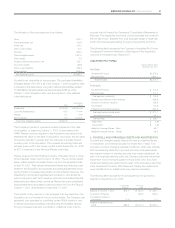

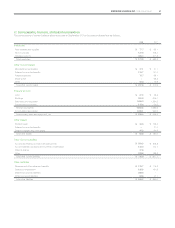

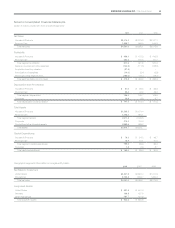

Energizer 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 ENERGIZER HOLDINGS, INC. 2008 Annual Report

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

of $28.2 which represented employee severance, contract termina-

tions and other exit costs, as well as $9.2 for other costs related to the

project. In 2006, $8.0 of these costs were reflected in cost of products

sold and $29.4 in SG&A expense. The remaining exit cost liability for

these projects at September 30, 2008 is immaterial.

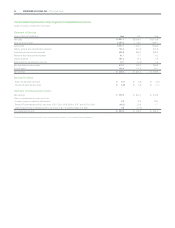

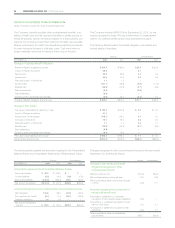

7. EARNINGS PER SHARE

For each period presented below, basic earnings per share is based on

the average number of shares outstanding during the period. Diluted

earnings per share is based on the average number of shares used for

the basic earnings per share calculation, adjusted for the dilutive effect

of stock options and restricted stock equivalents.

The following table sets forth the computation of basic and diluted

earnings per share (shares in millions):

FOR THE YEARS ENDED

SEPTEMBER 30, 2008

2007 2006

Numerator:

Net earnings for basic and

dilutive earnings per share

$329.3

$321.4

$260.9

Denominator:

Weighted-average shares –

basic

57.6 56.7

61.2

Effect of dilutive securities:

Stock options 0.7 1.0 1.4

Restricted stock equivalents 0.6 0.6 0.5

Total dilutive securities 1.3 1.6 1.9

Weighted-average shares –

diluted

58.9

58.3

63.1

Basic net earnings per share $ 5.71 $ 5.67 $ 4.26

Diluted net earnings per share $ 5.59 $ 5.51 $ 4.14

At September 30, 2008, approximately 0.4 million of the Company’s

outstanding restricted stock equivalents were not included in the

diluted net earnings per share calculation because to do so would

have been anti-dilutive. In the event the potentially dilutive securities are

anti-dilutive on net earnings per share (i.e., have the effect of increas-

ing EPS), the impact of the potentially dilutive securities is not included

in the computation. There were no anti-dilutive securities for the years

ended September 30, 2007 or 2006.

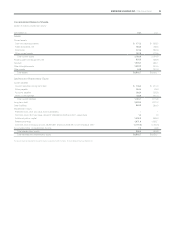

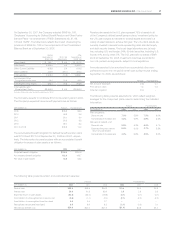

8. SHARE-BASED PAYMENTS

The Company’s 2000 Incentive Stock Plan (the Plan) was adopted by

the Board of Directors in March 2000 and approved by shareholders,

with respect to future awards, which may be granted under the Plan, at

the 2001 Annual Meeting of Shareholders. Under the Plan, awards of

restricted stock, restricted stock equivalents or options to purchase the

Company’s common stock (ENR stock) may be granted to directors,

officers and key employees. A maximum of 15.0 million shares of ENR

stock was approved to be issued under the Plan. At September 30,

2008, 2007 and 2006, respectively, there were 2.8 million, 3.3 million

and 3.7 million shares available for future awards.

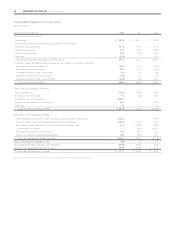

Options under the Plan have been granted at the market price on the

grant date and generally vest ratably over four to seven years. These

awards have a maximum term of 10 years. Restricted stock and

restricted stock equivalent awards may also be granted under the Plan.

Under the terms of the Plan, option shares and prices, and restricted

stock and stock equivalent awards, are adjusted in conjunction with

stock splits and other recapitalizations so that the holder is in the same

economic position before and after these equity transactions.

The Company permits deferrals of bonus and salary and for directors,

retainers and fees, under the terms of its Deferred Compensation Plan.

Under this plan, employees or directors deferring amounts into the

Energizer Common Stock Unit Fund are credited with a number of

stock equivalents based on the fair value of ENR stock at the time of

deferral. In addition, the participants are credited with an additional

number of stock equivalents, equal to 25% for employees and 33 1/3%

for directors, of the amount deferred. This additional company match

vests immediately for directors and three years from the date of initial

crediting for employees. Amounts deferred into the Energizer Com-

mon Stock Unit Fund, and vested company matching deferrals, may

be transferred to other investment options offered under the plan after

specified restriction periods. At the time of termination of employment,

or for directors, at the time of termination of service on the Board, or

at such other time for distribution which may be elected in advance by

the participant, the number of equivalents then vested and credited to

the participant’s account is determined and then an amount in cash

equal to the fair value of an equivalent number of shares of ENR stock

is paid to the participant. This plan is reflected in Other Liabilities on the

Consolidated Balance Sheet.

The Company uses the straight-line method of recognizing compen-

sation cost. Total compensation cost charged against income for the

Company’s share-based compensation arrangements was $26.4,

$25.3 and $16.0 for the years ended September 30, 2008, 2007 and

2006, respectively, and was recorded in SG&A expense. The total

income tax benefit recognized in the Consolidated Statements of

Earnings for share-based compensation arrangements was $9.6, $9.2

and $5.9 for the years ended September 30, 2008, 2007 and 2006,

respectively. Restricted stock issuance and shares issued for stock

option exercises under the Company’s share-based compensation

program are generally issued from treasury shares.

Options As of September 30, 2008, the aggregate intrinsic value of

stock options outstanding and stock options exercisable was $77.5

and $74.0, respectively. The aggregate intrinsic value of stock options

exercised for the years ended September 30, 2008, 2007 and 2006

was $36.7, $107.8 and $34.0, respectively. When valuing new grants,

Energizer uses an implied volatility, which reflects the expected volatility

for a period equal to the expected life of the option. No new option

awards were granted in the years ended September 30, 2008,

2007 and 2006.

As of September 30, 2008, there was no unrecognized compensation

costs related to stock options granted. For outstanding nonqualified

stock options, the weighted average remaining contractual life is

3.8 years.