Energizer 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 15

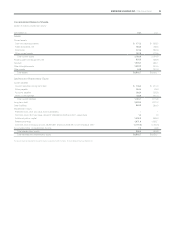

Working capital, which is defined as current assets less current

liabilities was $665.1 and $888.5 at September 30, 2008 and 2007,

respectively. The year over year working capital change reflects the use

of $261.0 of cash to complete the Playtex acquisition. As adjusted to

reflect the Playtex acquisition, accounts receivable increased $39.4 at

September 30, 2008 due to higher sales in the fourth quarter of 2008.

Inventories decreased $29.5 as the inventory step-up related to the

Playtex acquisition flowed through earnings as the inventory was sold.

Current liabilities decreased $22.8 due primarily to payments related

to exit and contract termination costs for Playtex as part of the

integration plan.

Investing Activities Net cash used by investing activities was

$1,994.5, $82.3 and $115.6 in 2008, 2007 and 2006, respectively.

Capital expenditures were $160.0, $88.6 and $94.9 in 2008, 2007

and 2006, respectively. These expenditures were funded by cash

flow from operations. Capital expenditures increased in 2008 due to

production related spending and Playtex related spending. See Note

18 of the Consolidated Financial Statements for capital expenditures

by segment. On October 1, 2007, the Company paid $1,875.7 for the

acquisition of all outstanding Playtex common stock, repayment or

defeasance of outstanding Playtex debt, and other transaction costs.

See “Financing Activities” below for discussion of the financing of the

transaction. At September 30, 2007, the Company held a net-cash

settled prepaid share option with a major multinational financial institu-

tion to mitigate the impact of changes in the Company’s deferred

compensation liabilities. In December 2007, the prepaid feature was

removed from the transaction and the Company received cash of

$60.5, which was used to repay existing debt. Of the $60.5 received,

$46.0 was a return of investment and was classified within investing

activities on the Statement of Cash Flows. The remaining $14.5 was

a return on investment and was classified as a cash inflow from

operating activities on the Statement of Cash Flows.

Capital expenditures of approximately $150 are anticipated in 2009

with increases in production related capital for existing businesses and

planned spending for Playtex. Such capital expenditures are expected

to be financed with funds generated from operations.

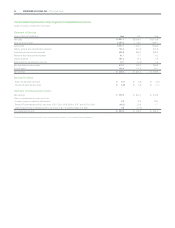

Financing Activities The Company’s total borrowings were $2,959.9

at September 30, 2008. The Company maintained total committed

debt facilities of $3,449.9, of which $479.0 was available as of

September 30, 2008.

In October 2007, the Company borrowed approximately $1,500 under

a bridge loan facility which, together with cash on hand was used to

acquire Playtex. The Company subsequently refinanced the bridge loan

with $890 of long-term debt financing, with maturities ranging from

three to ten years and fixed rates ranging from 5.71% to 6.55% and

$600 of long-term bank financing priced at LIBOR plus 100

basis points.

Under the terms of the Company’s debt facilities, the ratio of the

Company’s indebtedness to its Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA) cannot be greater than 4.00 to

1, and may not remain above 3.50 to 1 for more than four consecutive

quarters. If the ratio is above 3.50 to 1, the Company is required to pay

an additional 75 basis points in interest for the period in which the ratio

exceeded 3.50 to 1. In addition, the ratio of its current year Earnings

Before Interest and Taxes (EBIT) to total interest expense must exceed

3.00 to 1. The Company’s ratio of indebtedness to its pro forma

EBITDA, as defined in the agreements, was 3.25 to 1, and the

ratio of its pro forma EBIT, as defined in the agreements, to total

interest expense was 3.91 to 1 as of September 30, 2008. As a

result of the ratio of indebtedness to pro forma EBITDA during fiscal

2008, which was above 3.50 to 1 for the period from January 1, 2008

through September 30, 2008, at which time the ratio reduced to 3.25

to 1, the Company had higher pre-tax interest expense on fixed bor-

rowings of approximately $13.0 for the current year. Failure to comply

with the above ratios or other covenants could result in acceleration

of maturity, which could trigger cross defaults on other borrowings.

The Company believes that covenant violations, which may result in

acceleration of maturity, are unlikely. The Company’s fixed rate debt is

callable by the Company, subject to a “make whole” premium, which

would be required to the extent the underlying benchmark U.S. trea-

sury yield has declined since issuance.

The Company routinely sells a pool of U.S. accounts receivable

through a financing arrangement between Energizer Receivables

Funding Corporation (the SPE), which is a bankruptcy-remote special

purpose entity subsidiary of the Company, and outside parties (the

Conduits). Under the current structure, funds received from the

Conduit are treated as borrowings rather than proceeds of accounts

receivables sold for accounting purposes. Borrowings under this pro-

gram receive favorable treatment in the Company’s debt compliance

covenants. The program renews annually in May. Further deterioration

in credit markets could result in an inability to renew the program or

renewal on less favorable terms, which may negatively impact compli-

ance reported Debt-to-EBITDA and may require the Company to draw

on other available committed debt facilities.

The counterparties to long-term committed borrowings consist of a

number of major multinational and international financial institutions.

The Company continually monitors positions with, and credit ratings of,

counterparties both internally and by using outside ratings agencies.

The Company has staggered long-term borrowing maturities through

2017 to minimize refinancing risk in any single year and to optimize the

use of free cash flow for repayment. See the contractual obligations

table provided below.

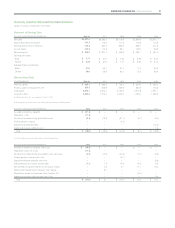

The Company purchased shares of its common stock as follows

(shares in millions):

Fiscal Year

Shares

Cost

Total

Average

Price

2008 0.0 $ 0.0 $ 0.00

2007 0.8 $ 53.0 $67.67

2006 11.3 $600.7 $53.02

The Company has 8 million shares remaining on the current authoriza-

tion from its Board of Directors to repurchase its common stock in the

future. Future purchases may be made from time to time on the open

market or through privately negotiated transactions, subject to corpo-

rate objectives and the discretion of management.