Energizer 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 ENERGIZER HOLDINGS, INC. 2008 Annual Report

ENERGIZER TRANSFORMED

Energizer continues to evolve, growing from a $1.7 billion battery company to a $4.3 billion diversified

consumer products company with the acquisition of SWS in 2003 and Playtex in 2007. Our diluted earnings

per share has climbed from $1.88 in fiscal 2000 to $5.59 in fiscal 2008. Where we operated in a single

category, we now compete in five major product categories – and within those categories, we hold the

No. 1 or No. 2 U.S. market share position in 12 distinct sub-categories. Comprised of strong brands and

competitive market positions, our businesses share similar customers and distribution channels.

Energizer has been dramatically and materially transformed – since our 2000 spin-off, as well as from

just 12 months ago. Today, our two-division organizational structure gives us a new, more efficient platform

for growth and enables us to focus on exploring and executing innovations across more categories than

ever before.

INTEGRATION OF PLAYTEX

Playtex Products became part of Energizer on October 1, 2007, and throughout the fiscal year, we worked

diligently to forge the new Personal Care Division, effectively bringing together the SWS and Playtex

organizations. During the year, we integrated various Playtex corporate functions including information

technology, human resources, accounting and legal, eliminating duplicate activities and reducing overall

headcount. In addition, we consolidated sales and sales support under a Personal Care sales force

structure, moving the new group into a common office facility, and grafted Playtex’s order-to-cash, logistics

and distribution activities onto the Energizer Holdings platform. By fiscal 2008 year-end, the integration was

substantially complete, and we achieved synergies of approximately $14 million, net of integration costs,

for the year. We estimate that we will realize $57 million of synergies in fiscal 2009 and ultimately expect to

achieve approximately $70 million annually.

Much more than simply a cost-cutting exercise, the integrated organization gives us a greater footprint

in customers’ stores and consumers’ homes, plus opportunities to improve our go-to-market efficiencies

and effectiveness. The combined Personal Care business has achieved critical mass in North America,

going from just over $400 million in sales to more than $1.1 billion, while delivering significant economies of

scale. And with over 90 percent of Playtex sales generated in North America, we remain enthusiastic about

opportunities to strategically expand the Playtex product line internationally through our existing global

distribution and commercial structure.

OPERATIONAL PERFORMANCE

The Household Products Division, consisting of our battery and lighting products businesses, accounted for

57 percent of company sales and 60 percent of profits in fiscal 2008. The Personal Care Division, including

our wet shave, skin care, feminine care and infant care segments, contributed 43 percent of sales and

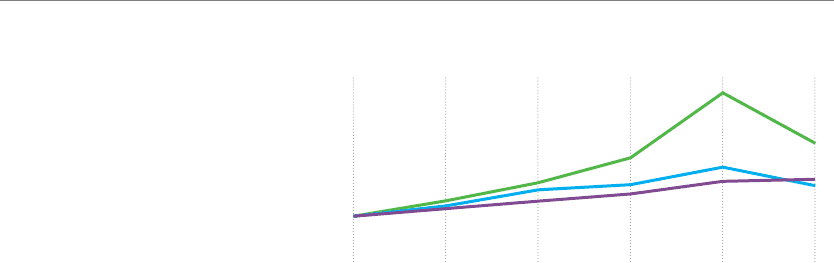

Stock Price Performance

Comparison of Cumulative Total Return on

$100 invested in Energizer Holdings, Inc. on

September 30, 2003, versus the S&P 400

and the S&P Household Products indices

through September 30, 2008, including

reinvestment of dividends.

Energizer Holdings, Inc.

S&P MidCap 400

S&P Household Products

$400

$300

$200

$100

$0

SEP 03 SEP 04 SEP 05 SEP 06 SEP 07 SEP 08