Energizer 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

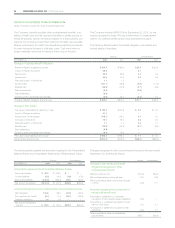

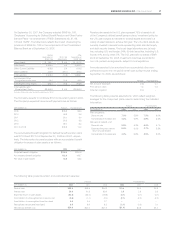

36 ENERGIZER HOLDINGS, INC. 2008 Annual Report

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

The Company currently provides other postretirement benefits, con-

sisting of health care and life insurance benefits for certain groups of

retired employees. Certain retirees are eligible for a fixed subsidy, pro-

vided by the Company, toward their total cost of health care benefits.

Retiree contributions for health care benefits are adjusted periodically

to cover the entire increase in total plan costs. Cost trend rates no

longer materially impact the Company’s future cost of the plan.

The Company adopted SFAS 158 on September 30, 2007, on the

required prospective basis. We use a September 30 measurement

date for our defined benefit pension and postretirement plans.

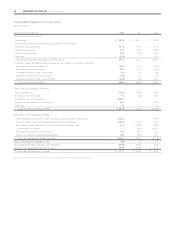

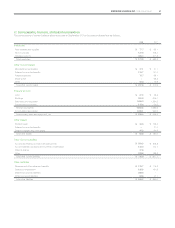

The following tables present the benefit obligation, plan assets and

funded status of the plans:

Pension Postretirement

SEPTEMBER 30, 2008 2007 2008 2007

Change in Projected Benefit Obligation

Benefit obligation at beginning of year $ 815.4 $790.9 $ 35.5 $ 51.6

Impact of Playtex acquisition 69.6 – 8.1 –

Service cost 33.9 29.9 0.4 0.4

Interest cost 50.6 41.3 2.5 2.9

Plan participants' contributions 1.1 1.2 - –

Actuarial gain (107.7) (28.8) (2.9) (17.6)

Benefits paid (48.5) (42.3) (2.7) (2.5)

Plan amendments (2.6) – (2.9) –

Plan settlements (6.8) – – –

Foreign currency exchange rate changes (5.0) 23.2 (0.3) 0.7

Projected Benefit Obligation at end of year $ 800.0 $815.4 $ 37.7 $ 35.5

Change in Plan Assets

Fair value of plan assets at beginning of year $ 795.2 $704.8 $ 2.0 $ 2.4

Impact of Playtex acquisition 61.4 – – –

Actual return on plan assets (118.7) 100.0 0.1 0.1

Company contributions 18.7 18.2 2.3 2.0

Plan participants' contributions 1.1 1.2 4.0 4.1

Benefits paid (48.5) (42.3) (6.7) (6.6)

Plan settlements (6.8) – – –

Foreign currency exchange rate changes (6.4) 13.3 – –

Fair value of plan assets at end of year $ 696.0 $795.2 $ 1.7 $ 2.0

Funded status at end of year $(104.0) $ (20.2) $(36.0) $(33.5)

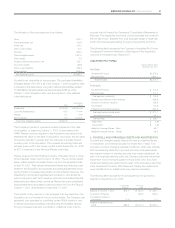

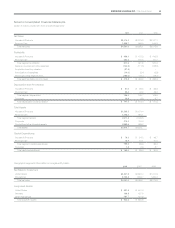

The following table presents the amounts recognized in the Consolidated

Balance Sheets and Consolidated Statements of Shareholders’ Equity.

Pension Postretirement

SEPTEMBER 30, 2008 2007 2008 2007

Amounts Recognized in the Consolidated Balance Sheets

Noncurrent assets $ 42.5 $ 125.2 $ – $ –

Current liabilities (6.5) (6.2) (1.9) (0.9)

Noncurrent liabilities (140.0) (139.2) (34.1) (32.6)

Net amount recognized $(104.0) $ (20.2) $(36.0) $(33.5)

Amounts Recognized in Accumulated Other Comprehensive Income

Net loss/(gain) 106.6 38.2 (27.0) (26.4)

Prior service cost (credit) (9.7) (7.4) (26.7) (25.9)

Transition obligation 1.4 1.8 – –

Net amount recognized,

pre-tax

$ 98.3

$ 32.6

$(53.7) $(52.3)

Changes recognized in other comprehensive income for the year ended

September 30, 2008 are as follows:

Pension Postretirement

Changes in plan assets and benefit

obligations recognized in other

comprehensive income

New prior service cost $ (2.6) $(2.9)

Net loss/(gain) arising during the year 74.3 (2.8)

Effect of exchange rates on amounts included

in AOCI (2.3)

0.1

Amounts recognized as a component of

net periodic benefit cost

Amortization, settlement or curtailment

recognition of net transition asset (obligation) (0.5)

–

Amortization or curtailment recognition of prior

service credit (cost) 0.6 2.1

Amortization or settlement recognition of net

gain/(loss) (3.8) 2.1

Total recognized in other comprehensive

loss/(income) $65.7 $(1.4)