Energizer 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 11

growth. The category is extremely competitive with competitors vying for

consumer loyalty and retail shelf space.

A significant portion of SWS’s product cost is closely tied to the U.S.

dollar and the euro. As such, SWS results are highly sensitive to fluctua-

tions in other currencies, particularly Japan, where the Company holds a

significant market share position. Strengthening of currencies compared

to the U.S. dollar, and to a lesser extent to the euro, improves margins

while weakening of such currencies reduces margins. This margin impact

coupled with the translation of foreign operating results to the U.S. dollar

for financial reporting purposes has an impact on reported operating

profits. At November 17, 2008 foreign currency exchange rates, we

estimate the impact to segment profit due to currency translation to be

approximately $25 to $30 unfavorable for Personal Care as compared

to the 2008 average currency translation rate. As with the Household

Products business, changes in the value of local currencies in relation to

the U.S. dollar and, to a lesser extent, the euro will continue to impact

reported sales and segment profitability in the future, and the Company

cannot predict the direction or magnitude of future changes.

ACQUISITION OF PLAYTEX PRODUCTS, INC. (PLAYTEX)

On October 1, 2007, the Company paid $1,875.7 for the acquisition

of all outstanding Playtex common stock, repayment or defeasance

of outstanding Playtex debt, and other transaction costs. Playtex

operates six manufacturing and packaging facilities in the U.S. Playtex

is a leading North American manufacturer and marketer in the skin,

feminine and infant care product categories, with a diversified portfolio

of well-recognized branded consumer products.

In Skin Care, Playtex markets and sells sun care products under two

well known brand names, Banana Boat and Hawaiian Tropic. Combin-

ing Banana Boat and Hawaiian Tropic, Playtex holds the number one

dollar market share position in the U.S. sun care category. The sun care

category in the U.S. is segmented by product type such as general

protection, tanning and babies; as well as by method of application

such as lotions and sprays. Playtex competes across this full spectrum

of sun care products. In addition, Playtex owns the number one market

share position in the U.S. hands and face wet wipes category with its

Wet Ones brand and the number one dollar market share position for

branded U.S. household gloves with its Playtex household gloves.

In Feminine Care, Playtex sells tampon products under the brand

names Playtex Gentle Glide and Playtex Sport, both of which are plas-

tic applicator tampons. In the tampon category, consumer purchases

are driven primarily by protection, comfort, quality and value. For more

than 20 years, Playtex has been the second largest selling tampon

brand in the U.S. and maintains a leadership position in the higher

growth plastic applicator segment. The tampon category in the U.S.

has become more competitive in recent years including substantial

new product innovation and increased levels of promotional activity.

The Infant Care product category includes U.S. dollar market share

leading infant feeding products marketed under the Playtex brand

name and the U.S. dollar market share leading diaper disposal system

marketed under the Playtex Diaper Genie brand name. Infant feeding

products include disposable feeding systems, plastic reusable hard

bottles, cups and a full line of mealtime products such as plates,

utensils and placemats. The Diaper Genie brand consists of the diaper

pail unit and refill liners. The refill liner individually seals diapers in an

odor-proof plastic film.

As noted previously, Playtex is primarily a North American business.

The Company intends to leverage its existing international selling and

distribution infrastructure to expand the international presence of cer-

tain Playtex brands, with initial efforts centered on sun care products.

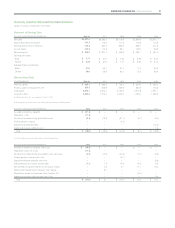

FINANCIAL RESULTS

For the year ended September 30, 2008, net earnings were $329.3, or

$5.59 per diluted share, compared to net earnings of $321.4, or $5.51

per diluted share, in 2007 and net earnings of $260.9, or $4.14 per

diluted share in 2006.

Fiscal 2008 results included:

■ an after-tax expense of $16.5, or $0.28 per diluted share, related

to the write-up and subsequent sale of inventory purchased in the

Playtex acquisition,

■ integration and other realignment costs of $13.4, after-tax, or $0.22

per diluted share, and

■ a net, unfavorable prior year income tax accrual adjustment of $1.1,

or $0.02 per diluted share.

Fiscal 2007 results included:

■ favorable adjustments of $21.9, or $0.37 per diluted share, related

to a reduction of deferred tax balances and prior years’ tax accruals

and previously unrecognized tax benefits from prior years’ foreign

losses, and

■ charges of $12.2, after-tax, or $0.21 per diluted share, for the

company’s European restructuring projects.

Fiscal 2006 results included:

■ charges of $24.9, after-tax, or $0.39 per diluted share, related to

European restructuring programs,

■ a charge of $3.7, after-tax, or $0.06 per diluted share, to record the

cumulative amount of foreign pension costs that should have been

previously recognized, and

■ favorable adjustments to prior years’ tax accruals and previously

unrecognized tax benefits related to foreign losses of $16.6, or

$0.26 per diluted share.

For the fiscal year, the inclusion of Playtex’s results and incremental

interest expense associated with the financing of the acquisition reduced

diluted earnings per share by $0.24, which includes a charge of $0.28

related to the inventory write-up and $0.19 related to acquisition inte-

gration costs. Excluding these one-time costs, Playtex was accretive

to Energizer’s earnings in its first year post-acquisition.