Energizer 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 37

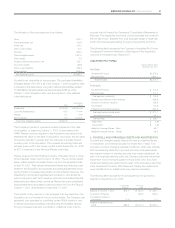

On September 30, 2007, the Company adopted SFAS No. 158,

“Employers’ Accounting for Defined Benefit Pension and Other Postre-

tirement Plans – an amendment of FASB Statements No. 87, 88,

106 and 132(R)”. The table below reflects the impact of adopting the

provisions of SFAS No. 158 on the components of the Consolidated

Balance Sheet as of September 30, 2007:

Before

Application of

SFAS 158

SFAS 158

Adjustments

After

Application of

SFAS 158

Other Assets $ 194.7 $ 6.5 $ 201.2

Total Assets 3,546.5 6.5 3,553.0

Other Current Liabilities 608.9 5.4 614.3

Other Liabilities* 423.9 (19.7) 404.2

Total Liabilities 2,913.4 (14.3) 2,899.1

Accumulated Other

Comprehensive Income 26.0 20.8 46.8

Total Shareholders’ Equity 633.1 20.8 653.9

Total Liabilities and

Shareholders’ Equity $3,546.5 $ 6.5 $3,553.0

*Includes Deferred Income Tax liability adjustment of $15.7.

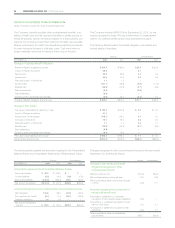

The Company expects to contribute $16.5 to its pension plans in 2009.

The Company’s expected future benefit payments are as follows:

SEPTEMBER 30, Pension Postretirement

2009 $45.9 $3.6

2010 46.8 3.6

2011 50.1 3.4

2012 54.3 3.3

2013 59.4 3.2

2014 to 2018 368.5 14.0

The accumulated benefit obligation for defined benefit pension plans

was $716.8 and $727.2 at September 30, 2008 and 2007, respec-

tively. The information for pension plans with an accumulated benefit

obligation in excess of plan assets is as follows:

SEPTEMBER 30, 2008 2007

Projected benefit obligation $189.2 $200.8

Accumulated benefit obligation 162.9 169.7

Fair value of plan assets 45.8 53.5

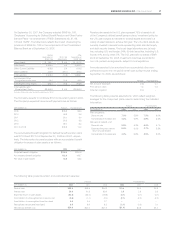

Pension plan assets in the U.S. plan represent 79% of assets in all

of the Company’s defined benefit pension plans. Investment policy for

the U.S. plan includes a mandate to diversify assets and invest in a

variety of asset classes to achieve that goal. The U.S. plan’s assets are

currently invested in several funds representing most standard equity

and debt security classes. The broad target allocations are: (a) equi-

ties, including U.S. and foreign: 54%, (b) debt securities, including U.S.

bonds: 41% and (c) other: 5%. The U.S. plan held no shares of ENR

stock at September 30, 2008. Investment objectives are similar for

non-U.S. pension arrangements, subject to local regulations.

Amounts expected to be amortized from accumulated other com-

prehensive income into net period benefit cost during the year ending

September 30, 2009, are as follows:

Pension Postretirement

Net actuarial (loss)/gain (2.8) 2.1

Prior service credit 1.5 2.3

Initial net obligation (0.4) –

The following table presents assumptions, which reflect weighted-

averages for the component plans, used in determining the indicated

information:

Pension Postretirement

SEPTEMBER 30, 2008 2007 2008 2007

Plan obligations:

Discount rate 7.0% 5.8% 7.5% 6.0%

Compensation increase rate 4.2% 3.9% 3.9% 3.5%

Net periodic benefit cost:

Discount rate 5.9% 5.3% 6.0% 5.7%

Expected long-term rate of

return on plan assets

8.0% 8.0% 3.7% 5.5%

Compensation increase rate 4.0% 3.8% 3.5% 3.6%

The following table presents pension and postretirement expense:

Pension Postretirement

SEPTEMBER 30, 2008 2007 2006 2008 2007 2006

Service cost $33.9 $29.9 $26.3 $ 0.4 $0.4 $0.3

Interest cost 50.6 41.3 38.4 2.5 2.8 3.3

Expected return on plan assets (63.3) (53.2) (49.8) (0.1) (0.1) (0.1)

Amortization of unrecognized prior service cost (0.6) (1.1) (0.2) (2.1) (2.2) (2.2)

Amortization of unrecognized transition asset 0.5 0.4 0.7 – – –

Recognized net actuarial loss/(gain) 3.8 6.9 6.2 (2.1) (0.3) 0.1

Net periodic benefit cost $24.9 $24.2 $21.6 $(1.4) $0.6 $1.4