Energizer 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 31

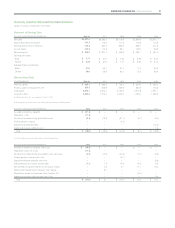

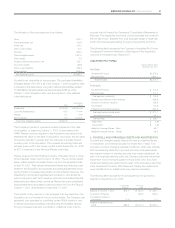

The allocation of the purchase price is as follows:

Cash $13.1

Trade receivables, net 102.9

Inventories 124.0

Other current assets 37.0

Goodwill 826.2

Other intangible assets 1,367.9

Other assets 0.3

Property, plant and equipment, net 152.1

Accounts payable (33.9)

Other current liabilities (169.0)

Other liabilities (525.4)

Net assets acquired $1,895.2

Goodwill is not deductible for tax purposes. The purchased identifiable

intangible assets of $1,367.9 as of the October 1, 2007 acquisition date,

is included in the table below. Long-term deferred tax liabilities related

to identifiable intangible assets are approximately $484 as of the

October 1, 2007 acquisition date, and are included in other liabilities

in the table above.

Total

Amortization

Period

Trademarks $1,313.9 indefinite-lived

Customer Relationships 43.9 10 years

Patents 5.1 7 years

Non-Compete 5.0 18 months

Total other intangible assets $1,367.9

The Company’s results of operations include Playtex as of the date

of acquisition, or beginning October 1, 2007. In accordance with

GAAP, Playtex inventory acquired in the Acquisition was valued at its

estimated fair value on the date of acquisition. As a result, the fair value

of inventory was $27.5 greater than the historical cost basis of such

inventory prior to the Acquisition. This required accounting treatment

reduced gross profit in the twelve months ended September 30, 2008

by $27.5 compared to the historical Playtex cost basis.

Playtex acquired Tiki Hut Holding Company (“Hawaiian Tropic”), owner

of the Hawaiian Tropic brand on April 18, 2007. The pro forma results

below, reflect results for Hawaiian Tropic only from the acquisition date

of April 18, 2007. They include incremental interest and financing costs

related to the Acquisition and purchase accounting adjustments includ-

ing the impact of increased depreciation and amortization expense. The

unaudited pro forma earnings statement is based on, and should be

read in conjunction with the Company’s historical consolidated financial

statements and related notes, as well as Playtex historical consolidated

financial statements and related notes included in the Form 8-K filing of

October 1, 2007, as amended on December 17, 2007.

The impacts of any revenue or cost synergies that may result from the

Acquisition are not included in the pro forma results. The Company has

generated cost synergies by combining certain SG&A functions, and

continues pursuing purchasing, manufacturing and logistics savings

through increased scale and coordination. Additional costs may be

incurred that will impact the Company’s Consolidated Statements of

Earnings. The magnitude and timing of such synergies and costs are

still not fully known. Benefits from cost synergies began in fiscal year

2008, with total savings building throughout fiscal 2009 and 2010.

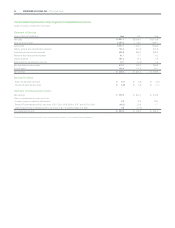

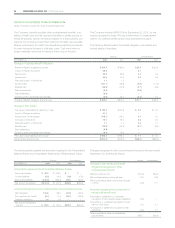

The following table represents the Company’s Unaudited Pro Forma

Condensed Combined Statement of Earnings as if the Acquisition

occurred at the beginning of fiscal 2007.

UNAUDITED PRO FORMA

Twelve Months Ended

September 30, 2007

Net Sales

Household Products $2,376.3

Personal Care 1,694.1

Total net sales $4,070.4

Profitability

Household Products $ 472.3

Personal Care 271.2

Total segment profitability $ 743.5

General corporate and other expenses (138.3)

Acquisition inventory valuation (29.4)

Amortization (12.5)

Interest and other financial items (192.2)

Earnings before income taxes $ 371.1

Income tax provision 88.1

Net earnings $ 283.0

Basic EPS $ 4.99

Diluted EPS $ 4.85

Weighted-Average Shares - Basic 56.7

Weighted-Average Shares - Diluted 58.3

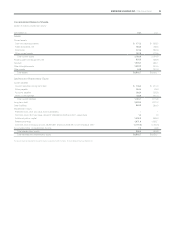

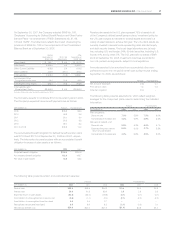

4. GOODWILL AND INTANGIBLE ASSETS AND AMORTIZATION

Goodwill and intangible assets deemed to have an indefinite life are

not amortized, but reviewed annually for impairment of value. The

Company monitors changing business conditions, which may indicate

that the remaining useful life of goodwill and other intangible assets

may warrant revision or carrying amounts may require adjustment. As

part of its business planning cycle, the Company performed its annual

impairment test in the fourth quarter of fiscal 2008, 2007 and 2006.

Impairment testing was performed for each of the Company’s reporting

units, Household Products, Wet Shave and Playtex. No impairments

were identified and no adjustments were deemed necessary.

The following table represents the carrying amount of goodwill by

segment at September 30, 2008:

Household

Products

Personal

Care

Total

Balance at October 1, 2007 $40.1 $ 340.0 $ 380.1

Acquisition of Playtex – 826.2 826.2

Cumulative translation

adjustment (1.3) 1.4 0.1

Balance at September 30,

2008 $38.8 $1,167.6 $1,206.4