Energizer 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 ENERGIZER HOLDINGS, INC. 2008 Annual Report

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)

Looking forward, similar to Household Products, commodities, raw

materials and other inflationary input costs for Personal Care are

estimated to be unfavorable $35 to $40 in 2009 compared to 2008

average costs based on current market conditions. Pricing actions

already initiated together with manufacturing cost reduction programs

and incremental synergies of approximately $32 from the Playtex

acquisition should more than offset these increases.

Finally, as noted previously, the U.S. dollar has recently strengthened

against most other currencies, which will negatively impact reported

sales and profits in Personal Care. At November 17, 2008 foreign

currency exchange rates, we estimate the impact on segment profit

due to currency translation to be approximately $25 to $30 unfavorable

for Personal Care as compared to the 2008 average currency

translation rate.

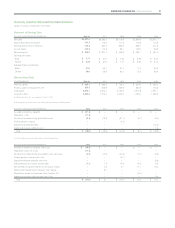

General Corporate and Other Expenses

2008 2007 2006

General Corporate Expenses $ 83.8 $ 93.3 $ 87.0

Integration 17.9 – –

General Corporate Expenses

with Integration 101.7 93.3 87.0

Restructuring and Related

Charges 3.2 18.2 37.4

Foreign Pension Charge –– 4.5

General Corporate and Other

Expenses $104.9 $111.5 $128.9

% of total net sales 2.4% 3.3% 4.2%

General Corporate and Other Expenses For the year, general

corporate expenses, including integration costs increased $8.4,

as $17.9 of Playtex integration costs were partially offset by lower

compensation expenses. The Company estimates that approximately

$14 of favorable synergies were achieved at, or shortly after, the

acquisition date via a reduction of Playtex corporate expenses includ-

ing executive and stock related compensation and public company

costs. However, the savings had no impact on the year over year

comparative as the costs were not included in the Company’s current

year or historical results. The Playtex integration efforts will continue

into 2009, but integration costs are expected to be much lower than

in 2008. Fiscal 2008, 2007 and 2006 included $3.2, $18.2 and $37.4,

respectively, of restructuring and realignment costs associated with a

project to improve the effectiveness and reduce costs of the Compa-

ny’s European packaging, warehousing and distribution activities.

General corporate expenses increased in 2007 compared to 2006 due

to higher stock-based compensation, partially offset by lower project

related costs.

See Note 6 to the Consolidated Financial Statements for further infor-

mation on restructuring activities.

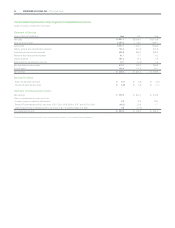

Interest and Other Financing Items Interest expense for the fiscal

year increased $90.1 on higher average borrowings resulting from

the Playtex acquisition. Other financing items, which includes interest

income and foreign exchange gains and losses from the Company’s

worldwide affiliates, were unfavorable $25.2 for the fiscal year due

primarily to exchange losses in the current period compared to

exchange gains last year and lower interest income of $8.4. These

exchange losses were offset by currency gains in segment profit.

Interest expense increased $13.3 in 2007 as compared to 2006 due

to higher average borrowings resulting from share repurchases and

higher interest rates. Other financing expense was favorable $15.8 in

2007 compared to 2006, due to higher interest income of $11.0 and

currency exchange gains in 2007 compared to currency exchange

losses in 2006.

Income Taxes Income taxes, which include federal, state and foreign

taxes, were 30.4%, 26.0% and 26.8% of earnings before income taxes

in 2008, 2007 and 2006, respectively. Income taxes include the follow-

ing items which impact the overall tax rate:

■ Adjustments were recorded in each of the three years to revise

previously recorded tax accruals to reflect refinement of estimates

of tax attributes to amounts in filed returns, settlement of tax audits

and certain other tax adjustments in a number of jurisdictions. Such

adjustments increased the income tax provision by $1.1 in 2008

and decreased the income tax provision by $7.9 and $10.9 in 2007

and 2006, respectively.

■ A tax benefit of $11.0 was recorded in 2008 associated with the

write-up and subsequent sale of inventory acquired in the Playtex

acquisition.

■ In 2007 and 2006, $4.3 and $5.7, respectively, of tax benefits

related to prior years’ losses were recorded. These benefits related

to foreign countries where our subsidiary subsequently began to

generate earnings and could reasonably expect future profitability

sufficient to utilize tax loss carry-forwards prior to expiration.

Improved profitability in Mexico in 2007 and 2006 account for

the bulk of the benefits recognized.

■ Legislation enacted in Germany in August 2007 reduced the tax rate

applicable to the Company’s subsidiaries in Germany for fiscal 2008

and beyond. Thus, an adjustment of $9.7 was made to reduce

deferred tax liabilities in fiscal 2007.

Excluding the items discussed above, the income tax percentage was

30.9% in 2008, 31.0% in 2007 and 31.5% in 2006.

The Company’s effective tax rate is highly sensitive to country mix, from

which earnings or losses are derived. Declines in earnings in lower tax

rate countries, earnings increases in higher tax rate countries, increas-

es in repatriation of foreign earnings or operating losses in the future

could increase future tax rates. Additionally, adjustments to prior year

tax accrual estimates could increase or decrease future tax provisions.

LIQUIDITY AND CAPITAL RESOURCES

Operating Activities Cash flow from operations is the primary funding

source for operating needs and capital investments. Cash flow from

operations was $466.5 in 2008, an increase of $21.2 from 2007. Cash

flow from operations was $445.3 in 2007, an increase of $72.3 from

2006. Each of these year over year changes was due to improved

operating cash flow before changes in working capital.