Energizer 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 ENERGIZER HOLDINGS, INC. 2008 Annual Report

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

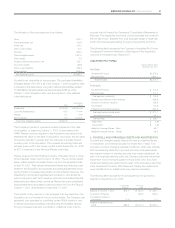

The expected return on plan assets was determined based on historical

and expected future returns of the various asset classes, using the target

allocations described below. Specifically, the expected return on equities

(U.S. and foreign combined) is 9.5%, and the expected return on debt

securities (including higher-quality and lower-quality bonds) is 5.5%.

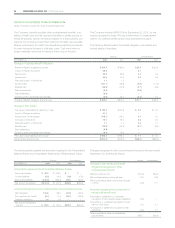

10. DEFINED CONTRIBUTION PLAN

The Company sponsors a defined contribution plan, which extends

participation eligibility to substantially all U.S. employees. The Com-

pany matches 50% of participants’ before-tax contributions up to 6%

of eligible compensation. In addition, participants can make after-tax

contributions into the plan. The participant’s after-tax contribution of

1% of eligible compensation is matched with a 325% Company contri-

bution to the participant’s pension plan account. Amounts charged to

expense during fiscal 2008, 2007 and 2006 were $8.5, $5.6 and $5.4,

respectively, and are reflected in SG&A and cost of products sold in

the Consolidated Statements of Earnings. The increase in expense for

2008 was due primarily to the addition of Playtex.

11. DEBT

Notes payable at September 30, 2008 and 2007 consisted of notes

payable to financial institutions with original maturities of less than one

year of $264.4 and $43.0, respectively, and had a weighted-average

interest rate of 4.7% and 6.7%, respectively.

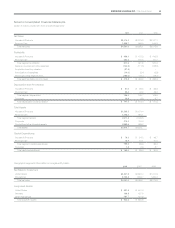

The detail of long-term debt at September 30 for the year indicated is

as follows:

2008 2007

Private Placement, fixed interest rates ranging

from 4.2% to 7.3%, due 2009 to 2017

$2,230.0 $1,475.0

Term Loan, variable interest at LIBOR + 100

basis points, or 5.05%, due 2012 465.5

–

Singapore Bank Syndication, multi-currency

facility, variable interest at LIBOR + 80 basis

points, or 4.85%, due 2010

– 107.0

Total long-term debt, including current maturities 2,695.5 1,582.0

Less current portion 106.0 210.0

Total long-term debt $2,589.5 $1,372.0

The Company maintains total committed debt facilities of $3,449.9, of

which $479.0 remained available as of September 30, 2008.

Under the terms of the Company’s debt facilities, the ratio of the

Company’s indebtedness to its EBITDA cannot be greater than 4.00 to

1, and may not remain above 3.50 to 1 for more than four consecutive

quarters. If the ratio is above 3.50 to 1, the Company is required to pay

an additional 75 basis points in interest for the period in which the ratio

exceeded 3.50 to 1. In addition, the ratio of its current year Earnings

Before Interest and Taxes (EBIT) to total interest expense must exceed

3.00 to 1. The Company’s ratio of indebtedness to its pro forma

EBITDA, as defined in the agreements, was 3.25 to 1, and the ratio of

its pro forma EBIT, as defined in the agreements, to total interest

expense was 3.91 to 1 as of September 30, 2008. As a result of the

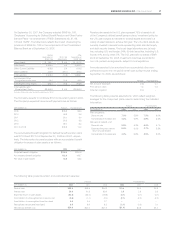

ratio of indebtedness to pro forma EBITDA during fiscal 2008, which

was above 3.50 to 1 for the period from January 1, 2008 through

September 30, 2008, at which time the ratio reduced to 3.25 to 1, the

Company had higher pre-tax interest expense on fixed borrowings of

approximately $13.0 for the current year. Failure to comply with the

above ratios or other covenants could result in acceleration of maturity,

which could trigger cross defaults on other borrowings. The Company

believes that covenant violations, which may result in acceleration

of maturity, are unlikely. The Company’s fixed rate debt is callable by

the Company, subject to a “make whole” premium, which would be

required to the extent the underlying benchmark U.S. treasury yield has

declined since issuance.

The Company routinely sells a pool of U.S. accounts receivable through

a financing arrangement between Energizer Receivables Funding

Corporation (the SPE), which is a bankruptcy-remote special purpose

entity subsidiary of the Company, and outside parties (the Conduits).

Under the current structure, funds received from the Conduit are

treated as borrowings rather than proceeds of accounts receivables

sold for accounting purposes. Borrowings under this program receive

favorable treatment in the Company’s debt compliance covenants. The

program renews annually in May. Further deterioration in credit markets

could result in an inability to renew the program or renewal on less

favorable terms, which may negatively impact compliance reported

Debt-to-EBITDA and may require the Company to draw on other

available committed debt facilities.

The counterparties to long-term committed borrowings consist of

a number of major international financial institutions. The Company

continually monitors positions with, and credit ratings of, counterparties

both internally and by using outside ratings agencies. The Company

has staggered long-term borrowing maturities through 2017 to mini-

mize refinancing risk in any single year and to optimize the use of free

cash flow for repayment.

Aggregate maturities on long-term debt at September 30, 2008 are as

follows: $106.0 in 2009, $301.0 in 2010, $266.0 in 2011, $231.0 in

2012, $701.5 in 2013 and $1,090.0 thereafter.

12. PREFERRED STOCK

The Company’s Articles of Incorporation authorize the Company to

issue up to 10 million shares of $0.01 par value of preferred stock.

During the three years ended September 30, 2008, there were no

shares of preferred stock outstanding.

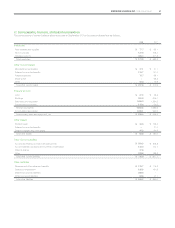

13. SHAREHOLDERS’ EQUITY

On March 16, 2000, the Board of Directors declared a dividend of

one share purchase right (Right) for each outstanding share of ENR

common stock. Each Right entitles a shareholder of ENR stock to

purchase an additional share of ENR stock at an exercise price of

$150.00, which price is subject to anti-dilution adjustments. Rights,

however, may only be exercised if a person or group has acquired, or

commenced a public tender for 20% or more of the outstanding ENR

stock, unless the acquisition is pursuant to a tender or exchange offer

for all outstanding shares of ENR stock and a majority of the Board of

Directors determines that the price and terms of the offer are adequate

and in the best interests of shareholders (a Permitted Offer). At the time