Energizer 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 29

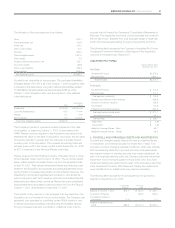

Goodwill and Other Intangible Assets Goodwill and indefinite-lived

intangibles are not amortized, but are evaluated annually for impair-

ment as part of the Company’s annual business planning cycle in

the fourth quarter. The fair value of each reporting unit is estimated

using valuation techniques such as Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA) multiples and discounted cash

flows. Intangible assets with finite lives, and a remaining weighted aver-

age life of approximately seven years, are amortized on a straight-line

basis over expected lives of 18 months to 15 years. Such intangibles

are also evaluated for impairment including on-going monitoring of

potential impairment indicators.

Impairment of Long-Lived Assets The Company reviews long-lived

assets, other than goodwill and other intangible assets for impairment,

when events or changes in business circumstances indicate that the

remaining useful life may warrant revision or that the carrying amount

of the long-lived asset may not be fully recoverable. The Company

performs undiscounted cash flow analyses to determine if impairment

exists. If impairment is determined to exist, any related impairment

loss is calculated based on fair value. Impairment losses on assets

to be disposed of, if any, are based on the estimated proceeds to be

received, less cost of disposal.

Revenue Recognition The Company’s revenue is from the sale of its

products. Revenue is recognized when title, ownership and risk of loss

pass to the customer. Discounts are offered to customers for early pay-

ment and an estimate of such discounts is recorded as a reduction of

net sales in the same period as the sale. Our standard sales terms are

final and returns or exchanges are not permitted unless a special excep-

tion is made; reserves are established and recorded in cases where the

right of return does exist for a particular sale. Under certain circum-

stances, we authorize customers to return Sun Care products that

have not been sold by the end of the sun care season, which is normal

practice in the sun care industry. We record sun care sales at the time

the products are shipped and title transfers. Simultaneously with the time

of the shipment, we reduce sun care sales and cost of sales, and record

an accrued liability on our Consolidated Balance Sheet for anticipated

returns based upon an estimated return level. Customers are required to

pay for the sun care product purchased under the required terms. Due

to the seasonal nature of sun care, we offer a limited extension of terms

to certain qualified customers. This limited extension requires substantial

cash payments prior to or during the sun care season. We generally

receive returns of our U.S. Sun Care products from September through

January following the summer sun care season.

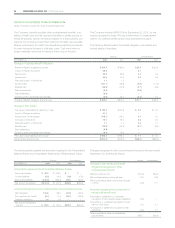

The Company offers a variety of programs, primarily to its retail

customers, designed to promote sales of its products. Such programs

require periodic payments and allowances based on estimated results

of specific programs and are recorded as a reduction to net sales. The

Company accrues, at the time of sale, the estimated total payments

and allowances associated with each transaction. Additionally, the

Company offers programs directly to consumers to promote the sale

of its products. Promotions which reduce the ultimate consumer

sale prices are recorded as a reduction of net sales at the time the

promotional offer is made, generally using estimated redemption and

participation levels. Taxes we collect on behalf of governmental

authorities, which are generally included in the price to the customer,

are also recorded as a reduction of net sales. The Company continually

assesses the adequacy of accruals for customer and consumer

promotional program costs not yet paid. To the extent total program

payments differ from estimates, adjustments may be necessary.

Historically, these adjustments have not been material.

Advertising and Promotion Costs The Company advertises and pro-

motes its products through national and regional media and expenses

such activities in the year incurred.

Reclassifications Certain reclassifications have been made to the

prior year financial statements to conform to the current presentation.

Recently Issued Accounting Pronouncements Other than as

described below, no new accounting pronouncement issued or effec-

tive during the fiscal year has had or is expected to have a material

impact on the consolidated financial statements.

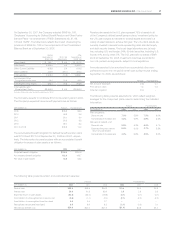

Adoption of FIN 48, “Accounting for Uncertainty in Income Taxes – An

Interpretation of FASB Statement No. 109”

On October 1, 2007, the Company adopted Financial Accounting

Standards Board (FASB) Interpretation No. 48, “Accounting for Uncer-

tainty in Income Taxes – an Interpretation of FASB Statement No. 109”

(FIN 48). FIN 48 addresses the accounting and disclosure of uncertain

tax positions. FIN 48 prescribes a recognition threshold and measure-

ment attributes for the financial statement recognition and measurement

of a tax position taken or expected to be taken in a tax return. The differ-

ence between the tax benefit recognized in the financial statements for

a position in accordance with FIN 48 and the tax benefit claimed in the

tax return is referred to as an unrecognized tax benefit.

At October 1, 2007, the adoption date, the Company had $34.5 of

unrecognized tax benefits in the financial statements exclusive of the

Playtex acquisition. Of this amount, the change to the October 1, 2007

balance sheet resulting from the cumulative effect of the change in

accounting principle was immaterial. Included in the unrecognized tax

benefits at September 30, 2008 is $43.5 of uncertain tax positions

that would affect the Company’s effective tax rate, if recognized. The

Company does not expect any significant increases or decreases to

the unrecognized tax benefits within the next twelve months of this

reporting date. Unrecognized tax benefits are classified as other

liabilities (non-current) to the extent that payment is not anticipated

within one year.

Prior to the adoption of FIN 48, only interest expense on underpay-

ments of income taxes was included in the income tax provision.

Penalties were classified as an operating expense in arriving at pre-tax

income. Upon adoption of FIN 48, the Company elected a new

accounting policy, as permitted by FIN 48, to also classify accrued

penalties related to unrecognized tax benefits in the income tax provi-

sion. The Company has accrued approximately $5.8 of interest and

$0.7 in penalties in the income tax provision. Interest was computed

on the difference between the tax position recognized in accordance

with FIN 48 and the amount previously taken or expected to be taken

in the Company’s tax returns.