Energizer 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 13

For the year ended September 30, 2007, sales increased $229.2, or

11%, due primarily to favorable pricing and product mix of $68.5 and

higher sales volume of $111.5. In addition, currency was favorable by

$49.2 as compared to the prior year. Fiscal 2007 benefited from price

increases implemented in both 2006 and 2007 in response to signifi-

cant increases in material costs. Energizer MAX unit sales were flat

in North America, which reflected soft volume in the overall premium

alkaline battery segment of the category, partially due to virtually no

hurricane-related consumption. Volume growth reflected increased unit

shipments in lithium and rechargeable batteries primarily in the more

developed markets.

Gross profit dollars increased $82.8 in 2007 as higher sales and

favorable currency were partially offset by higher product costs, due

primarily to the increased cost of zinc. Currency contributed $41.6 of

favorability to gross profit as compared to the prior year. Product cost

in 2007 was unfavorable $83.3 compared to 2006, as material cost

increases exceeded the favorable impact of other cost reductions.

Segment profit increased $30.0, or 7% in 2007, but was essentially flat

on a constant currency basis as higher gross profit was partially offset

by higher advertising, promotion and selling expenses.

Looking forward, the battery category continues to be soft in the U.S.

and other developed markets. In addition, we estimate residual U.S.

retail inventory from hurricane-related shipments combined with the

level of early holiday shipments will dampen the Company’s sales by

an additional $30 in fiscal 2009 beyond any negative underlying retail

consumption or competitive activity. By comparison, sales in last year’s

December quarter were unusually high relative to retail consumption,

which resulted in a significant retail inventory reduction in the March

2008 quarter.

Commodities, raw materials and other inflationary input costs are

estimated to be unfavorable $35 to $40 in 2009 compared to 2008

average costs based on current market conditions. Pricing actions

already initiated together with manufacturing cost reduction programs

should offset these increases.

Finally, as mentioned previously, the U.S. dollar has recently strength-

ened against most other currencies, which will negatively impact

reported sales and profits in Household Products. At November 17,

2008 foreign currency exchange rates, we estimate the impact on

segment profit due to currency translation to be approximately $100

to $110 unfavorable for Household Products as compared to the

2008 average currency translation rate.

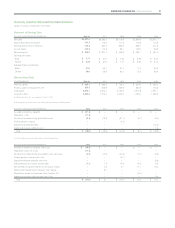

Personal Care

2008

2007

pro forma

Net sales $1,856.7 $1,694.1

Segment profit $ 322.5 $ 271.2

As noted in Energizer’s quarterly filings during 2008, Energizer’s acqui-

sition of Playtex was completed on October 1, 2007; therefore, Playtex

is not included in the attached historical financial statements prior to

the current fiscal year. To provide a clearer understanding of the impact

of the acquisition on results, the comparison of the 2008 results for the

Personal Care segment are versus unaudited pro forma results for the

year ended September 30, 2007 as shown in Note 3 of the Consoli-

dated Financial Statements. Hawaiian Tropic results are included in the

pro forma results in Note 3 beginning on April 18, 2007, the date at

which Playtex acquired the business. The comparative for fiscal 2007

versus fiscal 2006 remains a historical comparison of the SWS wet

shave business, which constituted the Personal Care business prior to

the addition of Playtex in 2008.

Net sales for the fiscal year were $1,856.7, an increase of $162.6,

with Hawaiian Tropic and favorable currency accounting for $54.6 and

$66.8, respectively, of the increase. As noted above, Hawaiian Tropic

is not included for the full year in the 2007 pro forma comparison.

On a constant currency basis, net sales increased 6% due primar-

ily to Wet Shave and the acquisition of Hawaiian Tropic. Wet Shave

sales increased 3% as higher volumes in disposable razors and the

Quattro family of products more than offset declines in older technol-

ogy products and unfavorable pricing and product mix due to higher

promotional spending in all categories. Skin Care net sales increased

22% due to the inclusion of Hawaiian Tropic. Excluding the impact of

Hawaiian Tropic, Skin Care net sales increased 5% driven by growth

in Banana Boat. Feminine Care net sales decreased 1% due to the

discontinuation of the Beyond cardboard applicator tampon in 2007

partially offset by growth in plastic applicator tampons. Sales of plastic

applicator tampons increased 3% for the year. Infant Care net sales

were essentially flat as higher sales of Diaper Genie and the dispos-

able Drop-In product were offset by a decline in sales of reusable infant

bottles as the company transitioned to BPA-free products.

Segment profit increased $51.3 for the fiscal year due, in part, to

$22.0 in favorable currency. The prior year includes the impact of the

write off of Beyond fixed assets of $10.4. Excluding this write off and

the impact of currencies, segment profit increased $18.9 as gross

margin on higher sales and lower A&P were offset by higher overheads

and product costs. The Company estimates that segment profit was

favorably impacted by approximately $17 of synergies related to the

Playtex acquisition.

Wet Shave sales in 2007 increased $59.0, including $26.3 of favorable

currency impacts. Initial launch sales of new products in the prior year

were approximately $26 compared to approximately $52 in the same

period in 2006. Absent currency and initial product launches, sales

increased 6%, as Quattro branded system products contributed $40

of sales growth, disposables contributed $32 and Intuition contributed

$14 partially offset by lower sales of older technology products.

Segment profit for Wet Shave increased $27.8 in 2007, on $16.4 of

contribution from higher sales, favorable currency of $3.8, and lower

SG&A and R&D expenses. Lower SG&A reflects the cost savings from

the European restructuring. R&D expense declined $3.7 due to the

inclusion of a large, discrete R&D project expense in 2006.