

lithium manufacturing site in Singapore, where we have had a production presence for many decades.

*Results vary by camera.

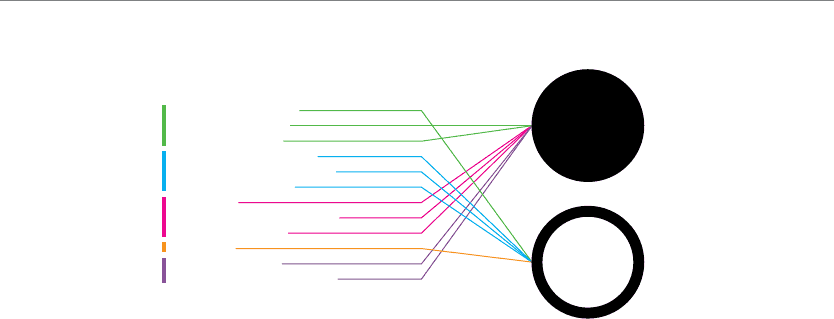

U.S. Market Share Position

Latest 52-week data

Subcategories

Household Batteries

Specialty Batteries

Lighting Products

Men’s Shaving Systems

Women’s Shaving Systems

Disposable Shavers

Sun Care

Hands and Face Towelettes

Household Gloves

Tampons

Bottles and Cups

Disposable Diaper Systems

BATTERIES & LIGHTING

WET SHAVE

SKIN CARE

FEMININE CARE

INFANT CARE 2

1