Energizer 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ENERGIZER HOLDINGS, INC. 2008 Annual Report

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

Statement of Financial Accounting Standards (SFAS) No. 141(R),

“Business Combinations”

In December 2007, the FASB issued a revised standard, SFAS

No. 141, “Business Combinations” (SFAS No. 141(R)), which improves

the relevance, representational faithfulness and comparability of the

financial information that is disclosed on business combinations and its

effects. In addition, it revises the method of accounting for a number

of aspects of business combinations including acquisition costs,

contingent liabilities, contingent purchase price and post-acquisition

exit activities of the acquired business. SFAS No. 141(R) is effective

for business combinations entered into in fiscal years beginning on or

after December 15, 2008, which would be as of October 1, 2009 for

Energizer. Early adoption is prohibited. The Company believes that

the adoption of SFAS No. 141(R) will not have a material effect on its

financial position, results of operations or cash flows.

SFAS No.160, “Non-Controlling Interests in Consolidated Financial

Statements - An Amendment to ARB No. 51”

In December 2007, the FASB issued SFAS 160, “Non-Controlling

Interests in Consolidated Financial Statements – An Amendment to

ARB No. 51” (SFAS 160), which improves the relevance, comparabil-

ity and transparency of the financial information that is disclosed for

minority interests. SFAS No. 160 is effective for fiscal years beginning

on or after December 15, 2008, which would be October 1, 2009 for

Energizer. Early adoption is prohibited. The Company believes that the

adoption of SFAS No. 160 will not have a material effect on its financial

position, results of operations or cash flows.

SFAS Standard No. 161, “Disclosures About Derivative Instruments

And Hedging Activities-An Amendment of FASB Statement No. 133”

In March 2008, the FASB issued SFAS No. 161, “Disclosures About

Derivative Instruments And Hedging Activities” (SFAS No. 161). SFAS

No. 161 is intended to help investors better understand how derivative

instruments and hedging activities affect an entity’s financial position,

financial performance and cash flows through enhanced disclosure

requirements. SFAS No. 161 is effective for financial statements issued

for fiscal years and interim periods beginning after November 15, 2008.

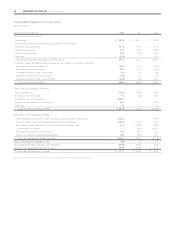

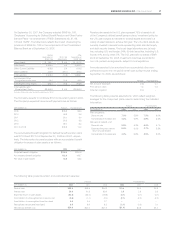

3. PLAYTEX ACQUISITION

On October 1, 2007, the Company acquired all of the issued and

outstanding shares of common stock of Playtex at $18.30 per share

in cash and simultaneously repaid all of Playtex’s outstanding debt as

of that date (the Acquisition) for consideration totaling $1,875.7. The

Company acquired all assets and assumed all liabilities of Playtex.

There are no contingent payments, options or commitments associ-

ated with the Acquisition. In a separate transaction, for consideration

totaling $19.5, the Company acquired certain intangible assets related

to the Wet Ones brand in the United Kingdom. Playtex owns the Wet

Ones trademark in the U.S. and Canada. This is included with the

Acquisition in the presentation of the financial impact of the Acquisition

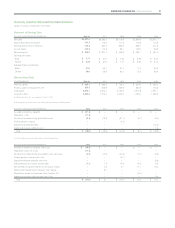

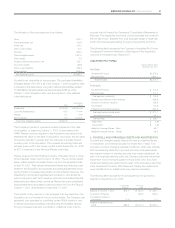

presented below. A summary of consideration paid is as follows:

Short-term borrowings $ 175.0

Long-term borrowings 880.2

Borrowing to repay outstanding Playtex debt 590.9

Total consideration from borrowings 1,646.1

Cash used - gross 261.0

Less: Amount paid for deferred financing fees (7.5)

Less: Amount paid on deposit to collateralize open letters of

credit issued under the terminated Playtex credit agreement (4.4)

Total consideration from available cash 249.1

Total consideration $1,895.2

Playtex is a leading North American manufacturer and marketer in the

Skin, Feminine and Infant Care product categories, with a diversified

portfolio of well-recognized branded consumer products including

Banana Boat, Hawaiian Tropic, Wet Ones, Playtex tampons, Playtex

infant feeding products, Playtex household gloves, and Playtex Diaper

Genie. Playtex operates six facilities in the U.S. The Acquisition will

allow the Company to expand its product portfolio and presence in

the Personal Care business, including achieving economies of scale in

selling and distribution. In addition, the Acquisition further diversifies the

Company’s product portfolio.

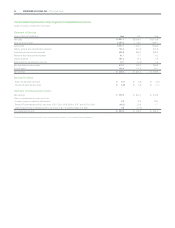

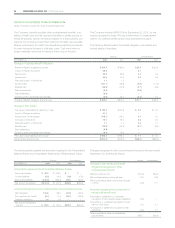

The fair values of assets and liabilities acquired for purposes of allocat-

ing the purchase price were determined in accordance with SFAS

No. 141, “Business Combinations”. The Company estimated a fair

value adjustment for inventory based on the estimated selling price of

finished goods on hand at the closing date less the sum of (a) costs

of disposal and (b) a reasonable profit allowance for the selling effort

of the acquiring entity. The fair value adjustment for Playtex’s property,

plant and equipment was established using a cost approach for the

operating fixed assets and comparable sales and property assessment

data for the valuation of land. The fair values of Playtex’s identifiable

intangible assets were estimated using various valuation methods includ-

ing discounted cash flows using both an income and cost approach.

Estimated deferred income tax impacts as a result of purchase

accounting adjustments are reflected using the best estimate of the

applicable statutory income tax rates.

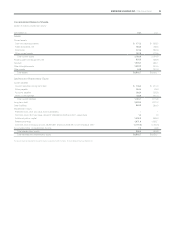

The Company developed an integration plan, pursuant to which the

Company will incur costs related primarily to involuntary severance

costs, exit plans and contractual obligations with no future economic

benefit. The estimates of liabilities assumed were determined in accor-

dance with Emerging Issues Task Force 95-3 “Recognition of Liabilities

in Connection with a Purchase Business Combination” (EITF 95-3).

The Company has combined certain SG&A functions, and is pursuing

purchasing, manufacturing and logistics savings through increased

scale and coordination. The allocation of the purchase price reflects

estimated additional liabilities associated with employee termination

and relocation totaling $35.3, of which $31.0 has been spent as of

September 30, 2008 with the remaining $4.3 classified as a current

liability at September 30, 2008. Additional estimated liabilities assumed

include contract termination and other exit costs totaling $18.5, of

which $8.0 has been spent as of September 30, 2008 with the remain-

ing $8.5 and $2.0 classified as current liabilities and other liabilities,

respectively, at September 30, 2008.